- South Korea

- /

- Communications

- /

- KOSDAQ:A094360

What Chips&Media, Inc.'s (KOSDAQ:094360) 28% Share Price Gain Is Not Telling You

Chips&Media, Inc. (KOSDAQ:094360) shares have had a really impressive month, gaining 28% after a shaky period beforehand. But the last month did very little to improve the 51% share price decline over the last year.

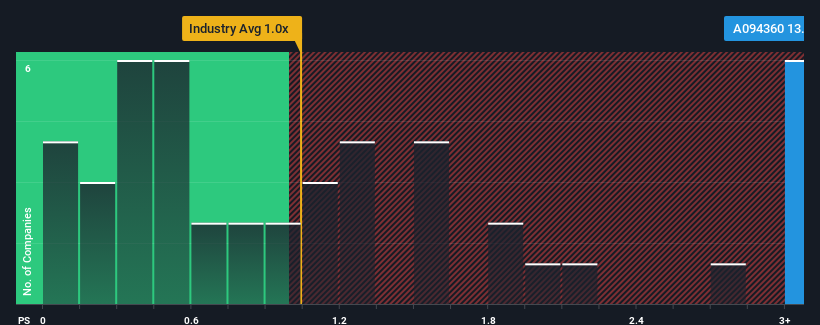

Since its price has surged higher, you could be forgiven for thinking Chips&Media is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.3x, considering almost half the companies in Korea's Communications industry have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Chips&Media

How Has Chips&Media Performed Recently?

Chips&Media hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chips&Media.How Is Chips&Media's Revenue Growth Trending?

In order to justify its P/S ratio, Chips&Media would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.3%. Still, the latest three year period has seen an excellent 52% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 24% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 41%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Chips&Media's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Chips&Media's P/S Mean For Investors?

The strong share price surge has lead to Chips&Media's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Chips&Media currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Chips&Media you should be aware of.

If you're unsure about the strength of Chips&Media's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A094360

Chips&Media

Develops and sells multimedia IP in South Korea and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives