- South Korea

- /

- Communications

- /

- KOSDAQ:A091440

The one-year earnings decline has likely contributed toHanWool Materials Science's (KOSDAQ:091440) shareholders losses of 74% over that period

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame HanWool Materials Science, Inc. (KOSDAQ:091440) shareholders if they were still in shock after the stock dropped like a lead balloon, down 74% in just one year. That'd be a striking reminder about the importance of diversification. We note that it has not been easy for shareholders over three years, either; the share price is down 37% in that time. Furthermore, it's down 30% in about a quarter. That's not much fun for holders.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

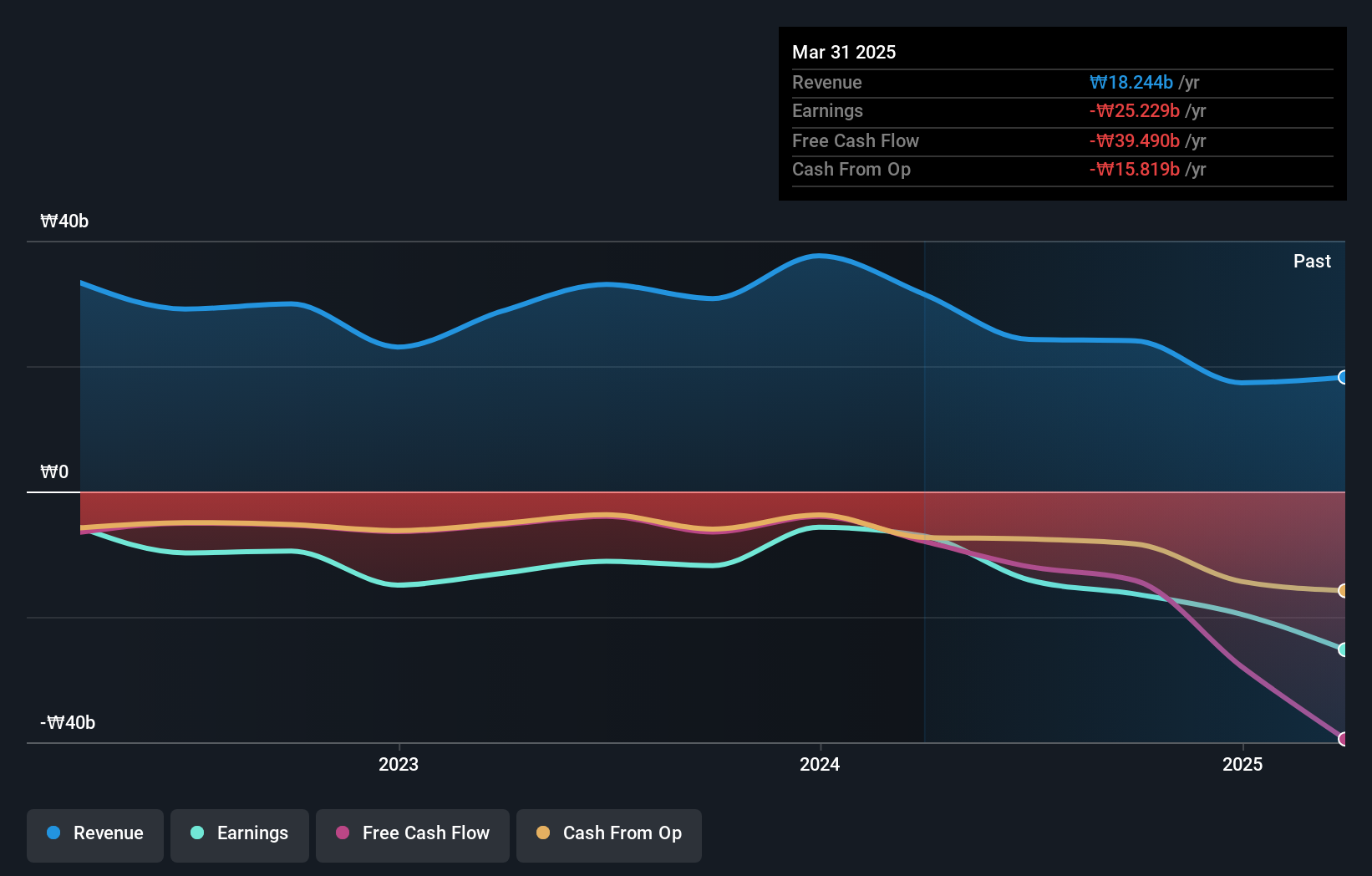

Given that HanWool Materials Science didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year HanWool Materials Science saw its revenue fall by 42%. That looks pretty grim, at a glance. The market obviously agrees, since the share price tanked 74%. That's a stern reminder that profitless companies need to grow the top line, at the very least. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling HanWool Materials Science stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 8.1% in the last year, HanWool Materials Science shareholders lost 74%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - HanWool Materials Science has 4 warning signs (and 3 which shouldn't be ignored) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HanWool Materials Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A091440

HanWool Materials Science

Develops, manufactures, and sells communication devices and software in South Korea.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives