- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A089010

Revenues Not Telling The Story For CHEMTRONICS.Co.,Ltd. (KOSDAQ:089010) After Shares Rise 28%

CHEMTRONICS.Co.,Ltd. (KOSDAQ:089010) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

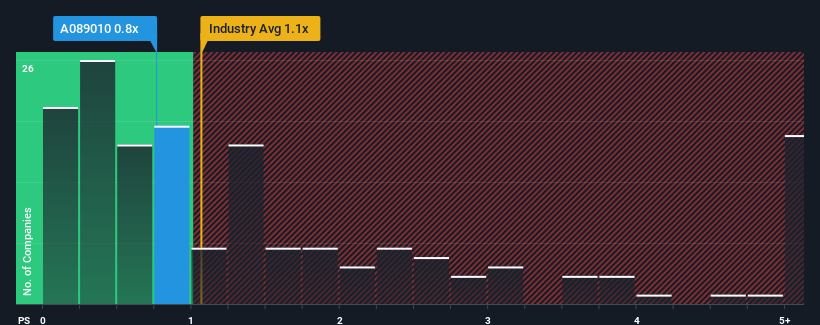

In spite of the firm bounce in price, it's still not a stretch to say that CHEMTRONICS.Co.Ltd's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Electronic industry in Korea, where the median P/S ratio is around 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for CHEMTRONICS.Co.Ltd

How CHEMTRONICS.Co.Ltd Has Been Performing

For example, consider that CHEMTRONICS.Co.Ltd's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for CHEMTRONICS.Co.Ltd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like CHEMTRONICS.Co.Ltd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 13% shows it's noticeably less attractive.

In light of this, it's curious that CHEMTRONICS.Co.Ltd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Its shares have lifted substantially and now CHEMTRONICS.Co.Ltd's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of CHEMTRONICS.Co.Ltd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

It is also worth noting that we have found 4 warning signs for CHEMTRONICS.Co.Ltd (2 are concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A089010

CHEMTRONICS.Co.Ltd

Engages in the manufacture and sale of electronic parts and chemicals in South Korea and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives