- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A089010

Does CHEMTRONICS.CO.Ltd (KOSDAQ:089010) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that CHEMTRONICS.CO.,Ltd. (KOSDAQ:089010) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CHEMTRONICS.CO.Ltd

What Is CHEMTRONICS.CO.Ltd's Net Debt?

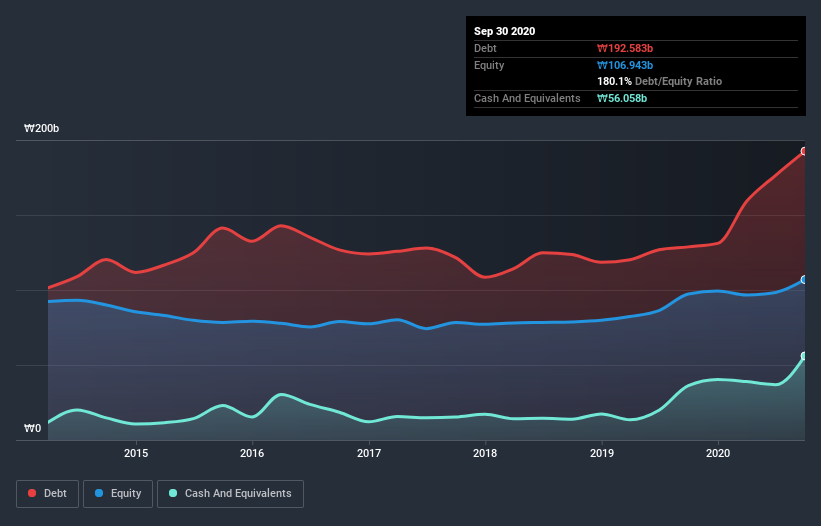

As you can see below, at the end of September 2020, CHEMTRONICS.CO.Ltd had ₩192.6b of debt, up from ₩128.7b a year ago. Click the image for more detail. On the flip side, it has ₩56.1b in cash leading to net debt of about ₩136.5b.

A Look At CHEMTRONICS.CO.Ltd's Liabilities

Zooming in on the latest balance sheet data, we can see that CHEMTRONICS.CO.Ltd had liabilities of ₩210.6b due within 12 months and liabilities of ₩64.2b due beyond that. On the other hand, it had cash of ₩56.1b and ₩76.9b worth of receivables due within a year. So its liabilities total ₩141.9b more than the combination of its cash and short-term receivables.

CHEMTRONICS.CO.Ltd has a market capitalization of ₩456.7b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CHEMTRONICS.CO.Ltd has a debt to EBITDA ratio of 3.2 and its EBIT covered its interest expense 3.4 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Worse, CHEMTRONICS.CO.Ltd's EBIT was down 25% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is CHEMTRONICS.CO.Ltd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, CHEMTRONICS.CO.Ltd burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, CHEMTRONICS.CO.Ltd's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to handle its total liabilities isn't such a worry. We're quite clear that we consider CHEMTRONICS.CO.Ltd to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 5 warning signs for CHEMTRONICS.CO.Ltd (2 are significant) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading CHEMTRONICS.CO.Ltd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A089010

CHEMTRONICS.Co.Ltd

Engages in the manufacture and sale of electronic parts and chemicals in South Korea and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives