- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A082210

OPTRONTEC Inc. (KOSDAQ:082210) Soars 55% But It's A Story Of Risk Vs Reward

OPTRONTEC Inc. (KOSDAQ:082210) shareholders would be excited to see that the share price has had a great month, posting a 55% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 57% share price drop in the last twelve months.

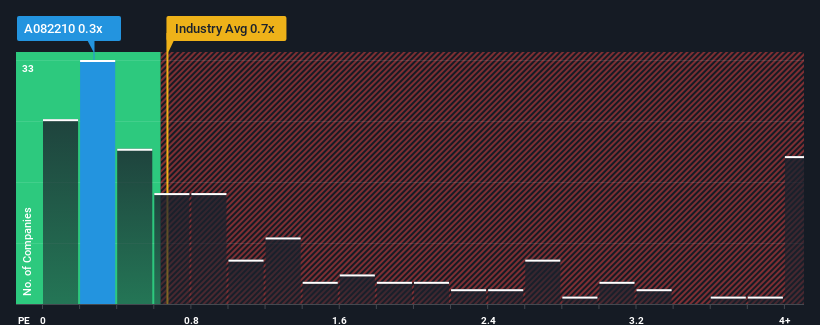

Even after such a large jump in price, there still wouldn't be many who think OPTRONTEC's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Korea's Electronic industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 6 warning signs investors should be aware of before investing in OPTRONTEC. Read for free now.See our latest analysis for OPTRONTEC

What Does OPTRONTEC's Recent Performance Look Like?

OPTRONTEC hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on OPTRONTEC will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For OPTRONTEC?

OPTRONTEC's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.5%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.5% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 12% as estimated by the only analyst watching the company. With the industry only predicted to deliver 7.4%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that OPTRONTEC is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On OPTRONTEC's P/S

Its shares have lifted substantially and now OPTRONTEC's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at OPTRONTEC's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 6 warning signs for OPTRONTEC (3 are a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on OPTRONTEC, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A082210

OPTRONTEC

Manufactures and sells optical components in Korea and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives