- Saudi Arabia

- /

- Basic Materials

- /

- SASE:9601

Undiscovered Gems With Promising Potential In December 2024

Reviewed by Simply Wall St

As global markets experience a mixed performance, with major indices like the S&P 500 and Nasdaq hitting record highs while small-cap stocks such as those in the Russell 2000 face declines, investors are keenly observing economic indicators and Federal Reserve signals for future rate cuts. In this environment of diverging market trends and geopolitical developments, identifying undervalued small-cap stocks with strong fundamentals can offer promising opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| TopGum Industries | 37.34% | 18.35% | 31.91% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Kona ILtd (KOSDAQ:A052400)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kona I Co., Ltd. offers solutions and platforms for the financial technology market both in South Korea and internationally, with a market cap of ₩386.30 billion.

Operations: Kona I Co., Ltd. generates revenue primarily from its Chip Business, with significant contributions from the Americas (₩67.94 billion) and Domestic markets (₩69.71 billion). Another notable revenue stream is the Prepaid Card Business in the Domestic market, contributing ₩57.39 billion. The company's cost structure impacts its net profit margin, which requires careful analysis for a comprehensive understanding of financial performance trends over time.

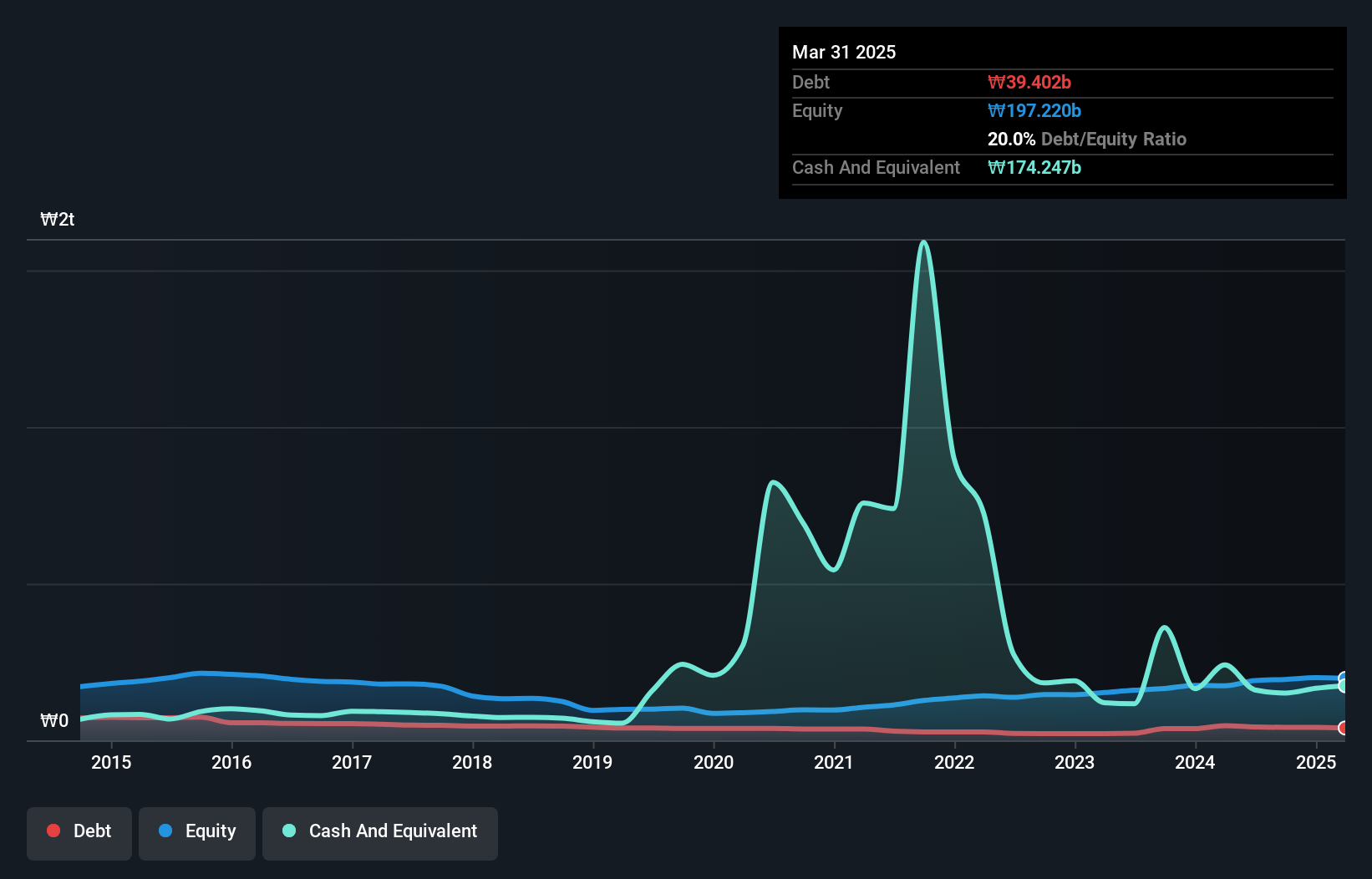

Kona I Ltd., a small cap entity, seems to be navigating through a challenging landscape with mixed financial signals. Over the past five years, its debt-to-equity ratio has improved from 36.8% to 21.4%, indicating better financial health. However, the company has not been free cash flow positive recently and shareholders have experienced dilution over the past year. Despite these challenges, earnings have grown at an impressive rate of 29.2% annually over five years, although recent quarterly earnings growth of 6.3% lagged behind industry benchmarks of 48.2%. Notably, Kona I repurchased about 234,707 shares for KRW 3,499 million in a strategic buyback move this year.

- Click here and access our complete health analysis report to understand the dynamics of Kona ILtd.

Examine Kona ILtd's past performance report to understand how it has performed in the past.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications, with a market capitalization of SAR1.03 billion.

Operations: The company generates revenue primarily from sales, amounting to SAR246.94 million, with a smaller contribution from contracting services at SAR7.73 million.

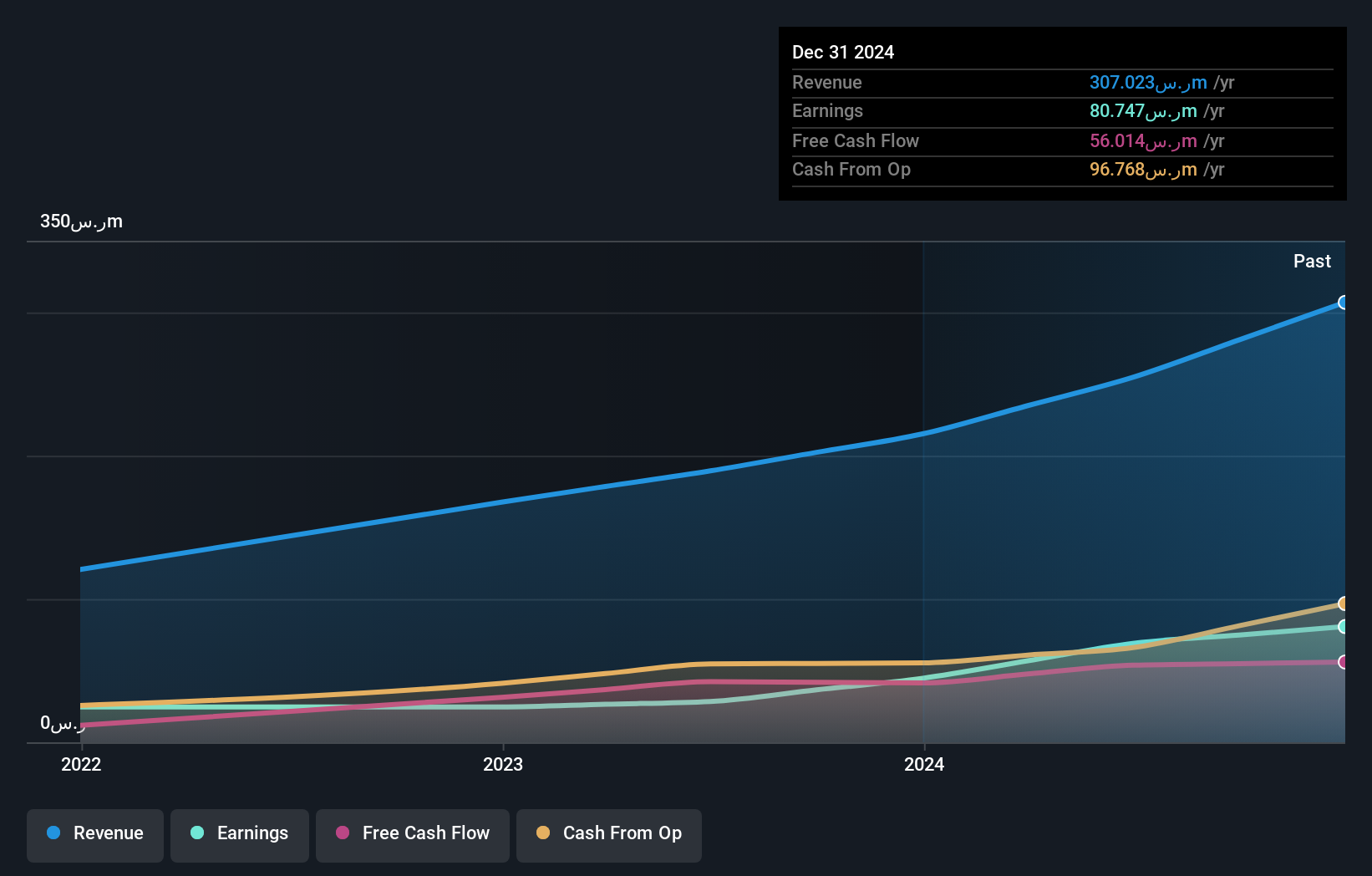

Mohammed Hadi Al-Rasheed Company, with its small cap status, has shown impressive financial growth recently. Earnings surged by 142% over the past year, outpacing the Basic Materials industry average of 12%. The company is trading at 10% below its estimated fair value, suggesting potential undervaluation. Despite a highly volatile share price in recent months, it maintains high-quality earnings and positive free cash flow. A special shareholders meeting held in September indicates active engagement with stakeholders. With more cash than total debt and solid interest coverage, financial stability seems well-supported for future endeavors.

Ceres (TSE:3696)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ceres Inc. provides mobile and financial services both in Japan and internationally, with a market cap of ¥39.48 billion.

Operations: Ceres Inc. generates revenue through its mobile and financial services sectors across Japan and international markets. The company has a market cap of ¥39.48 billion, reflecting its financial standing in the industry.

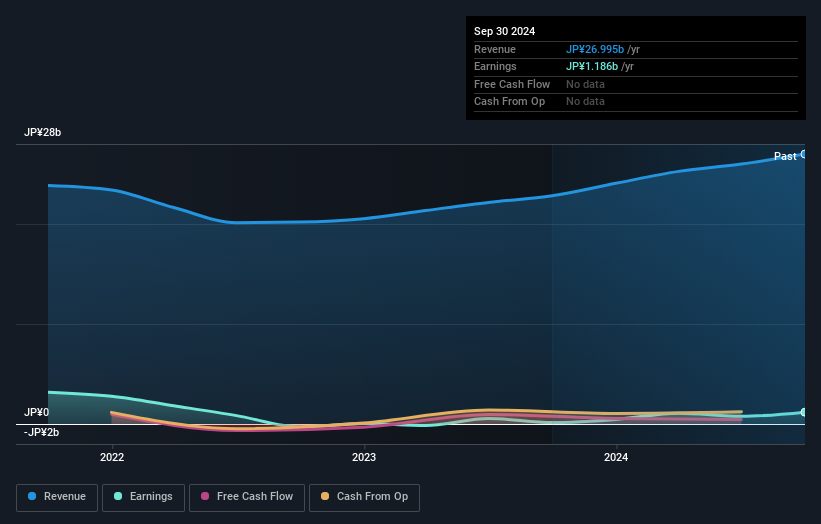

Ceres, a small-cap player in the media industry, has demonstrated remarkable earnings growth of 752.9% over the past year, significantly outpacing the industry's 6%. The company's high-quality earnings are underscored by its strong interest coverage ratio of 44 times EBIT. Despite an increase in its debt-to-equity ratio from 45.6% to 86.7% over five years, Ceres maintains more cash than total debt and is free cash flow positive. Recent events include a ¥40 dividend per share for 2024 and plans to raise ¥549 million through a third-party allotment, reflecting strategic capital management initiatives.

- Get an in-depth perspective on Ceres' performance by reading our health report here.

Gain insights into Ceres' past trends and performance with our Past report.

Where To Now?

- Gain an insight into the universe of 4647 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9601

Mohammed Hadi Al-Rasheed

Produces silica sand for various industrial applications.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives