- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A051370

Interflex Co., Ltd.'s (KOSDAQ:051370) Earnings Are Not Doing Enough For Some Investors

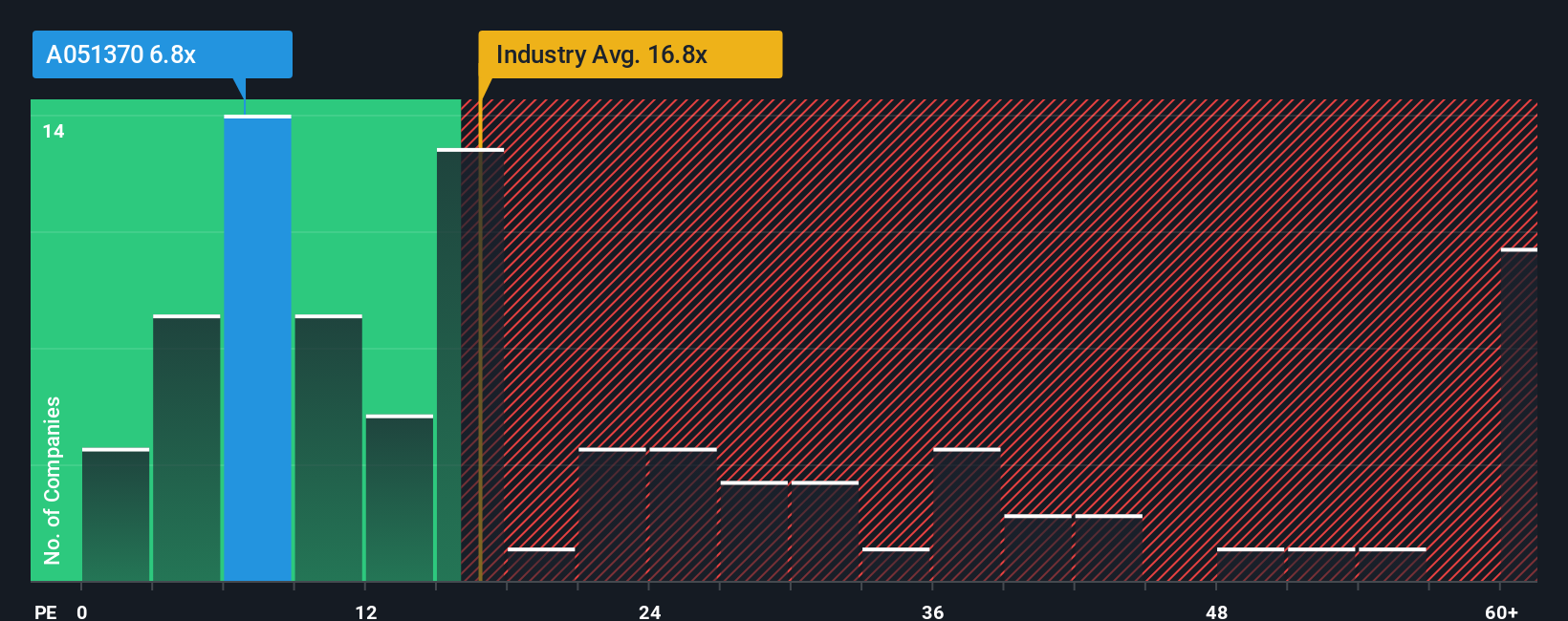

Interflex Co., Ltd.'s (KOSDAQ:051370) price-to-earnings (or "P/E") ratio of 6.8x might make it look like a strong buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 15x and even P/E's above 35x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Interflex as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Interflex

What Are Growth Metrics Telling Us About The Low P/E?

Interflex's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 26%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 8.9% per year as estimated by the one analyst watching the company. Meanwhile, the broader market is forecast to expand by 18% per year, which paints a poor picture.

With this information, we are not surprised that Interflex is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Interflex maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Interflex you should know about.

Of course, you might also be able to find a better stock than Interflex. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A051370

Interflex

Manufactures and sells flexible printed circuit boards in South Korea.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives