- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A051370

Interflex Co., Ltd. (KOSDAQ:051370) Stocks Pounded By 26% But Not Lagging Market On Growth Or Pricing

Interflex Co., Ltd. (KOSDAQ:051370) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 36%, which is great even in a bull market.

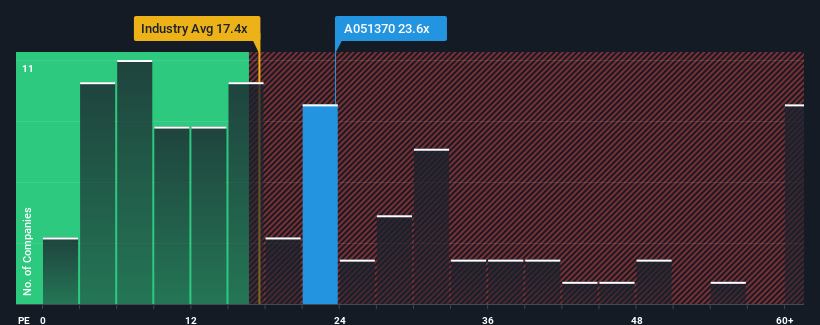

Even after such a large drop in price, Interflex's price-to-earnings (or "P/E") ratio of 23.6x might still make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 14x and even P/E's below 7x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Interflex has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Interflex

Does Growth Match The High P/E?

In order to justify its P/E ratio, Interflex would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 57%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 170% during the coming year according to the lone analyst following the company. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Interflex's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Interflex's P/E

Interflex's shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Interflex's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Interflex is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If these risks are making you reconsider your opinion on Interflex, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A051370

Interflex

Manufactures and sells flexible printed circuit boards in South Korea.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives