- South Korea

- /

- Communications

- /

- KOSDAQ:A050890

We Think That There Are Issues Underlying SOLiD's (KOSDAQ:050890) Earnings

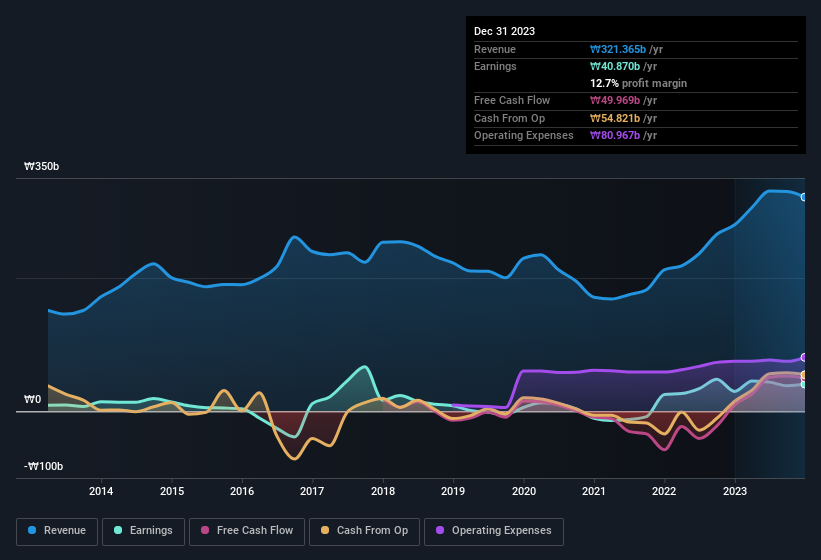

Unsurprisingly, SOLiD, Inc.'s (KOSDAQ:050890) stock price was strong on the back of its healthy earnings report. We did some analysis and think that investors are missing some details hidden beneath the profit numbers.

See our latest analysis for SOLiD

How Do Unusual Items Influence Profit?

To properly understand SOLiD's profit results, we need to consider the ₩9.3b gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. If SOLiD doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of SOLiD.

Our Take On SOLiD's Profit Performance

Arguably, SOLiD's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that SOLiD's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 37% EPS growth in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 1 warning sign for SOLiD you should know about.

Today we've zoomed in on a single data point to better understand the nature of SOLiD's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A050890

SOLiD

Develops, manufactures, and sells parts, products, and equipment for mobile and digital communication networks.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion