- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A049070

June 2024's Promising KRX Stocks Estimated To Be Below Fair Value

Reviewed by Simply Wall St

The South Korean market has shown positive momentum, rising 1.7% over the past week and achieving a 4.5% increase over the last year, with earnings expected to grow by 29% annually. In this context, identifying stocks that are estimated to be below their fair value could present opportunities for investors looking for potential growth in a strengthening market.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Poongsan Holdings (KOSE:A005810) | ₩27950.00 | ₩49513.96 | 43.6% |

| Solum (KOSE:A248070) | ₩21800.00 | ₩40031.37 | 45.5% |

| Grand Korea Leisure (KOSE:A114090) | ₩12840.00 | ₩24870.11 | 48.4% |

| Caregen (KOSDAQ:A214370) | ₩22950.00 | ₩43428.59 | 47.2% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49536.79 | 49.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩56600.00 | ₩107503.05 | 47.4% |

| IMLtd (KOSDAQ:A101390) | ₩6940.00 | ₩13548.46 | 48.8% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩77400.00 | ₩137549.91 | 43.7% |

| Hancom Lifecare (KOSE:A372910) | ₩5590.00 | ₩10708.84 | 47.8% |

| NEXON Games (KOSDAQ:A225570) | ₩14560.00 | ₩25799.78 | 43.6% |

Underneath we present a selection of stocks filtered out by our screen

Intops (KOSDAQ:A049070)

Overview: Intops Co., Ltd., a company based in South Korea, specializes in the manufacturing and selling of information and communication devices, with a market capitalization of approximately ₩412.30 billion.

Operations: The firm specializes in the production and sales of information and communication devices.

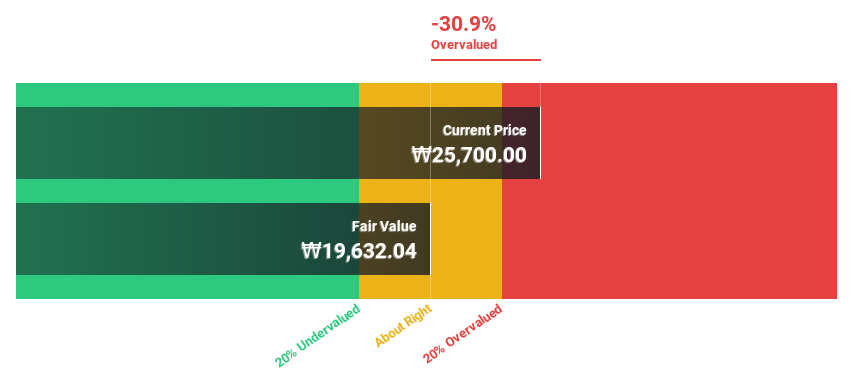

Estimated Discount To Fair Value: 17.1%

Intops Co., Ltd., trading at ₩25,650, is positioned below our fair value estimate of ₩30,949.53, marking a modest undervaluation. Despite recent earnings showing a decline in sales from KRW 61.69 billion to KRW 24.91 billion year-over-year and a significant drop in net income from KRW 100.38 billion to KRW 27.66 billion, the company's future looks promising with an expected annual earnings growth of 47.62%. This growth rate outpaces the broader South Korean market's forecasted average, coupled with its revenue projected to grow faster than the market average at 19.1% per year.

- The growth report we've compiled suggests that Intops' future prospects could be on the up.

- Click here to discover the nuances of Intops with our detailed financial health report.

Global Standard Technology (KOSDAQ:A083450)

Overview: Global Standard Technology, Limited operates in the environmental and energy sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩426.02 billion.

Operations: The company generates its revenue primarily from activities in the environmental and energy sectors across both domestic and international markets.

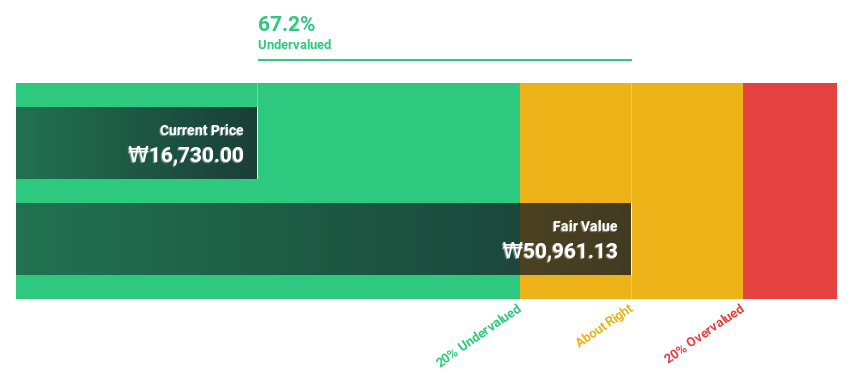

Estimated Discount To Fair Value: 23.2%

Global Standard Technology, priced at ₩46,900, trades 23.2% below our fair value estimate of ₩61,045.79. Despite a volatile share price and unstable dividend history, the company's earnings are expected to grow by 29.7% annually over the next three years—outpacing the South Korean market forecast of 28.9%. Additionally, its revenue growth at 17.5% annually is also above the market average of 10.5%, positioning it as an undervalued stock based on cash flows and growth prospects despite some financial inconsistencies in recent earnings reports for FY2023.

- Our earnings growth report unveils the potential for significant increases in Global Standard Technology's future results.

- Dive into the specifics of Global Standard Technology here with our thorough financial health report.

Poongsan Holdings (KOSE:A005810)

Overview: Poongsan Holdings Corporation, with a market cap of approximately ₩391.41 billion, is engaged in the manufacturing and global sales of copper and nonferrous metal products.

Operations: The company operates primarily in the production and international distribution of copper and nonferrous metal products.

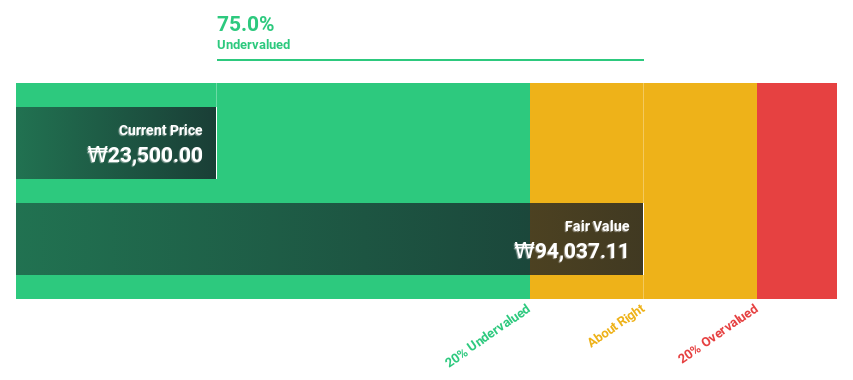

Estimated Discount To Fair Value: 43.6%

Poongsan Holdings, valued at ₩27,950, is significantly undervalued by 43.6%, with a fair value estimation of ₩49,513.96. Recent earnings have shown a decline to KRW 14.30 billion from KRW 24.25 billion year-over-year; however, the company's revenue and earnings are expected to grow by 45.3% and 36.1% annually respectively—substantially outpacing the South Korean market averages of 10.5% and 28.9%. Despite these growth prospects, the company has an unstable dividend track record and a forecasted low return on equity in three years at just over 10%.

- Our expertly prepared growth report on Poongsan Holdings implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Poongsan Holdings' balance sheet health report.

Make It Happen

- Get an in-depth perspective on all 33 Undervalued KRX Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A049070

Flawless balance sheet and good value.