- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A045970

Risks Still Elevated At These Prices As CoAsia Corporation (KOSDAQ:045970) Shares Dive 31%

CoAsia Corporation (KOSDAQ:045970) shares have had a horrible month, losing 31% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

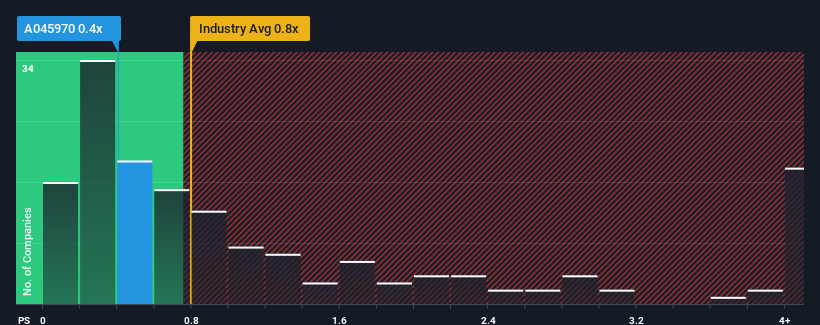

In spite of the heavy fall in price, there still wouldn't be many who think CoAsia's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Korea's Electronic industry is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for CoAsia

How Has CoAsia Performed Recently?

As an illustration, revenue has deteriorated at CoAsia over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CoAsia will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For CoAsia?

The only time you'd be comfortable seeing a P/S like CoAsia's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 7.1% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 12% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's somewhat alarming that CoAsia's P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On CoAsia's P/S

Following CoAsia's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at CoAsia revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Plus, you should also learn about these 3 warning signs we've spotted with CoAsia (including 1 which is significant).

If you're unsure about the strength of CoAsia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A045970

CoAsia

An investment holding company, provides system solutions in South Korea and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives