- South Korea

- /

- Tech Hardware

- /

- KOSDAQ:A038460

Shareholders In BioSmartLtd (KOSDAQ:038460) Should Look Beyond Earnings For The Full Story

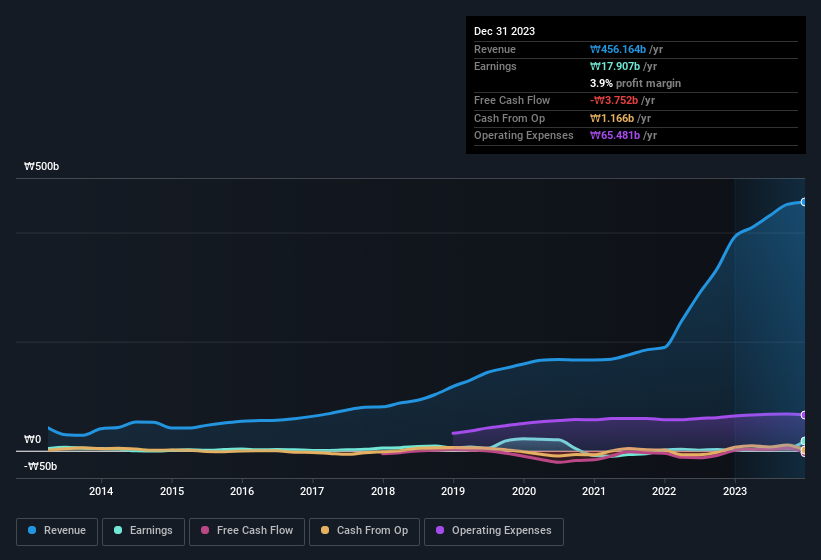

We didn't see BioSmart Co.,Ltd.'s (KOSDAQ:038460) stock surge when it reported robust earnings recently. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

Check out our latest analysis for BioSmartLtd

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, BioSmartLtd issued 7.0% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out BioSmartLtd's historical EPS growth by clicking on this link.

How Is Dilution Impacting BioSmartLtd's Earnings Per Share (EPS)?

Three years ago, BioSmartLtd lost money. On the bright side, in the last twelve months it grew profit by 2,383%. But EPS was less impressive, up only 2,308% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if BioSmartLtd can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of BioSmartLtd.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that BioSmartLtd's profit was boosted by unusual items worth ₩14b in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. We can see that BioSmartLtd's positive unusual items were quite significant relative to its profit in the year to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On BioSmartLtd's Profit Performance

To sum it all up, BioSmartLtd got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. For the reasons mentioned above, we think that a perfunctory glance at BioSmartLtd's statutory profits might make it look better than it really is on an underlying level. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For instance, we've identified 5 warning signs for BioSmartLtd (2 are a bit concerning) you should be familiar with.

Our examination of BioSmartLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BioSmartLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A038460

BioSmartLtd

Engages in the manufacture and sale of smart cards in South Korea.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion