- South Korea

- /

- Tech Hardware

- /

- KOSDAQ:A038460

BioSmart Co.,Ltd. (KOSDAQ:038460) Looks Interesting, And It's About To Pay A Dividend

BioSmart Co.,Ltd. (KOSDAQ:038460) is about to trade ex-dividend in the next four days. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 7th of April.

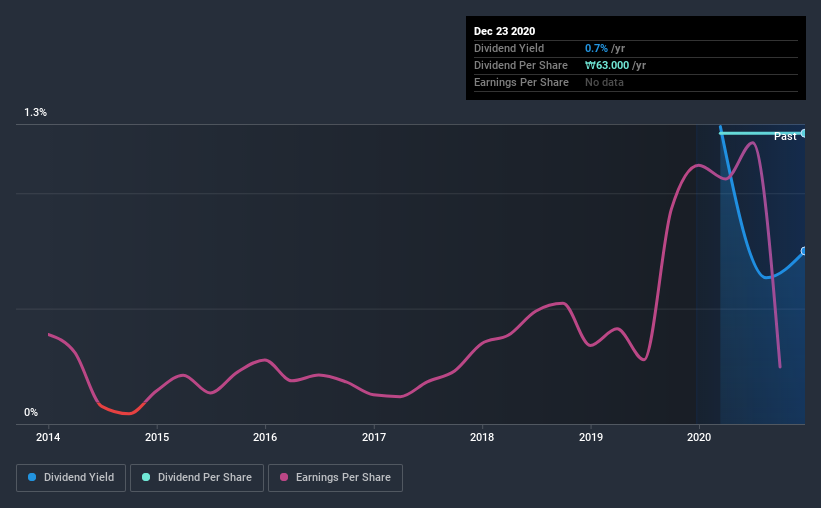

BioSmartLtd's next dividend payment will be ₩63.00 per share, and in the last 12 months, the company paid a total of ₩63.00 per share. Calculating the last year's worth of payments shows that BioSmartLtd has a trailing yield of 0.7% on the current share price of ₩8390. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether BioSmartLtd can afford its dividend, and if the dividend could grow.

See our latest analysis for BioSmartLtd

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. That's why it's good to see BioSmartLtd paying out a modest 38% of its earnings. BioSmartLtd paid a dividend despite reporting negative free cash flow last year. That's typically a bad combination and - if this were more than a one-off - not sustainable.

Click here to see how much of its profit BioSmartLtd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's encouraging to see BioSmartLtd has grown its earnings rapidly, up 25% a year for the past five years.

Unfortunately BioSmartLtd has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

To Sum It Up

Has BioSmartLtd got what it takes to maintain its dividend payments? When companies are growing rapidly and retaining a majority of the profits within the business, it's usually a sign that reinvesting earnings creates more value than paying dividends to shareholders. Perhaps even more importantly - this can sometimes signal management is focused on the long term future of the business. We think this is a pretty attractive combination, and would be interested in investigating BioSmartLtd more closely.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Every company has risks, and we've spotted 3 warning signs for BioSmartLtd you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading BioSmartLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BioSmartLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A038460

BioSmartLtd

Engages in the manufacture and sale of smart cards in South Korea.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion