- Taiwan

- /

- Consumer Durables

- /

- TWSE:9911

Discovering None And 2 Other Hidden Small Cap Treasures

Reviewed by Simply Wall St

As global markets navigate mixed performances, with the S&P 500 finishing a strong year despite recent slumps and economic indicators like the Chicago PMI showing contraction, investors are increasingly looking towards small-cap stocks for potential opportunities. In this environment of fluctuating indices and shifting economic forecasts, identifying promising small-cap companies can be particularly rewarding as they often offer unique growth potential that larger firms might not.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sekerbank T.A.S (IBSE:SKBNK)

Simply Wall St Value Rating: ★★★★☆☆

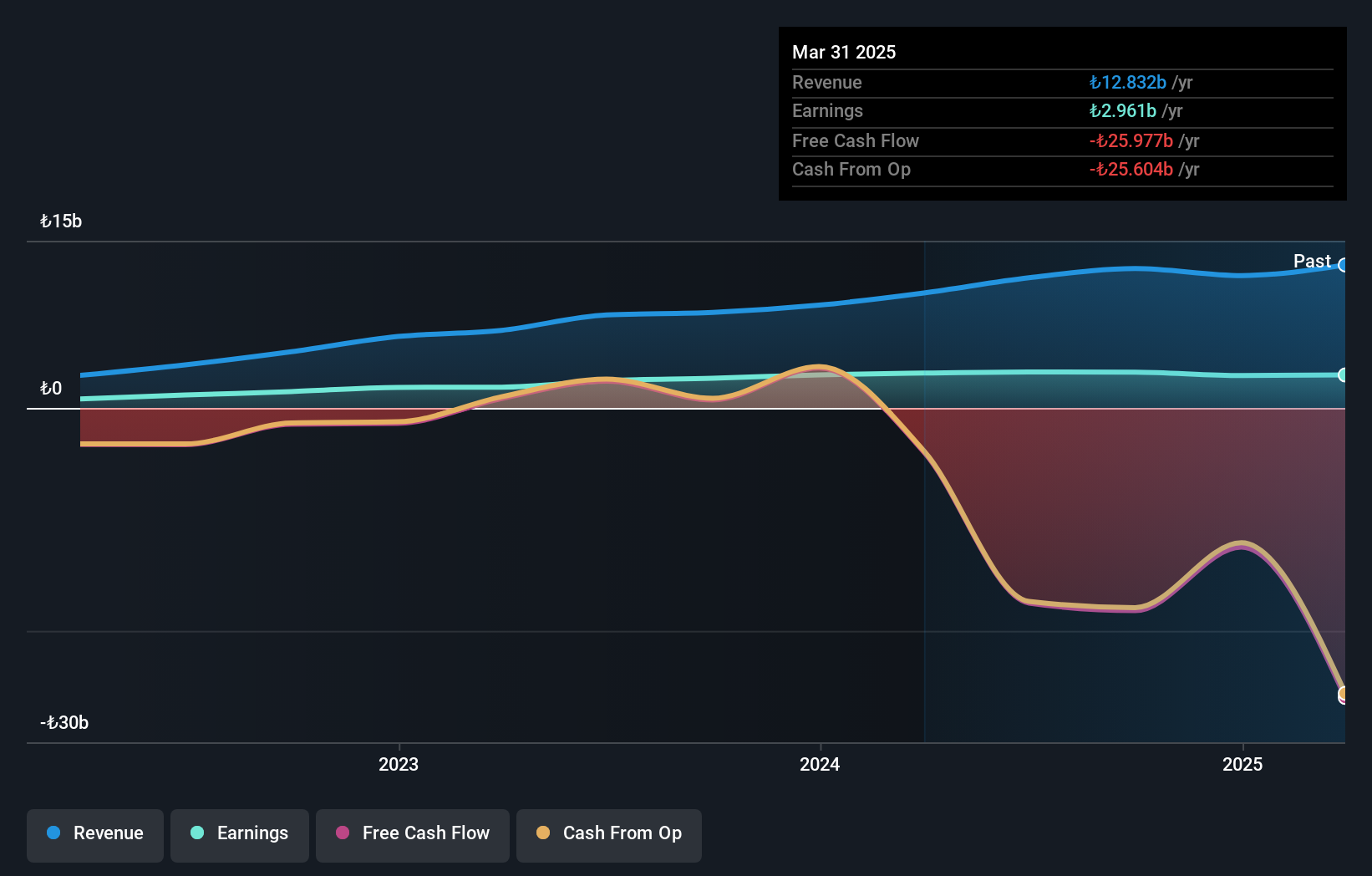

Overview: Sekerbank T.A.S., along with its subsidiaries, offers agricultural, business, SME, corporate, and retail banking services in Turkey and has a market capitalization of TRY12.33 billion.

Operations: Sekerbank T.A.S. generates revenue primarily through its SME and treasury/investment banking segments, contributing TRY3.98 billion and TRY3.71 billion, respectively. The corporate/commercial segment also plays a significant role with TRY2.73 billion in revenue.

Sekerbank T.A.S., a modest-sized player in the banking sector, relies on customer deposits for 69% of its funding, reducing external borrowing risks. With total assets at TRY120.5 billion and equity of TRY17.1 billion, its balance sheet reflects solid fundamentals. The bank's earnings growth over the past year was 20.5%, outpacing the industry average of 13.4%. Despite this robust growth, shareholders faced dilution in the past year which might be a concern for some investors. Its price-to-earnings ratio stands attractively low at 3.9x compared to the TR market's 16.2x, suggesting potential undervaluation amidst these dynamics.

- Navigate through the intricacies of Sekerbank T.A.S with our comprehensive health report here.

Review our historical performance report to gain insights into Sekerbank T.A.S''s past performance.

Synopex (KOSDAQ:A025320)

Simply Wall St Value Rating: ★★★★★★

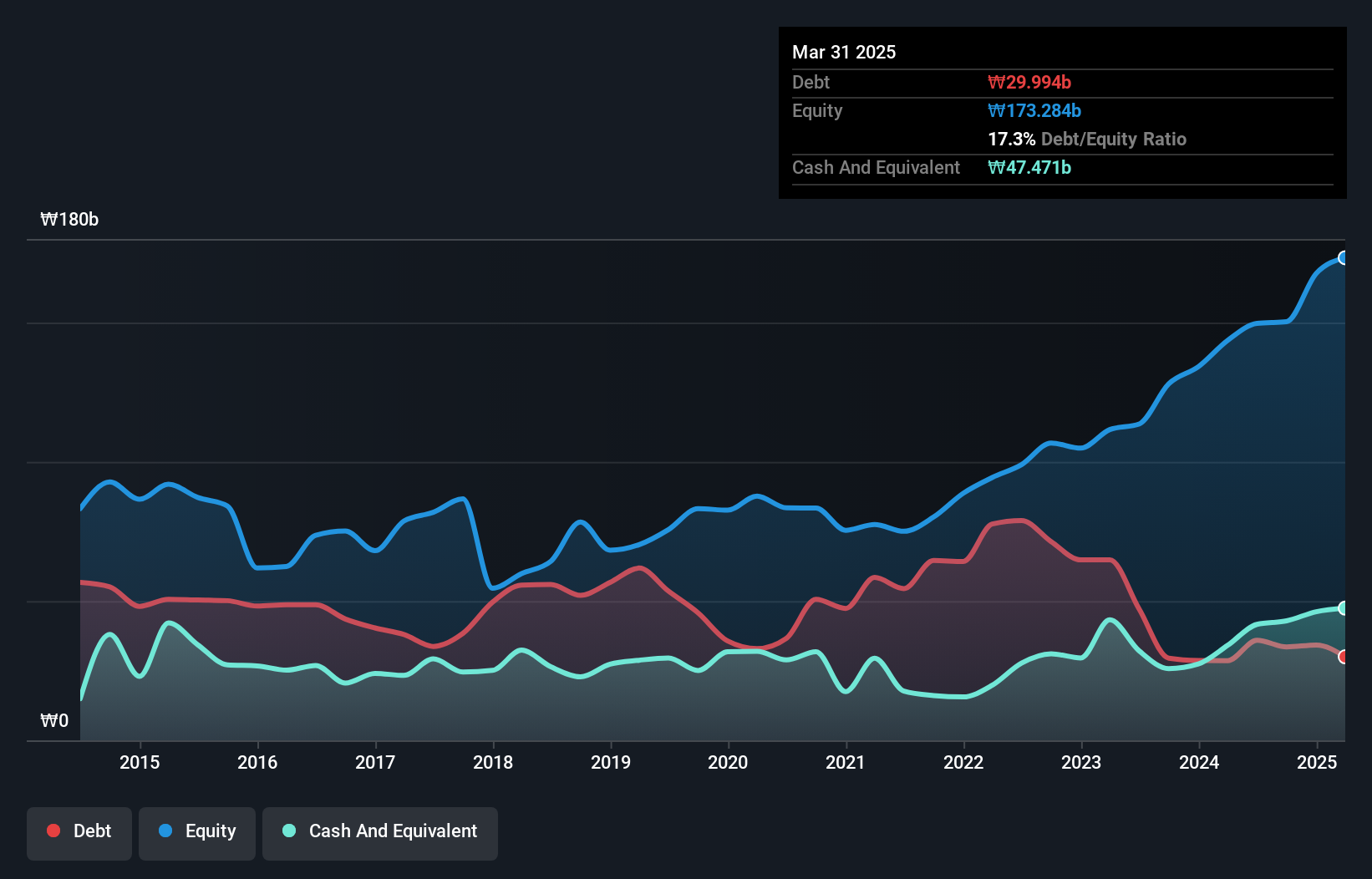

Overview: Synopex Inc. is a company that manufactures and sells flexible printed circuit board (FPCB) products and electronic components both in South Korea and internationally, with a market capitalization of ₩550.68 billion.

Operations: Synopex generates revenue primarily from its FPCB Business Division, contributing ₩316.16 billion, and the Filter Business Division, adding ₩38.32 billion.

Synopex, a nimble player in the electronics sector, has demonstrated impressive financial resilience. The company boasts cash reserves surpassing its total debt, indicating a solid balance sheet. Over the past year, Synopex's earnings skyrocketed by 213%, outpacing the industry average of -1%. Despite a recent dip in quarterly sales to KRW 59.69 billion from KRW 68.21 billion last year, net income for nine months climbed to KRW 15.10 billion from KRW 10.41 billion previously reported. With an EBIT covering interest payments by nearly 44 times and positive free cash flow, Synopex seems poised for continued growth with forecasted earnings expansion of about 28% annually.

- Click here and access our complete health analysis report to understand the dynamics of Synopex.

Gain insights into Synopex's historical performance by reviewing our past performance report.

Taiwan Sakura (TWSE:9911)

Simply Wall St Value Rating: ★★★★★☆

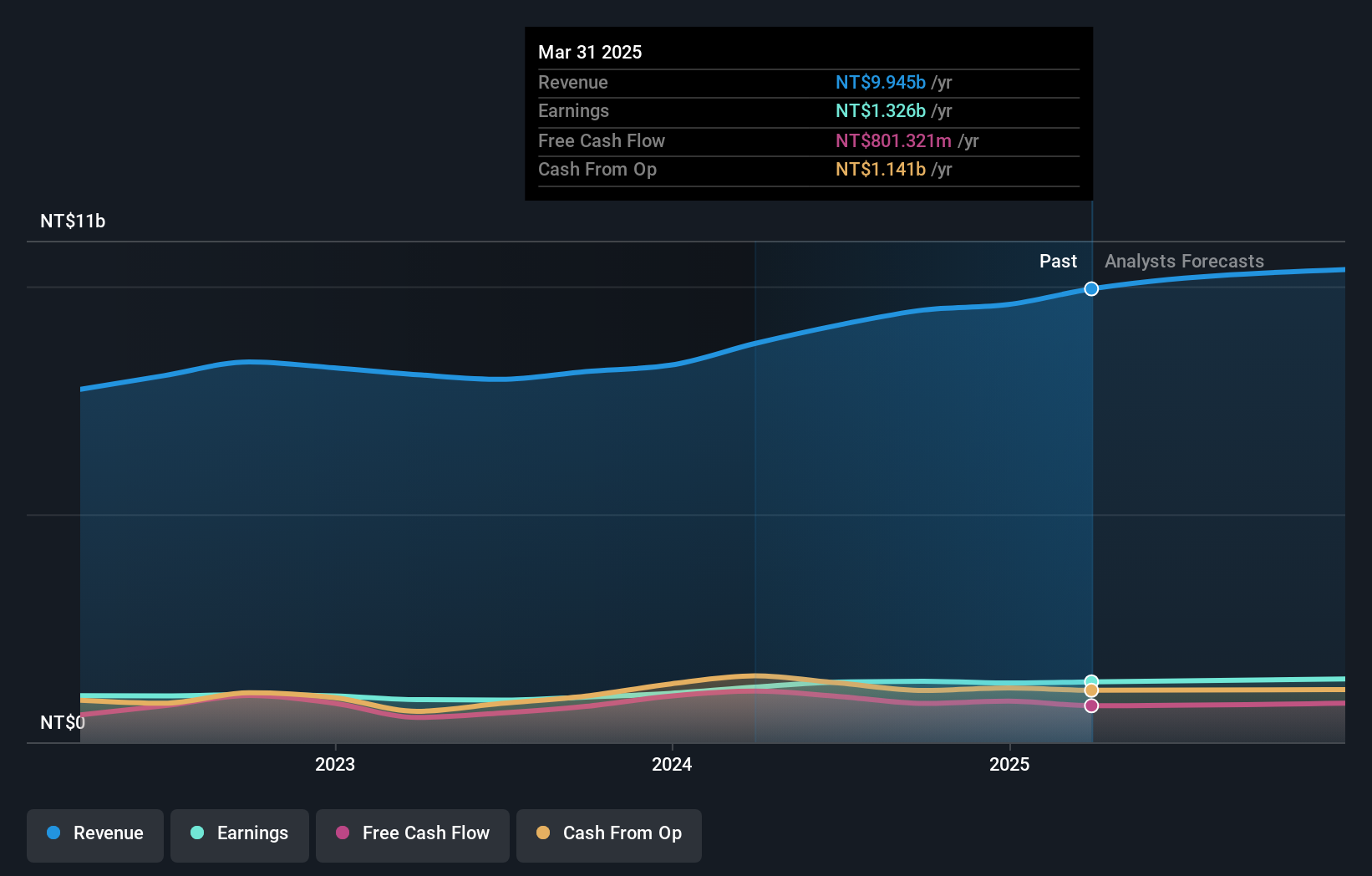

Overview: Taiwan Sakura Corporation is a Taiwanese company specializing in the manufacture and sale of kitchen appliances, with a market capitalization of NT$18.62 billion.

Operations: Taiwan Sakura Corporation generates revenue primarily from its Gas Appliance Division and Kitchenware Division, with the Gas Appliance Division contributing NT$5.76 billion and the Kitchenware Division NT$2.83 billion.

Taiwan Sakura, a promising player in the consumer durables sector, has shown impressive earnings growth of 35.1% over the past year, outpacing the industry average of 8.9%. The company reported a net income of TWD 335 million for Q3 2024, up from TWD 318 million in the previous year. With a price-to-earnings ratio of 13.9x, it offers good value compared to the Taiwan market's average of 20.8x. Despite an increase in its debt-to-equity ratio from 0.06% to 5.9% over five years, Taiwan Sakura maintains more cash than total debt and remains free cash flow positive.

- Click to explore a detailed breakdown of our findings in Taiwan Sakura's health report.

Assess Taiwan Sakura's past performance with our detailed historical performance reports.

Seize The Opportunity

- Access the full spectrum of 4665 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Sakura might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9911

Taiwan Sakura

Engages in the manufacture and sale of kitchen appliances in Taiwan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives