- South Korea

- /

- IT

- /

- KOSE:A286940

Should You Or Shouldn't You: A Dividend Analysis on Lotte Data Communication Company (KRX:286940)

Is Lotte Data Communication Company (KRX:286940) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

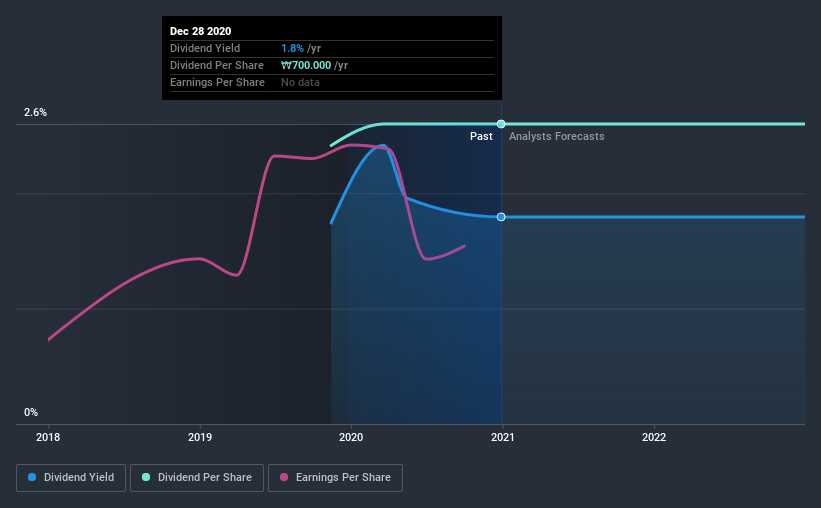

Some readers mightn't know much about Lotte Data Communication's 1.8% dividend, as it has only been paying distributions for a year or so. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Lotte Data Communication!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Lotte Data Communication paid out 30% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Last year, Lotte Data Communication paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

While the above analysis focuses on dividends relative to a company's earnings, we do note Lotte Data Communication's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Lotte Data Communication every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Dividends per share have grown at approximately 7.7% per year over this time.

Lotte Data Communication has been growing its dividend at a decent rate, and the payments have been stable despite the short payment history. This is a positive start.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. It's good to see Lotte Data Communication has been growing its earnings per share at 16% a year over the past five years. A company paying out less than a quarter of its earnings as dividends, and growing earnings at more than 10% per annum, looks to be right in the cusp of its growth phase. At the right price, we might be interested.

Conclusion

To summarise, shareholders should always check that Lotte Data Communication's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Lotte Data Communication has a low payout ratio, which we like, although it paid out virtually all of its generated cash. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. Ultimately, Lotte Data Communication comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Lotte Data Communication (1 is potentially serious!) that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade Lotte Data Communication, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A286940

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026