- South Korea

- /

- Software

- /

- KOSDAQ:A430690

We Don’t Think Hanssak's (KOSDAQ:430690) Earnings Should Make Shareholders Too Comfortable

Hanssak Co., Ltd.'s (KOSDAQ:430690) solid earnings report last week was underwhelming to investors. We did some digging and found some worrying factors that they might be paying attention to.

Check out our latest analysis for Hanssak

Zooming In On Hanssak's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

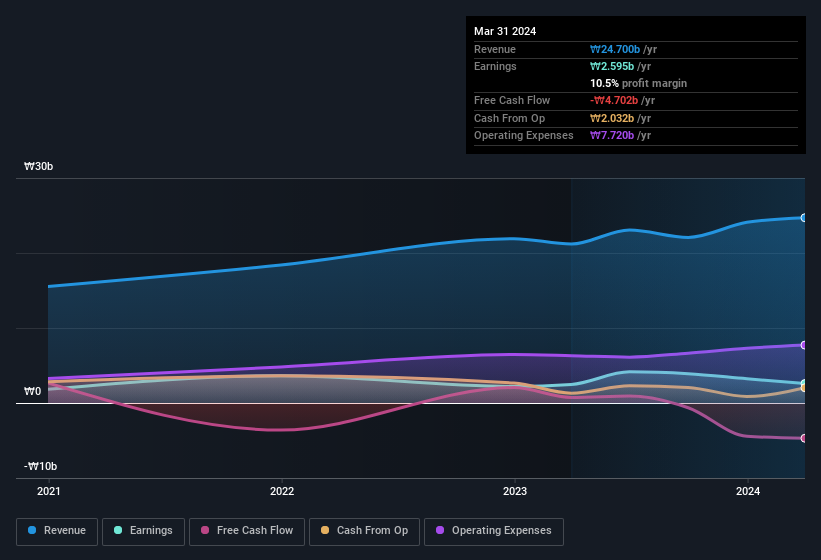

Hanssak has an accrual ratio of 0.44 for the year to March 2024. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of ₩2.59b, a look at free cash flow indicates it actually burnt through ₩4.7b in the last year. We saw that FCF was ₩734m a year ago though, so Hanssak has at least been able to generate positive FCF in the past. Importantly, we note an unusual tax situation, which we discuss below, has impacted the accruals ratio. This would partially explain why the accrual ratio was so poor.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hanssak.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that Hanssak received a tax benefit of ₩316m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Hanssak's Profit Performance

This year, Hanssak couldn't match its profit with cashflow. If the tax benefit is not repeated, then profit would drop next year, all else being equal. Considering all this we'd argue Hanssak's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing Hanssak at this point in time. Case in point: We've spotted 3 warning signs for Hanssak you should be mindful of and 2 of these bad boys are significant.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Hanssak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A430690

Low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026