- South Korea

- /

- IT

- /

- KOSDAQ:A307870

B2En Co., Ltd. (KOSDAQ:307870) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

B2En Co., Ltd. (KOSDAQ:307870) shares have continued their recent momentum with a 28% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 42% in the last twelve months.

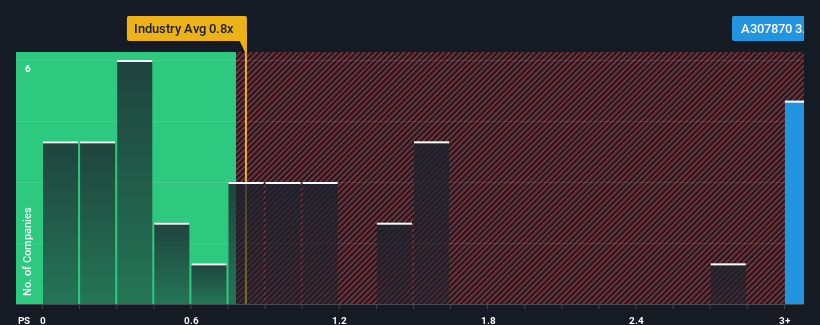

Following the firm bounce in price, given around half the companies in Korea's IT industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider B2En as a stock to avoid entirely with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for B2En

How Has B2En Performed Recently?

Revenue has risen firmly for B2En recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on B2En will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For B2En?

In order to justify its P/S ratio, B2En would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The latest three year period has also seen a 29% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 8.7% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that B2En's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What We Can Learn From B2En's P/S?

B2En's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into B2En has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for B2En (2 can't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if B2En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A307870

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives