- South Korea

- /

- Software

- /

- KOSDAQ:A300080

FLITTO Inc. (KOSDAQ:300080) Shares Slammed 31% But Getting In Cheap Might Be Difficult Regardless

To the annoyance of some shareholders, FLITTO Inc. (KOSDAQ:300080) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

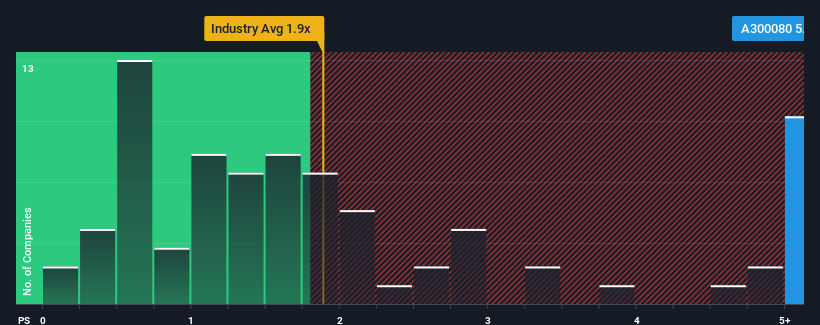

Although its price has dipped substantially, given around half the companies in Korea's Software industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider FLITTO as a stock to avoid entirely with its 5.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for FLITTO

What Does FLITTO's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, FLITTO has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on FLITTO will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For FLITTO?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like FLITTO's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.2% gain to the company's revenues. Pleasingly, revenue has also lifted 90% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 75% as estimated by the only analyst watching the company. With the industry only predicted to deliver 36%, the company is positioned for a stronger revenue result.

With this information, we can see why FLITTO is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

FLITTO's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of FLITTO's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware FLITTO is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on FLITTO, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A300080

FLITTO

Flitto Inc., an integrated platform and language data company, provides various translation services.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives