- South Korea

- /

- Software

- /

- KOSDAQ:A300080

Companies Like FLITTO (KOSDAQ:300080) Can Afford To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, FLITTO (KOSDAQ:300080) stock is up 103% in the last year, providing strong gains for shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky FLITTO's cash burn is. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for FLITTO

When Might FLITTO Run Out Of Money?

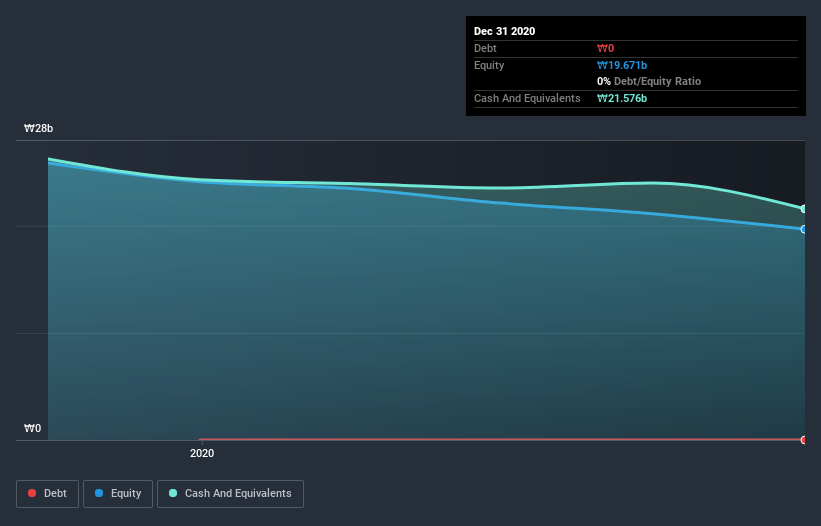

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When FLITTO last reported its balance sheet in December 2020, it had zero debt and cash worth ₩22b. In the last year, its cash burn was ₩2.0b. That means it had a cash runway of very many years as of December 2020. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

How Well Is FLITTO Growing?

Happily, FLITTO is travelling in the right direction when it comes to its cash burn, which is down 68% over the last year. Arguably, however, the revenue growth of 132% during the period was even more impressive. Considering these factors, we're fairly impressed by its growth trajectory. In reality, this article only makes a short study of the company's growth data. You can take a look at how FLITTO is growing revenue over time by checking this visualization of past revenue growth.

Can FLITTO Raise More Cash Easily?

There's no doubt FLITTO seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of ₩98b, FLITTO's ₩2.0b in cash burn equates to about 2.0% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is FLITTO's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way FLITTO is burning through its cash. For example, we think its revenue growth suggests that the company is on a good path. And even its cash burn reduction was very encouraging. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Taking an in-depth view of risks, we've identified 3 warning signs for FLITTO that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade FLITTO, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A300080

FLITTO

Flitto Inc., an integrated platform and language data company, provides various translation services.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives