- South Korea

- /

- Software

- /

- KOSDAQ:A296640

InnorulesLtd (KOSDAQ:296640) Is Reinvesting At Lower Rates Of Return

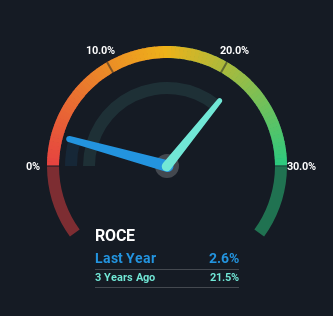

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think InnorulesLtd (KOSDAQ:296640) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for InnorulesLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.026 = ₩838m ÷ (₩43b - ₩10b) (Based on the trailing twelve months to September 2024).

Thus, InnorulesLtd has an ROCE of 2.6%. Ultimately, that's a low return and it under-performs the Software industry average of 5.0%.

See our latest analysis for InnorulesLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of InnorulesLtd.

So How Is InnorulesLtd's ROCE Trending?

Unfortunately, the trend isn't great with ROCE falling from 16% five years ago, while capital employed has grown 167%. That being said, InnorulesLtd raised some capital prior to their latest results being released, so that could partly explain the increase in capital employed. It's unlikely that all of the funds raised have been put to work yet, so as a consequence InnorulesLtd might not have received a full period of earnings contribution from it.

The Bottom Line On InnorulesLtd's ROCE

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for InnorulesLtd. These trends are starting to be recognized by investors since the stock has delivered a 1.6% gain to shareholders who've held over the last year. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

One more thing: We've identified 3 warning signs with InnorulesLtd (at least 1 which is concerning) , and understanding these would certainly be useful.

While InnorulesLtd isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A296640

InnorulesLtd

Provides digital innovation solutions to corporations worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives