- South Korea

- /

- Software

- /

- KOSDAQ:A288980

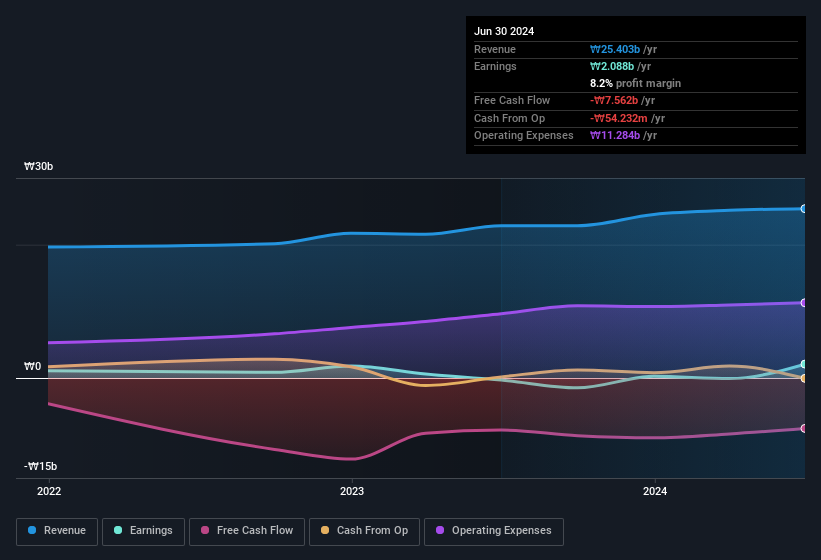

Solid Earnings Reflect Moadata's (KOSDAQ:288980) Strength As A Business

Moadata Co., Ltd. (KOSDAQ:288980) just reported healthy earnings but the stock price didn't move much. Investors are probably missing some underlying factors which are encouraging for the future of the company.

See our latest analysis for Moadata

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Moadata's profit was reduced by ₩1.0b, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Moadata took a rather significant hit from unusual items in the year to June 2024. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Moadata.

Our Take On Moadata's Profit Performance

As we discussed above, we think the significant unusual expense will make Moadata's statutory profit lower than it would otherwise have been. Based on this observation, we consider it possible that Moadata's statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For instance, we've identified 4 warning signs for Moadata (1 is a bit unpleasant) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Moadata's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A288980

Moadata

An artificial intelligence company, provides ICT infrastructure monitoring and healthcare solutions in South Korea.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market