- South Korea

- /

- Software

- /

- KOSDAQ:A263800

Datasolution, Inc. (KOSDAQ:263800) Held Back By Insufficient Growth Even After Shares Climb 47%

Datasolution, Inc. (KOSDAQ:263800) shareholders have had their patience rewarded with a 47% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 8.8% isn't as attractive.

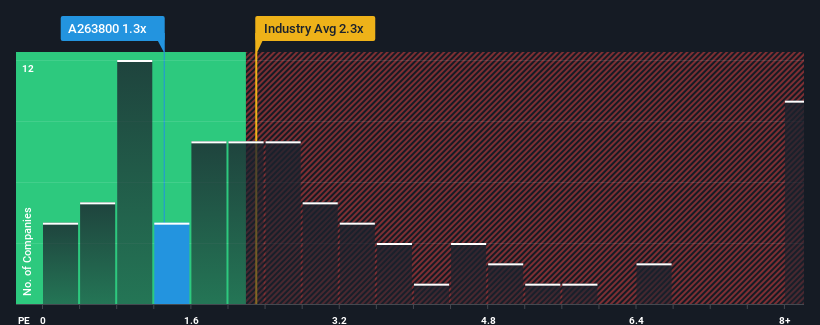

Even after such a large jump in price, it would still be understandable if you think Datasolution is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.3x, considering almost half the companies in Korea's Software industry have P/S ratios above 2.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Datasolution

What Does Datasolution's P/S Mean For Shareholders?

For example, consider that Datasolution's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Datasolution will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Datasolution's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 50% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Datasolution's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Datasolution's P/S

Despite Datasolution's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Datasolution maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Plus, you should also learn about these 3 warning signs we've spotted with Datasolution.

If these risks are making you reconsider your opinion on Datasolution, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A263800

Excellent balance sheet and good value.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

The Architect of Sovereignty: Palantir’s Premium Paradox at $149

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.