- South Korea

- /

- Software

- /

- KOSDAQ:A115310

Just Three Days Till INFOvine.co.,Ltd. (KOSDAQ:115310) Will Be Trading Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that INFOvine.co.,Ltd. (KOSDAQ:115310) is about to go ex-dividend in just three days. Investors can purchase shares before the 29th of December in order to be eligible for this dividend, which will be paid on the 31st of March.

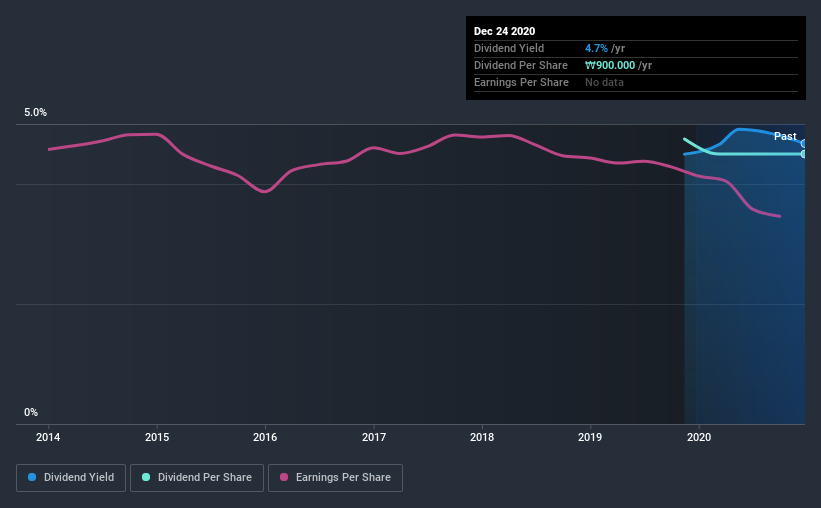

INFOvine.co.Ltd's next dividend payment will be ₩900 per share. Last year, in total, the company distributed ₩900 to shareholders. Looking at the last 12 months of distributions, INFOvine.co.Ltd has a trailing yield of approximately 4.7% on its current stock price of ₩19250. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for INFOvine.co.Ltd

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately INFOvine.co.Ltd's payout ratio is modest, at just 26% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It distributed 29% of its free cash flow as dividends, a comfortable payout level for most companies.

It's positive to see that INFOvine.co.Ltd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit INFOvine.co.Ltd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by INFOvine.co.Ltd's 6.4% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Given that INFOvine.co.Ltd has only been paying a dividend for a year, there's not much of a past history to draw insight from.

The Bottom Line

Should investors buy INFOvine.co.Ltd for the upcoming dividend? INFOvine.co.Ltd has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. All things considered, we are not particularly enthused about INFOvine.co.Ltd from a dividend perspective.

In light of that, while INFOvine.co.Ltd has an appealing dividend, it's worth knowing the risks involved with this stock. To that end, you should learn about the 3 warning signs we've spotted with INFOvine.co.Ltd (including 1 which is concerning).

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading INFOvine.co.Ltd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A115310

INFOvine.co.Ltd

INFOvine.co.,Ltd. engage in the development and supply of application software in mobile, security, gaming, and entertainment fields in South Korea.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives