- South Korea

- /

- Software

- /

- KOSDAQ:A086960

MDS Tech's (KOSDAQ:086960) Performance Is Even Better Than Its Earnings Suggest

The subdued stock price reaction suggests that MDS Tech Inc.'s (KOSDAQ:086960) strong earnings didn't offer any surprises. We think that investors have missed some encouraging factors underlying the profit figures.

See our latest analysis for MDS Tech

Zooming In On MDS Tech's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

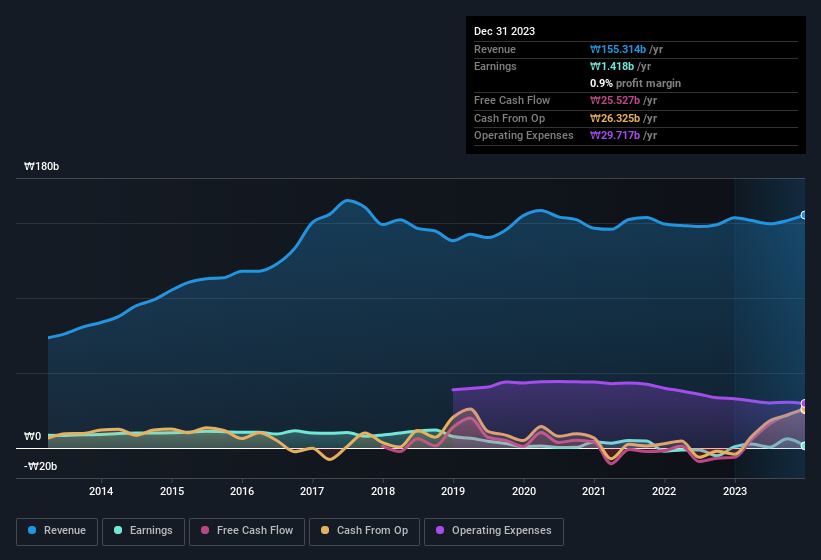

MDS Tech has an accrual ratio of -0.53 for the year to December 2023. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. To wit, it produced free cash flow of ₩26b during the period, dwarfing its reported profit of ₩1.42b. Given that MDS Tech had negative free cash flow in the prior corresponding period, the trailing twelve month resul of ₩26b would seem to be a step in the right direction. However, that's not the end of the story. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of MDS Tech.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, MDS Tech increased the number of shares on issue by 5.6% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out MDS Tech's historical EPS growth by clicking on this link.

How Is Dilution Impacting MDS Tech's Earnings Per Share (EPS)?

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. The good news is that profit was up 48% in the last twelve months. On the other hand, earnings per share are only up 47% over the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if MDS Tech can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

MDS Tech's profit was reduced by unusual items worth ₩6.1b in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. This is what you'd expect to see where a company has a non-cash charge reducing paper profits. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. In the twelve months to December 2023, MDS Tech had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On MDS Tech's Profit Performance

Summing up, MDS Tech's accrual ratio and its unusual items suggest that its statutory earnings were temporarily depressed (and could bounce back), while the dilution is a negative for shareholders. Looking at all these factors, we'd say that MDS Tech's underlying earnings power is at least as good as the statutory numbers would make it seem. If you want to do dive deeper into MDS Tech, you'd also look into what risks it is currently facing. To help with this, we've discovered 4 warning signs (1 shouldn't be ignored!) that you ought to be aware of before buying any shares in MDS Tech.

After our examination into the nature of MDS Tech's profit, we've come away optimistic for the company. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A086960

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion