- South Korea

- /

- Software

- /

- KOSDAQ:A067920

Three Things You Should Check Before Buying IGLOO SECURITY, Inc. (KOSDAQ:067920) For Its Dividend

Dividend paying stocks like IGLOO SECURITY, Inc. (KOSDAQ:067920) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

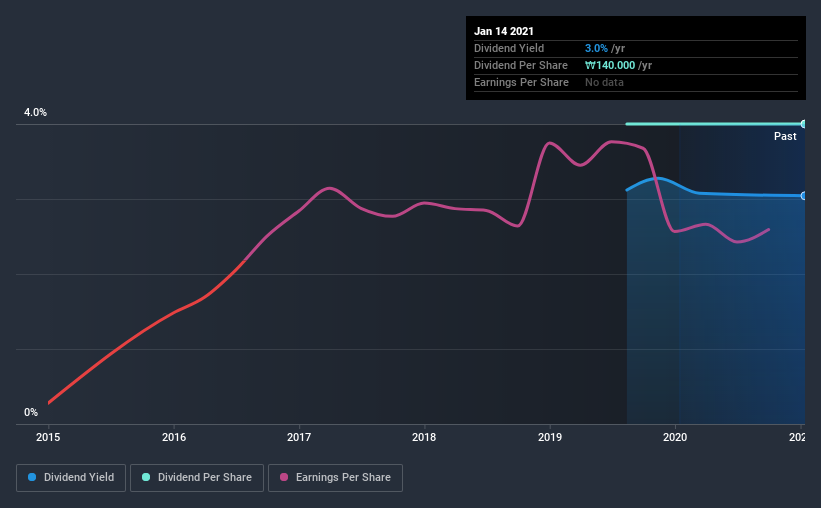

Some readers mightn't know much about IGLOO SECURITY's 3.0% dividend, as it has only been paying distributions for a year or so. During the year, the company also conducted a buyback equivalent to around 3.6% of its market capitalisation. Some simple research can reduce the risk of buying IGLOO SECURITY for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on IGLOO SECURITY!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. IGLOO SECURITY paid out 62% of its profit as dividends, over the trailing twelve month period. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. IGLOO SECURITY paid out 18% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

While the above analysis focuses on dividends relative to a company's earnings, we do note IGLOO SECURITY's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on IGLOO SECURITY's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was ₩140 per share.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. It's good to see IGLOO SECURITY has been growing its earnings per share at 27% a year over the past five years. With recent, rapid earnings per share growth and a payout ratio of 62%, this business looks like an interesting prospect if earnings are reinvested effectively.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we think IGLOO SECURITY has an acceptable payout ratio and its dividend is well covered by cashflow. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. IGLOO SECURITY has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 3 warning signs for IGLOO SECURITY that investors should know about before committing capital to this stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

When trading IGLOO SECURITY or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A067920

IGLOO

Provides security management solutions and services in Korea.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.

CEO comp looks high on the surface, but context matters. Cognyte is approaching profitability — losses narrowed 23% YoY and they’re now guiding positive adjusted EBITDA of $47M for FY26. Revenue is growing 12-14% annually with a debt-free balance sheet. The board is compensating for execution on a turnaround, not rewarding stagnation. If they hit their $500M revenue / 20%+ EBITDA margin target by FY28, today’s comp will look like a bargain in hindsight. Imagine if everyone that has invested in Tesla 10 years ago had the same mentality...