- South Korea

- /

- IT

- /

- KOSDAQ:A064480

Investors Appear Satisfied With BRIDGETEC Corp.'s (KOSDAQ:064480) Prospects As Shares Rocket 32%

BRIDGETEC Corp. (KOSDAQ:064480) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 7.2% isn't as impressive.

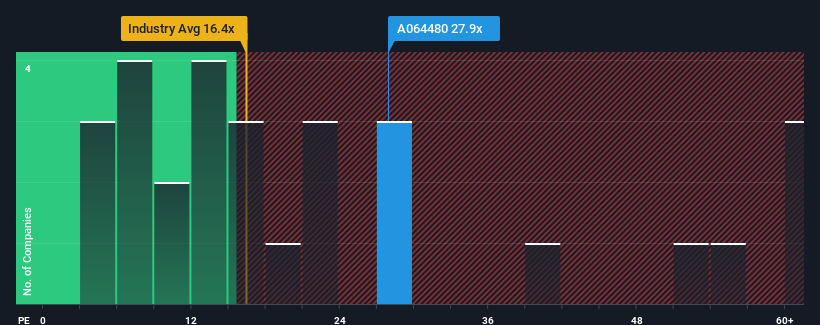

After such a large jump in price, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 13x, you may consider BRIDGETEC as a stock to avoid entirely with its 27.9x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

BRIDGETEC has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for BRIDGETEC

How Is BRIDGETEC's Growth Trending?

In order to justify its P/E ratio, BRIDGETEC would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 5.2%. This was backed up an excellent period prior to see EPS up by 351% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 29% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that BRIDGETEC's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

The strong share price surge has got BRIDGETEC's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of BRIDGETEC revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware BRIDGETEC is showing 3 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if BRIDGETEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A064480

Flawless balance sheet with low risk.

Market Insights

Community Narratives