- South Korea

- /

- Software

- /

- KOSDAQ:A057680

Shareholders in T ScientificLtd (KOSDAQ:057680) have lost 70%, as stock drops 14% this past week

It is a pleasure to report that the T Scientific Co.,Ltd. (KOSDAQ:057680) is up 58% in the last quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. The share price has failed to impress anyone , down a sizable 70% during that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone.

Since T ScientificLtd has shed ₩16b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Given that T ScientificLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

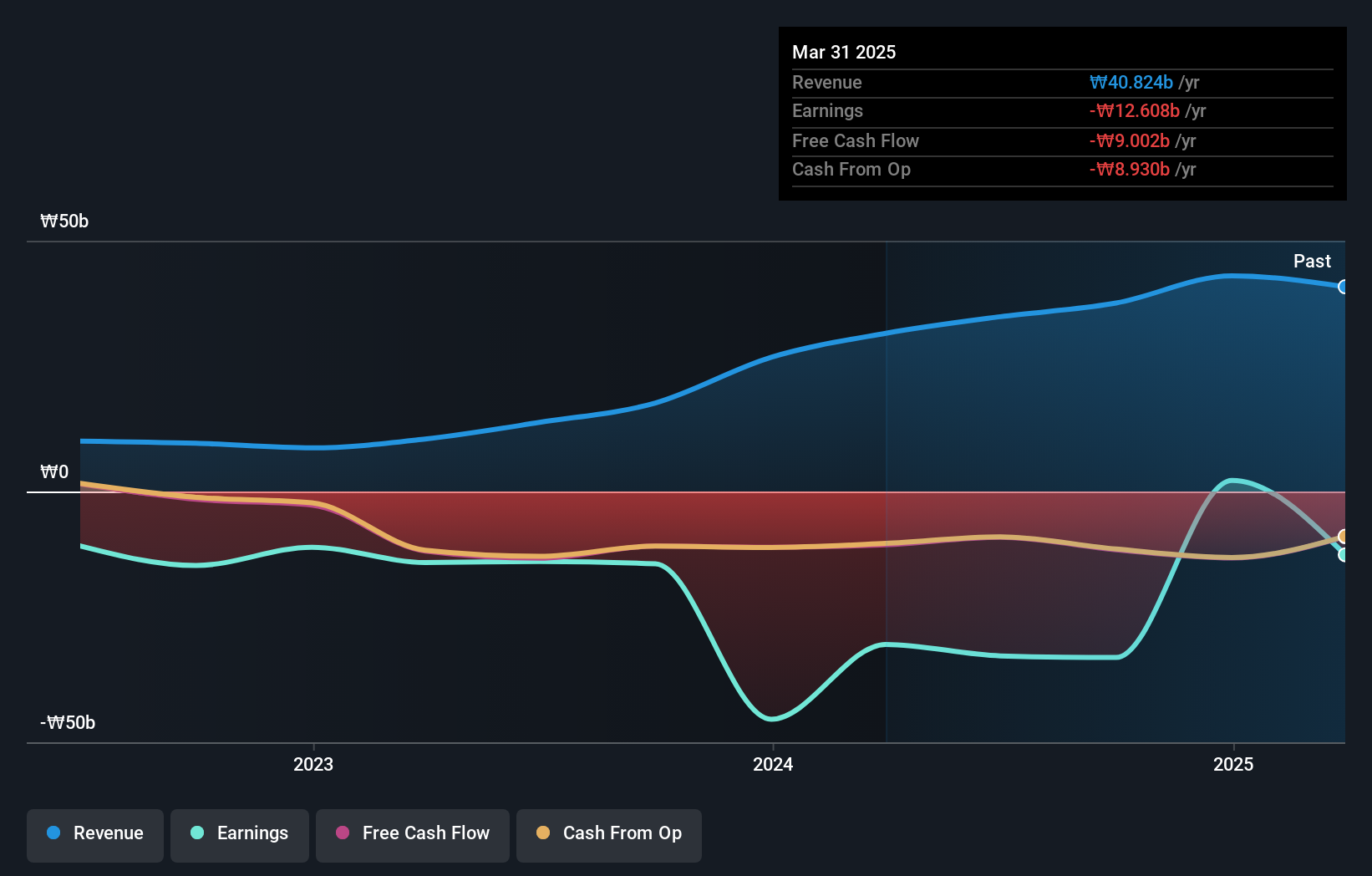

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that T ScientificLtd shareholders have received a total shareholder return of 21% over the last year. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that T ScientificLtd is showing 3 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

But note: T ScientificLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if T ScientificLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A057680

T ScientificLtd

Engages in the IT and mobile commerce businesses in South Korea.

Flawless balance sheet low.

Market Insights

Community Narratives