- South Korea

- /

- Diversified Financial

- /

- KOSDAQ:A035600

Why You Might Be Interested In Kginicis Co.,Ltd (KOSDAQ:035600) For Its Upcoming Dividend

It looks like Kginicis Co.,Ltd (KOSDAQ:035600) is about to go ex-dividend in the next 3 days. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 24th of April.

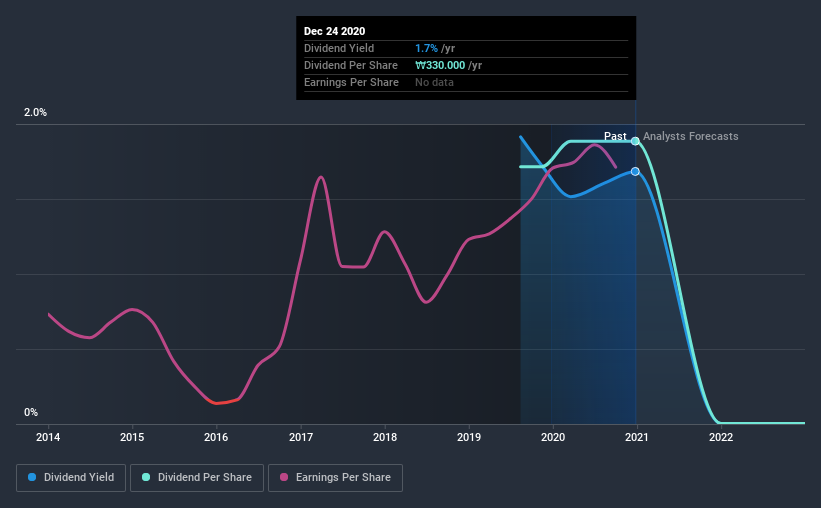

The upcoming dividend for KginicisLtd is ₩350 per share, increased from last year's total dividends per share of ₩330. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for KginicisLtd

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. KginicisLtd has a low and conservative payout ratio of just 18% of its income after tax. A useful secondary check can be to evaluate whether KginicisLtd generated enough free cash flow to afford its dividend. The good news is it paid out just 8.2% of its free cash flow in the last year.

It's positive to see that KginicisLtd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit KginicisLtd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see KginicisLtd has grown its earnings rapidly, up 21% a year for the past five years. With earnings per share growing rapidly and the company sensibly reinvesting almost all of its profits within the business, KginicisLtd looks like a promising growth company.

Given that KginicisLtd has only been paying a dividend for a year, there's not much of a past history to draw insight from.

The Bottom Line

Should investors buy KginicisLtd for the upcoming dividend? We love that KginicisLtd is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. KginicisLtd looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

While it's tempting to invest in KginicisLtd for the dividends alone, you should always be mindful of the risks involved. Case in point: We've spotted 2 warning signs for KginicisLtd you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade KginicisLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KginicisLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A035600

KginicisLtd

Provides electronic payment services in Korea, Asia, and internationally.

Very undervalued with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion