- South Korea

- /

- Software

- /

- KOSDAQ:A030520

Exploring 3 High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

Amid renewed U.S.-China trade tensions and geopolitical uncertainties, Asian markets have shown resilience, with some indices experiencing mixed performance as investors navigate the complex economic landscape. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate robust innovation, adaptability to market changes, and potential to capitalize on technological advancements despite broader market volatility.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 24.08% | 28.54% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Eoptolink Technology | 38.08% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Hancom (KOSDAQ:A030520)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hancom Inc. is a company that develops and sells office software products and solutions both in South Korea and internationally, with a market capitalization of approximately ₩605.13 billion.

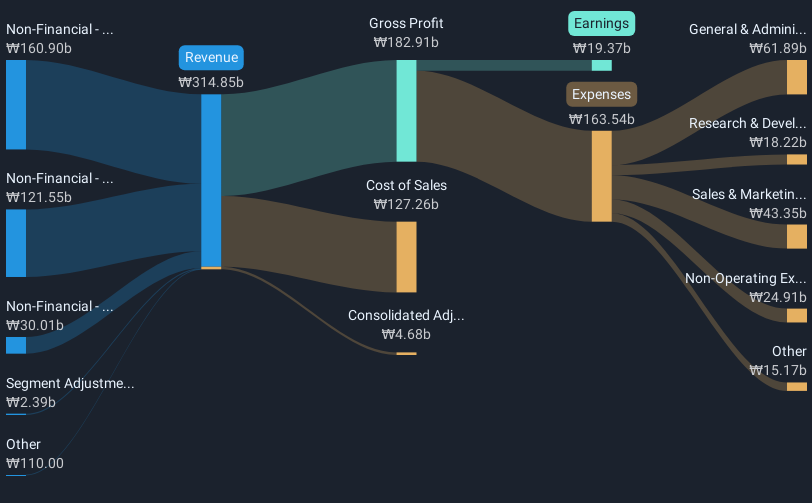

Operations: Hancom Inc. generates revenue primarily from its Non-Financial - SW Division, contributing ₩185.71 billion, and the Non-Financial - Manufacturing Sector, adding ₩90.53 billion. The company's business model is diversified across software development and manufacturing sectors, with additional contributions from the Non-Financial - Other Sectors at ₩29.82 billion and Finance - Financial Sector at ₩6.26 billion.

Despite a challenging year marked by a significant one-off loss of ₩4.7 billion, Hancom's resilience is evident in its robust forecasted earnings growth at 45.2% annually, outpacing the Korean market's average of 25.1%. This growth trajectory is supported by an anticipated revenue increase of 15.6% per year, which not only exceeds the national average (8.1%) but also aligns with broader industry trends towards software innovation and scalability. However, it's crucial to note that Hancom’s recent performance suffered due to negative earnings growth (-24.2%), contrasting sharply with the software industry’s average growth of 19.8%. Looking ahead, while challenges remain, Hancom's strong focus on R&D and strategic market positioning may well catalyze its recovery and future success in Asia’s high-growth tech landscape.

- Click here to discover the nuances of Hancom with our detailed analytical health report.

Gain insights into Hancom's historical performance by reviewing our past performance report.

Beijing Infosec TechnologiesLtd (SHSE:688201)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Infosec Technologies Co., Ltd. specializes in developing and providing application security products in China, with a market capitalization of approximately CN¥4.67 billion.

Operations: Infosec Technologies generates revenue primarily from the finance, enterprise, and government sectors, with finance contributing CN¥203.22 million and government CN¥190.80 million. The company's focus on application security products positions it as a key player in these segments within China.

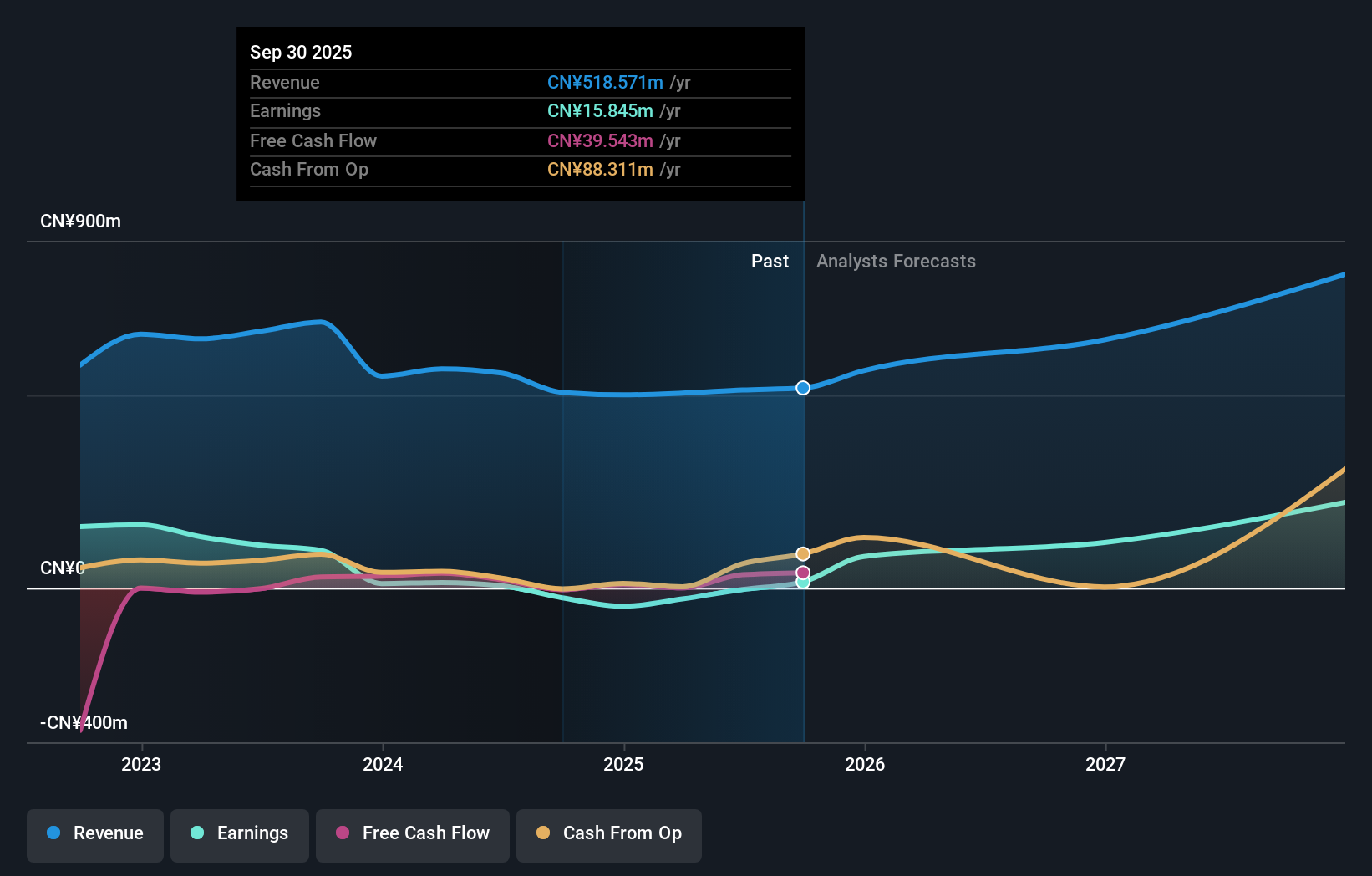

Beijing Infosec TechnologiesLtd has demonstrated a commendable turnaround, transitioning from a net loss of CNY 33.47 million to a net profit of CNY 10.37 million in the first half of 2025, showcasing an earnings jump that aligns with its forecasted annual growth rate of 75.81%. This resurgence is supported by a robust revenue increase from CNY 185.65 million to CNY 198.1 million over the same period, marking an annual growth rate of 17.5%, which surpasses the Chinese market average of 13.7%. Despite its past unprofitability and highly volatile share price, the company's positive shift in earnings and consistent investment in innovation signal promising prospects for future stability and growth within Asia's tech sector.

PLAIDInc (TSE:4165)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PLAID, Inc. is a Japanese company that develops and operates KARTE, a customer experience SaaS platform, with a market cap of ¥39.86 billion.

Operations: The company generates revenue primarily through its SaaS business, with ¥12.77 billion attributed to this segment.

PLAIDInc, amidst a strategic pivot, has issued new shares as restricted stock to executives and employees, underscoring its commitment to aligning long-term employee interests with shareholder value. This move coincides with an impressive earnings forecast showing a 19.6% annual growth rate and revenue projections rising at 17.2% annually—both metrics outpacing the broader Japanese market's averages of 8.1% and 4.4%, respectively. With the company turning profitable this year and maintaining robust investment in innovation, PLAIDInc is positioning itself as a resilient contender in Asia’s competitive tech landscape, leveraging internal strengths for sustained growth.

Key Takeaways

- Investigate our full lineup of 185 Asian High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hancom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A030520

Hancom

Develops and sells office software products and solutions in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success