- South Korea

- /

- Semiconductors

- /

- KOSE:A322000

Is Hyundai Energy Solutions Co.,Ltd's (KRX:322000) 2.3% ROE Worse Than Average?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). We'll use ROE to examine Hyundai Energy Solutions Co.,Ltd (KRX:322000), by way of a worked example.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Hyundai Energy SolutionsLtd

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hyundai Energy SolutionsLtd is:

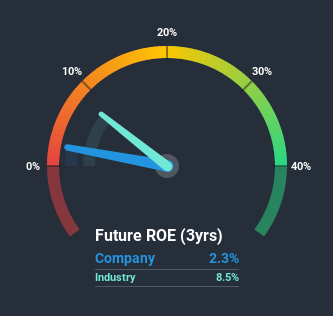

2.3% = ₩7.4b ÷ ₩316b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. One way to conceptualize this is that for each ₩1 of shareholders' capital it has, the company made ₩0.02 in profit.

Does Hyundai Energy SolutionsLtd Have A Good Return On Equity?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. If you look at the image below, you can see Hyundai Energy SolutionsLtd has a lower ROE than the average (8.5%) in the Semiconductor industry classification.

Unfortunately, that's sub-optimal. However, a low ROE is not always bad. If the company's debt levels are moderate to low, then there's still a chance that returns can be improved via the use of financial leverage. A high debt company having a low ROE is a different story altogether and a risky investment in our books. You can see the 2 risks we have identified for Hyundai Energy SolutionsLtd by visiting our risks dashboard for free on our platform here.

How Does Debt Impact Return On Equity?

Companies usually need to invest money to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. That will make the ROE look better than if no debt was used.

Hyundai Energy SolutionsLtd's Debt And Its 2.3% ROE

Hyundai Energy SolutionsLtd has a debt to equity ratio of 0.14, which is far from excessive. Its ROE is rather low, and it does use some debt, albeit not much. That's not great to see. Judicious use of debt to improve returns can certainly be a good thing, although it does elevate risk slightly and reduce future optionality.

Summary

Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So I think it may be worth checking this free report on analyst forecasts for the company.

Of course Hyundai Energy SolutionsLtd may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

If you’re looking to trade Hyundai Energy SolutionsLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Energy SolutionsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A322000

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives