- South Korea

- /

- Semiconductors

- /

- KOSE:A281820

Are KCTech's (KRX:281820) Statutory Earnings A Good Guide To Its Underlying Profitability?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether KCTech's (KRX:281820) statutory profits are a good guide to its underlying earnings.

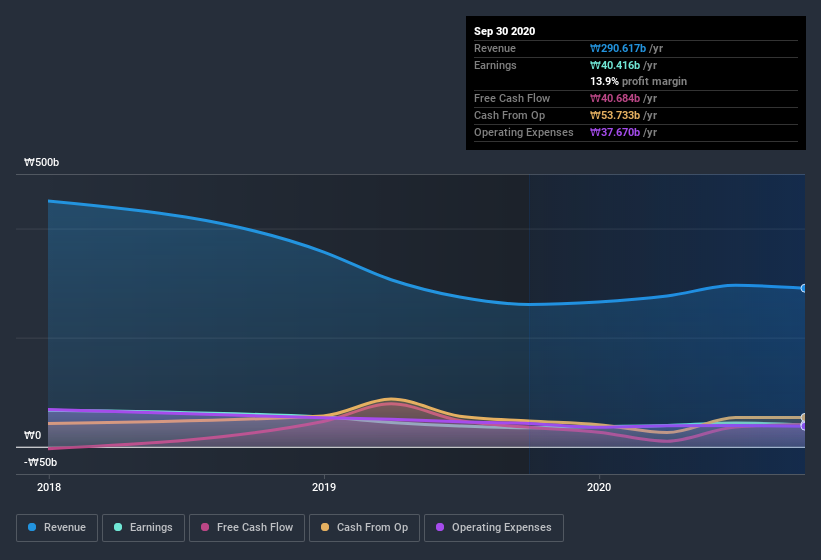

While KCTech was able to generate revenue of ₩290.6b in the last twelve months, we think its profit result of ₩40.4b was more important.

Check out our latest analysis for KCTech

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. In this article we will consider how KCTech's decision to issue new shares in the company has impacted returns to shareholders. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of KCTech.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, KCTech increased the number of shares on issue by 5.2% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of KCTech's EPS by clicking here.

How Is Dilution Impacting KCTech's Earnings Per Share? (EPS)

We don't have any data on the company's profits from three years ago. The good news is that profit was up 17% in the last twelve months. But EPS was less impressive, up only 17% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if KCTech can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On KCTech's Profit Performance

Each KCTech share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that KCTech's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 17% EPS growth in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing KCTech at this point in time. Case in point: We've spotted 2 warning signs for KCTech you should be aware of.

This note has only looked at a single factor that sheds light on the nature of KCTech's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade KCTech, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if KCTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A281820

KCTech

Engages in the manufacture and distribution of semiconductor systems, display systems, and electronic materials in South Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion