- South Korea

- /

- Semiconductors

- /

- KOSE:A108320

Could The Market Be Wrong About LX Semicon Co., Ltd. (KRX:108320) Given Its Attractive Financial Prospects?

With its stock down 7.2% over the past three months, it is easy to disregard LX Semicon (KRX:108320). However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. In this article, we decided to focus on LX Semicon's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for LX Semicon

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for LX Semicon is:

14% = ₩145b ÷ ₩1.0t (Based on the trailing twelve months to June 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each ₩1 of shareholders' capital it has, the company made ₩0.14 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

LX Semicon's Earnings Growth And 14% ROE

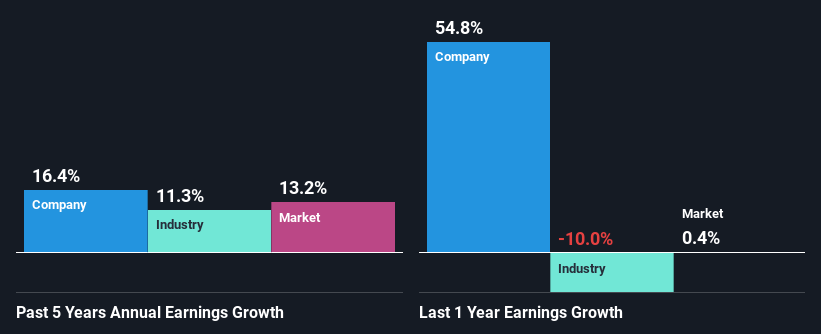

At first glance, LX Semicon seems to have a decent ROE. On comparing with the average industry ROE of 7.1% the company's ROE looks pretty remarkable. This probably laid the ground for LX Semicon's moderate 16% net income growth seen over the past five years.

As a next step, we compared LX Semicon's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 11%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is LX Semicon fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is LX Semicon Using Its Retained Earnings Effectively?

LX Semicon has a three-year median payout ratio of 29%, which implies that it retains the remaining 71% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Moreover, LX Semicon is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 29%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 16%.

Conclusion

Overall, we are quite pleased with LX Semicon's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A108320

LX Semicon

Operates as a semiconductor company in South Korea, China, Vietnam, Taiwan, Japan, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives