- South Korea

- /

- Semiconductors

- /

- KOSE:A077500

Earnings Not Telling The Story For Uniquest Corporation (KRX:077500) After Shares Rise 25%

Uniquest Corporation (KRX:077500) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

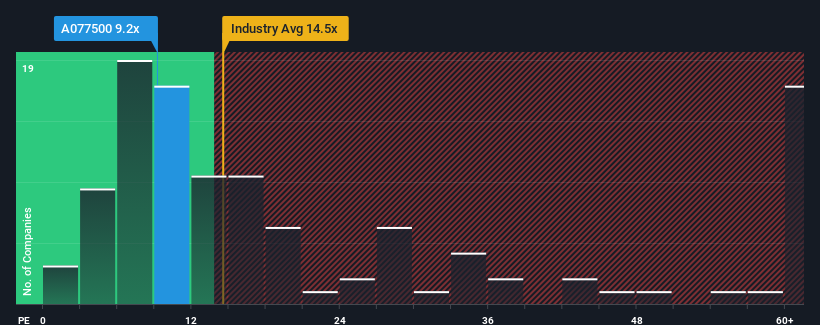

Although its price has surged higher, you could still be forgiven for feeling indifferent about Uniquest's P/E ratio of 9.2x, since the median price-to-earnings (or "P/E") ratio in Korea is also close to 11x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Uniquest over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Uniquest

Is There Some Growth For Uniquest?

In order to justify its P/E ratio, Uniquest would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 60%. As a result, earnings from three years ago have also fallen 74% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 32% shows it's an unpleasant look.

With this information, we find it concerning that Uniquest is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now Uniquest's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Uniquest revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for Uniquest that you should be aware of.

If these risks are making you reconsider your opinion on Uniquest, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A077500

Uniquest

Engages in manufacturing, selling, importing, and exporting of semiconductors, electrical, and electronic components in South Korea, the United States, and Hongkong.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives