- South Korea

- /

- Semiconductors

- /

- KOSE:A042700

What You Can Learn From HANMI Semiconductor Co., Ltd.'s (KRX:042700) P/E After Its 28% Share Price Crash

The HANMI Semiconductor Co., Ltd. (KRX:042700) share price has fared very poorly over the last month, falling by a substantial 28%. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

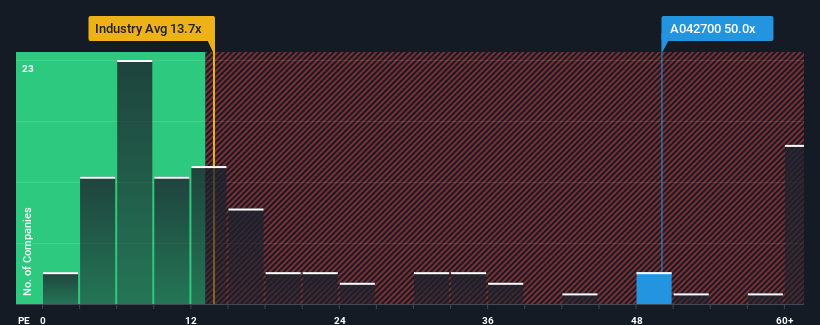

Even after such a large drop in price, HANMI Semiconductor's price-to-earnings (or "P/E") ratio of 50x might still make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

HANMI Semiconductor hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for HANMI Semiconductor

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, HANMI Semiconductor would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 113% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 53% per annum during the coming three years according to the eight analysts following the company. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that HANMI Semiconductor's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From HANMI Semiconductor's P/E?

A significant share price dive has done very little to deflate HANMI Semiconductor's very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that HANMI Semiconductor maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with HANMI Semiconductor (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if HANMI Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A042700

HANMI Semiconductor

Manufactures and sells semiconductor equipment in South Korea and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives