- South Korea

- /

- Machinery

- /

- KOSE:A009540

3 KRX Stocks Estimated To Be Trading At Discounts Of 33.6% To 44.8%

Reviewed by Simply Wall St

The South Korean market is up 1.4% over the last week but has experienced a decline of 3.9% over the past 12 months, with earnings forecasted to grow by 29% annually. In this fluctuating environment, identifying undervalued stocks can provide opportunities for investors to capitalize on potential growth at discounted prices.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| APR (KOSE:A278470) | ₩294500.00 | ₩519581.78 | 43.3% |

| T'Way Air (KOSE:A091810) | ₩2985.00 | ₩5723.90 | 47.9% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩87500.00 | ₩152267.11 | 42.5% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Oscotec (KOSDAQ:A039200) | ₩35700.00 | ₩65583.14 | 45.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩49600.00 | ₩90834.06 | 45.4% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1640.00 | ₩2972.85 | 44.8% |

| Global Tax Free (KOSDAQ:A204620) | ₩3630.00 | ₩6407.66 | 43.3% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45500.00 | ₩81897.82 | 44.4% |

| Kakao Games (KOSDAQ:A293490) | ₩17220.00 | ₩29717.17 | 42.1% |

We'll examine a selection from our screener results.

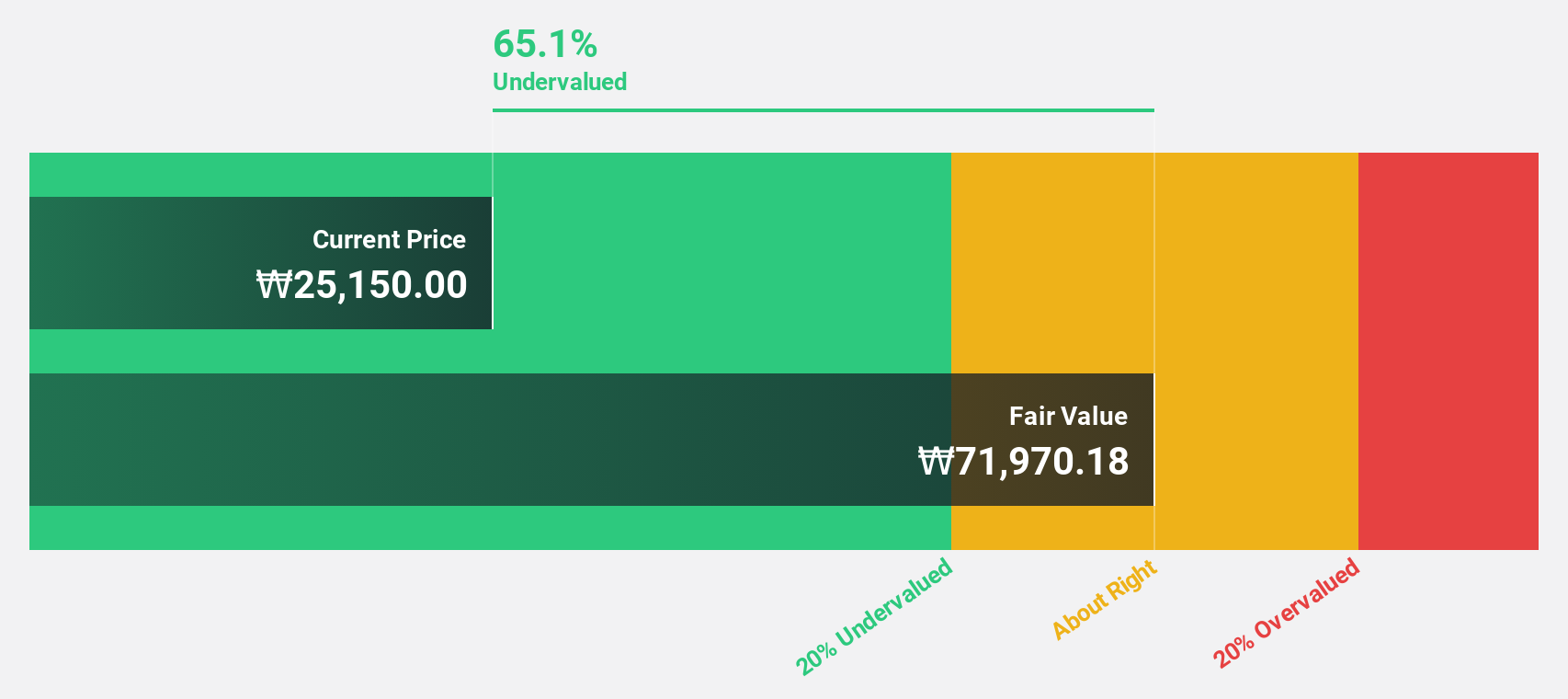

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products both in South Korea and internationally, with a market cap of ₩1.82 trillion.

Operations: Hanall Biopharma generates revenue primarily from the manufacture and sale of pharmaceuticals, amounting to ₩130.37 billion.

Estimated Discount To Fair Value: 33.6%

Hanall Biopharma is trading at 33.6% below its estimated fair value, with analysts forecasting a 41.7% rise in stock price. Despite recent financial setbacks, including a significant drop in Q2 sales to KRW 1.29 billion and a net loss of KRW 3.32 billion, the company is expected to grow earnings by 92.58% annually and become profitable within three years, making it an undervalued stock based on cash flows in South Korea.

- The growth report we've compiled suggests that Hanall Biopharma's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Hanall Biopharma's balance sheet health report.

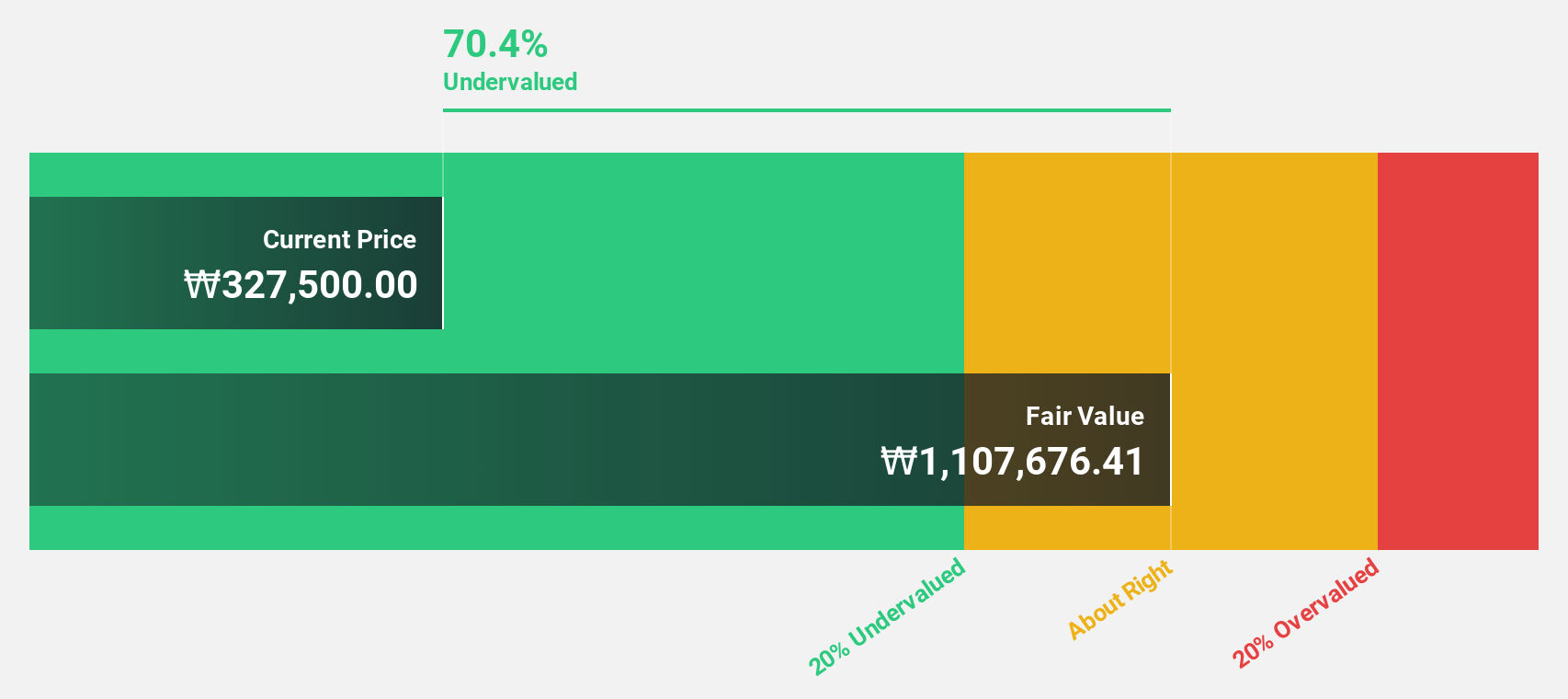

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. operates in the shipbuilding and offshore engineering industry with a market cap of approximately ₩12.94 trillion.

Operations: The company's revenue segments include Shipbuilding (₩21.80 billion), Engine (₩4.21 billion), Green Energy (₩467.66 million), and Marine Plant (₩802.72 million).

Estimated Discount To Fair Value: 40.6%

HD Korea Shipbuilding & Offshore Engineering is trading at ₩183,000, significantly below its estimated fair value of ₩308,032.1. Recent Q2 earnings showed a remarkable turnaround with net income of KRW 292.13 billion from KRW 49.78 billion a year ago and sales up to KRW 6.91 trillion from KRW 5.70 trillion last year. Analysts forecast annual profit growth of 38.8%, outpacing the market's 29.1% and highlighting its undervaluation based on cash flows in South Korea.

- Our earnings growth report unveils the potential for significant increases in HD Korea Shipbuilding & Offshore Engineering's future results.

- Get an in-depth perspective on HD Korea Shipbuilding & Offshore Engineering's balance sheet by reading our health report here.

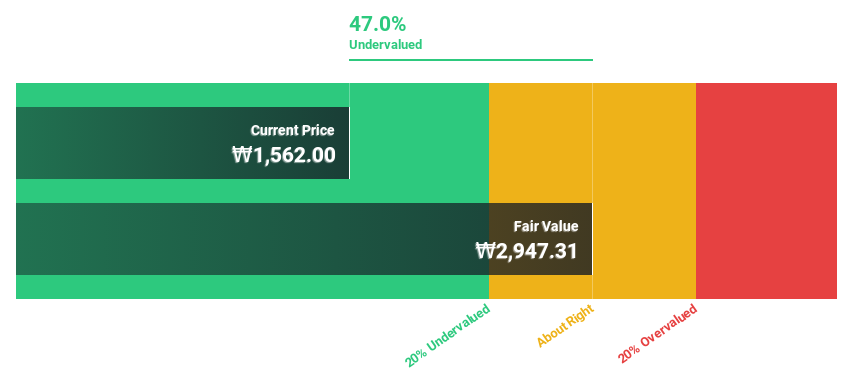

Shinsung E&GLtd (KOSE:A011930)

Overview: Shinsung E&G Co., Ltd. operates in the solar energy sector, providing solar modules and systems both in Korea and internationally, with a market cap of ₩333.85 billion.

Operations: Shinsung E&G Ltd.'s revenue segments include ₩41.38 billion from the Renewable Energy Business Division and ₩532.80 billion from the Clean Environment Business Division.

Estimated Discount To Fair Value: 44.8%

Shinsung E&G Ltd. is trading at ₩1,640, significantly below its estimated fair value of ₩2,972.85, indicating it is highly undervalued based on discounted cash flow analysis. The company's revenue is forecast to grow 16.6% annually, outpacing the South Korean market's 10.4%. Additionally, Shinsung E&G is expected to become profitable within three years with earnings projected to grow 108.51% per year despite low return on equity forecasts and insufficient interest coverage by earnings.

- Our expertly prepared growth report on Shinsung E&GLtd implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Shinsung E&GLtd here with our thorough financial health report.

Key Takeaways

- Access the full spectrum of 35 Undervalued KRX Stocks Based On Cash Flows by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Korea Shipbuilding & Offshore Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009540

HD Korea Shipbuilding & Offshore Engineering

HD Korea Shipbuilding & Offshore Engineering Co., Ltd.

Flawless balance sheet with solid track record.