- South Korea

- /

- Semiconductors

- /

- KOSE:A011930

3 KRX Growth Companies With Insider Ownership Up To 29%

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 1.9%, and over the past 12 months, it is up by 5.0%. With earnings expected to grow by 29% per annum over the next few years, identifying growth companies with high insider ownership can be a key strategy for investors looking to capitalize on this upward trend.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 72.9% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Global Tax Free (KOSDAQ:A204620) | 21.4% | 78.5% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 62.1% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 114.7% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 20.2% | 97.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

We're going to check out a few of the best picks from our screener tool.

Genomictree (KOSDAQ:A228760)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genomictree Inc., with a market cap of ₩399.06 billion, is a biomarker-based molecular diagnostics company that develops and commercializes products for detecting cancer and various infectious diseases.

Operations: The company's revenue segments include ₩1.86 billion from the Cancer Molecular Diagnosis Business and ₩681.43 million from Genomic Analysis and Other Business.

Insider Ownership: 16.2%

Genomictree, trading at 59.5% below its estimated fair value, exhibits significant growth potential with an expected annual revenue increase of 81%, outpacing the South Korean market's 10.5%. Despite anticipated profitability within three years and a forecasted earnings growth of 98.46% per year, the company has experienced shareholder dilution over the past year and maintains a highly volatile share price. Currently, there is no substantial insider trading information available for the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of Genomictree.

- In light of our recent valuation report, it seems possible that Genomictree is trading behind its estimated value.

Shinsung E&GLtd (KOSE:A011930)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shinsung E&G Co., Ltd. operates in the solar energy sector, offering solar modules and systems both in Korea and internationally, with a market cap of ₩363.57 billion.

Operations: The company's revenue segments include the Renewable Energy Business Division generating ₩53.41 billion and the Clean Environment Business Division contributing ₩533.30 billion.

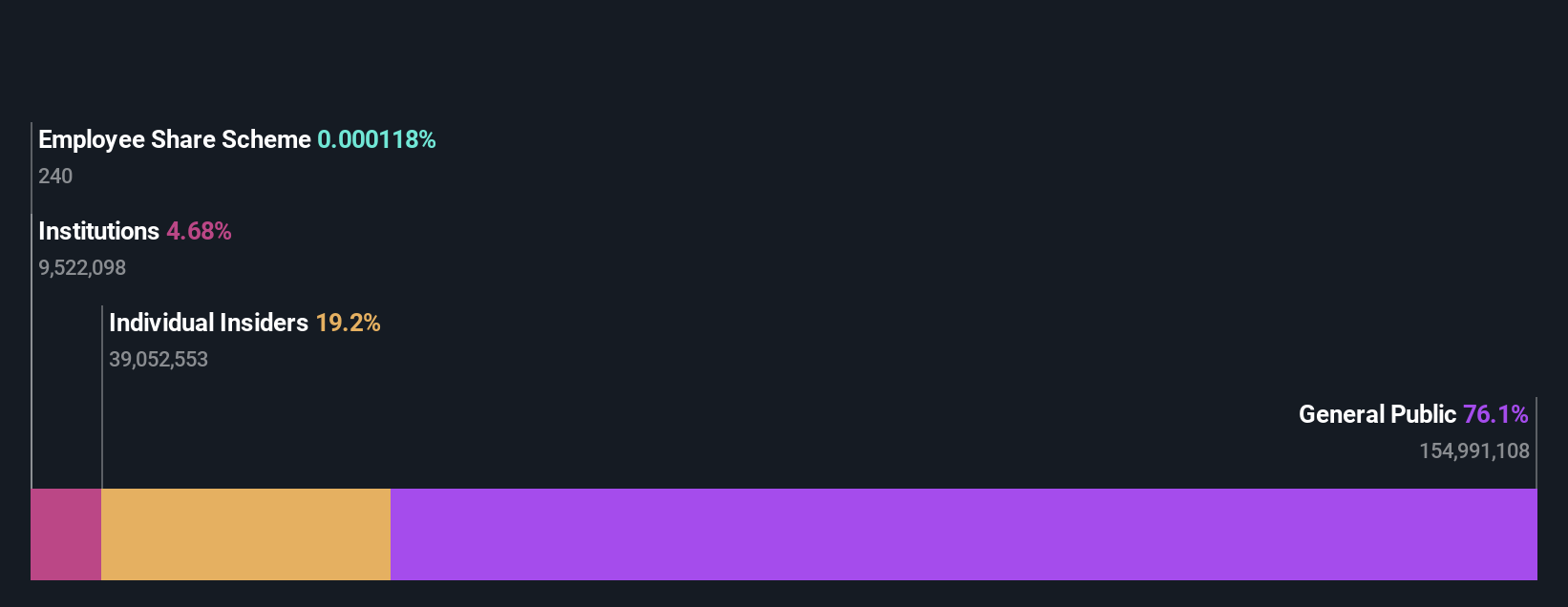

Insider Ownership: 19.2%

Shinsung E&G Ltd. shows promising growth potential with earnings forecasted to grow 84.4% per year, significantly outpacing the South Korean market's 28.5%. Revenue is expected to increase by 14.6% annually, faster than the market average of 10.5%. However, its return on equity is projected to be low at 14.2%, and profit margins have decreased from last year's 8.2% to 0.7%. The stock trades at a substantial discount of 41.3% below its estimated fair value, though interest payments are not well covered by earnings.

- Click to explore a detailed breakdown of our findings in Shinsung E&GLtd's earnings growth report.

- Upon reviewing our latest valuation report, Shinsung E&GLtd's share price might be too optimistic.

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Tour Development Co., Ltd., with a market cap of ₩674.34 billion, operates in South Korea providing travel and tourism services through its subsidiaries.

Operations: Lotte Tour Development's revenue segments include the Internet Media Sector (₩2.12 million), Dream Tower Integrated Resort Division (₩302.75 billion), and Travel Related Service Sector excluding Internet Journalism (₩67.80 billion).

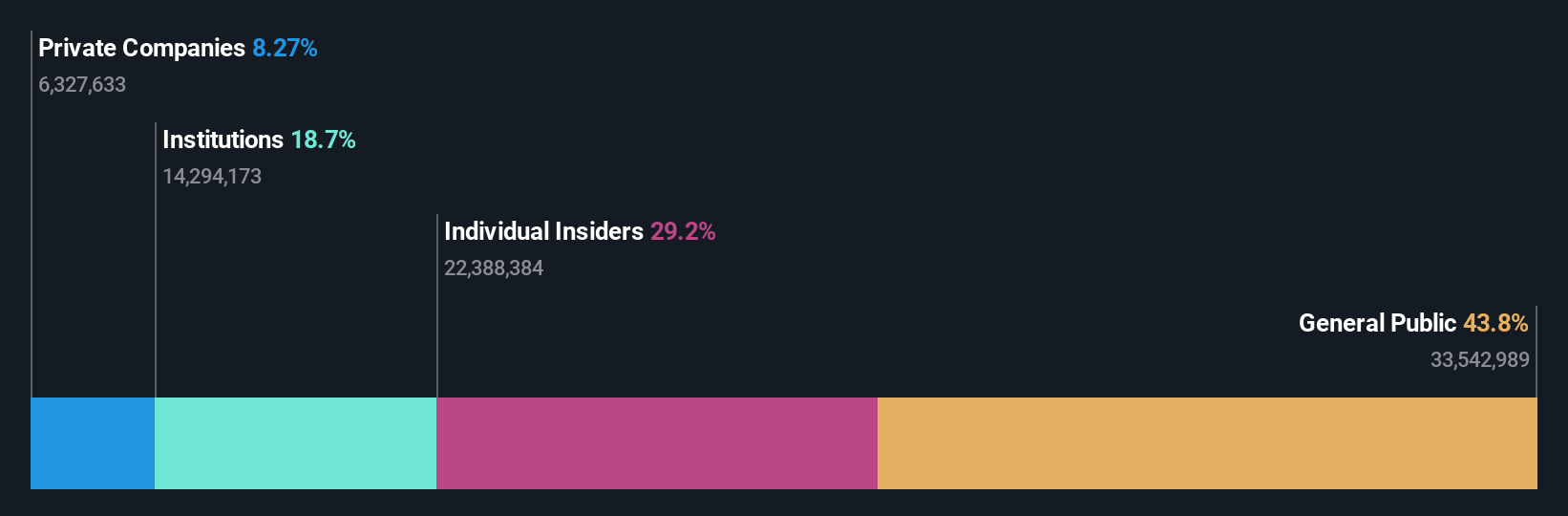

Insider Ownership: 29.4%

Lotte Tour Development's revenue is forecast to grow 16.5% per year, outpacing the South Korean market's 10.5%. Earnings are projected to increase by 96.43% annually, and the company is expected to become profitable within three years. However, its return on equity is anticipated to be low at 9%, and shareholders have experienced dilution over the past year. The stock trades at a significant discount of 37.7% below its estimated fair value.

- Click here to discover the nuances of Lotte Tour Development with our detailed analytical future growth report.

- Our valuation report here indicates Lotte Tour Development may be undervalued.

Seize The Opportunity

- Get an in-depth perspective on all 90 Fast Growing KRX Companies With High Insider Ownership by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A011930

Shinsung E&GLtd

Provides solar modules and solar systems in Korea and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives