- South Korea

- /

- Semiconductors

- /

- KOSE:A009310

Charm Engineering Co.,Ltd. (KRX:009310) Held Back By Insufficient Growth Even After Shares Climb 56%

Charm Engineering Co.,Ltd. (KRX:009310) shareholders have had their patience rewarded with a 56% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

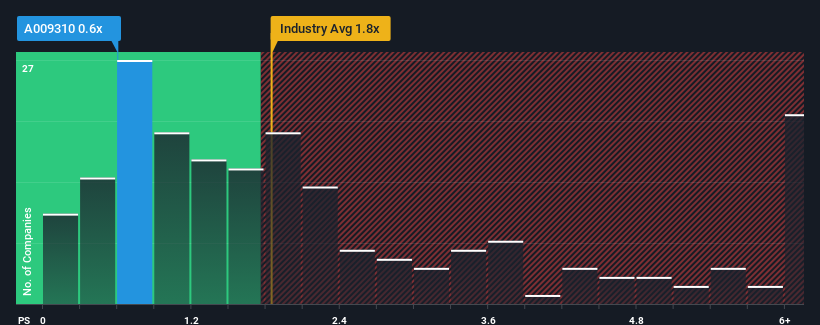

In spite of the firm bounce in price, Charm EngineeringLtd's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a buy right now compared to the Semiconductor industry in Korea, where around half of the companies have P/S ratios above 1.8x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Charm EngineeringLtd

What Does Charm EngineeringLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Charm EngineeringLtd over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Charm EngineeringLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Charm EngineeringLtd's earnings, revenue and cash flow.How Is Charm EngineeringLtd's Revenue Growth Trending?

Charm EngineeringLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 59%. The last three years don't look nice either as the company has shrunk revenue by 45% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 65% shows it's an unpleasant look.

With this information, we are not surprised that Charm EngineeringLtd is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Charm EngineeringLtd's P/S?

Despite Charm EngineeringLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Charm EngineeringLtd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Charm EngineeringLtd (2 make us uncomfortable!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009310

Charm EngineeringLtd

Researches, develops, manufactures, and sells FPD repair equipment in South Korea and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives