Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that KEC Holdings Co., Ltd. (KRX:006200) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

What Is KEC Holdings's Net Debt?

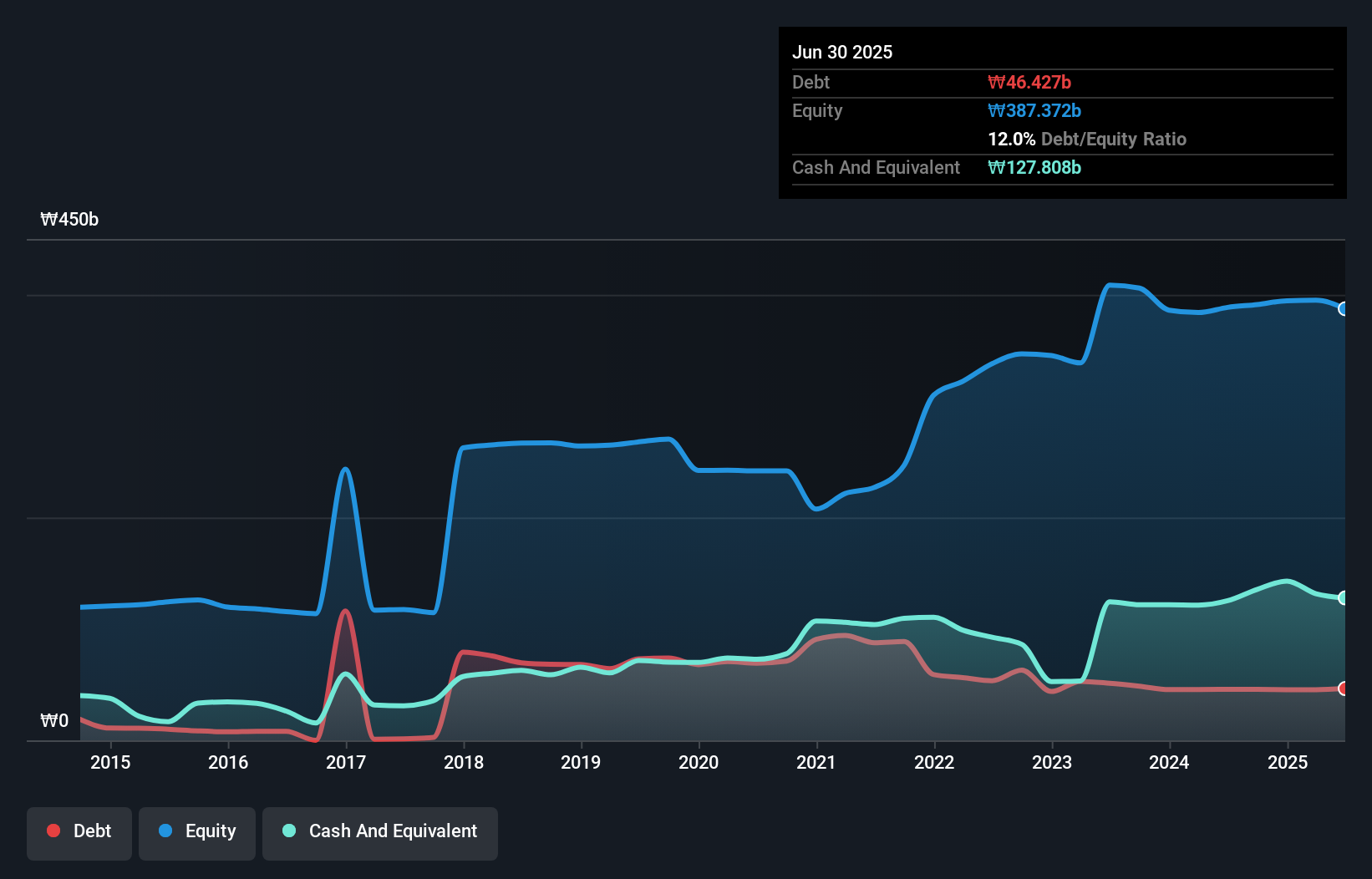

The chart below, which you can click on for greater detail, shows that KEC Holdings had ₩46.4b in debt in June 2025; about the same as the year before. However, its balance sheet shows it holds ₩127.8b in cash, so it actually has ₩81.4b net cash.

A Look At KEC Holdings' Liabilities

We can see from the most recent balance sheet that KEC Holdings had liabilities of ₩91.7b falling due within a year, and liabilities of ₩37.5b due beyond that. On the other hand, it had cash of ₩127.8b and ₩50.5b worth of receivables due within a year. So it actually has ₩49.1b more liquid assets than total liabilities.

This surplus strongly suggests that KEC Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that KEC Holdings has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since KEC Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

See our latest analysis for KEC Holdings

In the last year KEC Holdings wasn't profitable at an EBIT level, but managed to grow its revenue by 3.8%, to ₩287b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is KEC Holdings?

Although KEC Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of ₩3.6b. So taking that on face value, and considering the cash, we don't think its very risky in the near term. There's no doubt the next few years will be crucial to how the business matures. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with KEC Holdings .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if KEC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A006200

KEC Holdings

Through its subsidiaries, produces and sells semiconductors in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success