- South Korea

- /

- IT

- /

- KOSDAQ:A042000

3 KRX Stocks That Could Be Trading At A Discount Of Up To 34%

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.8%, and in the last 12 months, it is down 4.3%. Despite this downturn, earnings are expected to grow by 29% per annum over the next few years, highlighting potential opportunities for investors seeking undervalued stocks that could be trading at a discount.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HD Hyundai Electric (KOSE:A267260) | ₩255500.00 | ₩464305.26 | 45% |

| APR (KOSE:A278470) | ₩277500.00 | ₩521959.01 | 46.8% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩173100.00 | ₩305996.85 | 43.4% |

| Oscotec (KOSDAQ:A039200) | ₩34350.00 | ₩65583.14 | 47.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩48650.00 | ₩91077.03 | 46.6% |

| Global Tax Free (KOSDAQ:A204620) | ₩3340.00 | ₩6408.74 | 47.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1564.00 | ₩2943.57 | 46.9% |

| Hanall Biopharma (KOSE:A009420) | ₩37700.00 | ₩70271.91 | 46.4% |

| Hotel ShillaLtd (KOSE:A008770) | ₩44750.00 | ₩82518.83 | 45.8% |

| Kakao Games (KOSDAQ:A293490) | ₩16620.00 | ₩29588.09 | 43.8% |

Let's review some notable picks from our screened stocks.

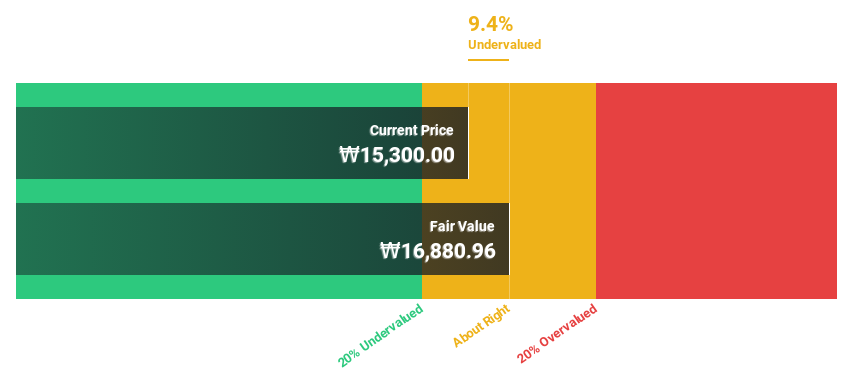

Cafe24 (KOSDAQ:A042000)

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of approximately ₩691.50 billion.

Operations: Cafe24 Corp. generates revenue from several segments, including Transit (₩42.97 million), Clothing (₩21.03 million), and Internet Business Solution (₩230.51 million).

Estimated Discount To Fair Value: 34%

Cafe24 is trading at ₩28,600, significantly below its estimated fair value of ₩43,363.65. Despite recent shareholder dilution and high share price volatility over the past three months, the company became profitable this year and is expected to see substantial earnings growth of 42.5% per year over the next three years. Additionally, Cafe24's revenue growth rate of 11.1% per year outpaces the South Korean market average of 10.4%.

- In light of our recent growth report, it seems possible that Cafe24's financial performance will exceed current levels.

- Navigate through the intricacies of Cafe24 with our comprehensive financial health report here.

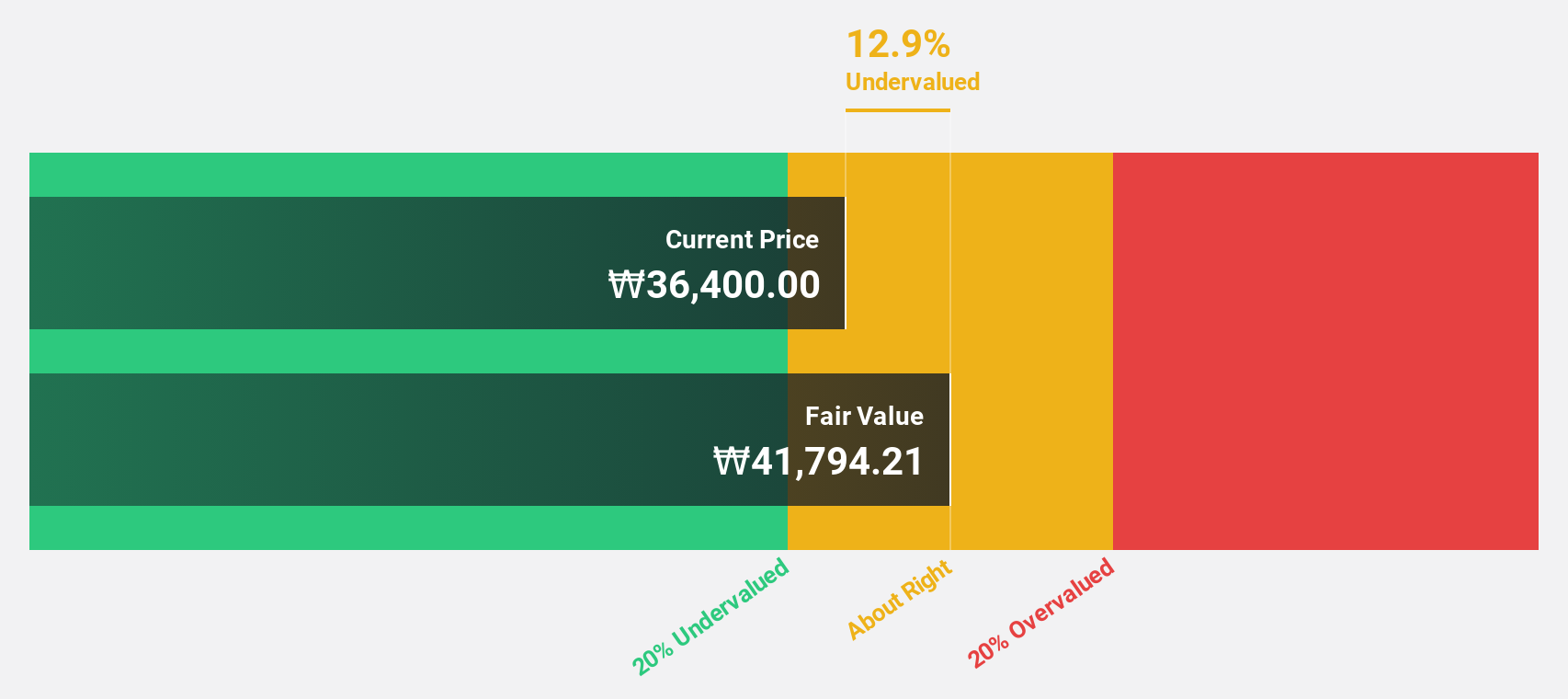

ZeusLtd (KOSDAQ:A079370)

Overview: Zeus Co., Ltd. offers semiconductor, robot, and display total solutions in South Korea and internationally, with a market cap of approximately ₩415.22 billion.

Operations: The company's revenue segments are comprised of ₩23.67 million from Valve and ₩467.14 million from the Equipment Division.

Estimated Discount To Fair Value: 28.3%

Zeus Ltd. is trading at ₩13,430, significantly below its fair value estimate of ₩18,735.45. The company has announced a share repurchase program worth ₩3 billion to stabilize stock prices and enhance shareholder value. Recent earnings reports show substantial improvement with net income rising to ₩6.79 billion in Q2 2024 from a net loss of ₩1.76 billion a year ago, indicating strong cash flow potential despite high share price volatility recently.

- The analysis detailed in our ZeusLtd growth report hints at robust future financial performance.

- Dive into the specifics of ZeusLtd here with our thorough financial health report.

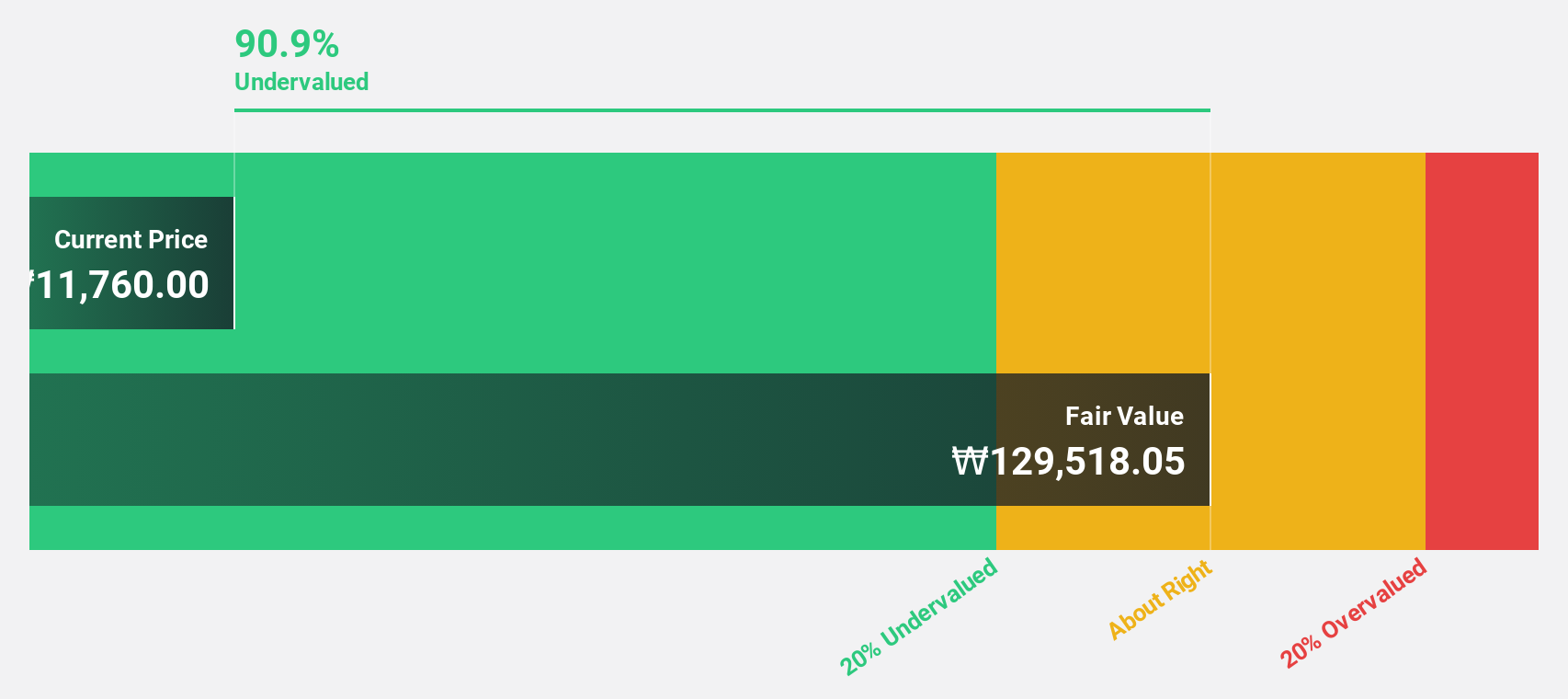

D.I (KOSE:A003160)

Overview: D.I Corporation manufactures and supplies semiconductor inspection equipment in South Korea and internationally, with a market cap of ₩336.92 billion.

Operations: The company's revenue segments include Electronic Parts (₩12.90 billion), Semiconductor Equipment (₩137.77 billion), Environmental Facilities (₩6.85 billion), Audio and Video Equipment (₩14.35 billion), and Secondary Battery Equipment (₩29.55 billion).

Estimated Discount To Fair Value: 21.5%

D.I. is trading at ₩13,010, which is 21.5% below its estimated fair value of ₩16,566.69. The company's revenue is projected to grow at an impressive 47.5% per year, significantly outpacing the South Korean market's average growth rate of 10.4%. Earnings are also forecast to increase by 102.27% annually over the next three years, during which D.I. is expected to become profitable and achieve a high return on equity of 29.6%.

- Insights from our recent growth report point to a promising forecast for D.I's business outlook.

- Click to explore a detailed breakdown of our findings in D.I's balance sheet health report.

Key Takeaways

- Investigate our full lineup of 33 Undervalued KRX Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A042000

Flawless balance sheet with reasonable growth potential.