- South Korea

- /

- Semiconductors

- /

- KOSE:A000990

Exploring DB HiTek And 2 Other Hidden Small Cap Opportunities With Solid Foundations

Reviewed by Simply Wall St

In the current global market landscape, smaller-cap stocks have shown resilience, benefiting from recent economic data that suggests potential interest rate adjustments by central banks. Amidst this backdrop, identifying stocks with solid foundations becomes crucial as investors seek opportunities that can weather economic fluctuations and capitalize on growth prospects. A good stock in this environment is one that demonstrates strong fundamentals such as robust financial health, a competitive edge in its industry, and the ability to adapt to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 31.08% | 1.17% | 31.28% | ★★★★★★ |

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| ASL Marine Holdings | 155.37% | 13.24% | 51.91% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

DB HiTek (KOSE:A000990)

Simply Wall St Value Rating: ★★★★★★

Overview: DB HiTek Co., Ltd. operates in the semiconductor foundry industry in South Korea with a market capitalization of ₩1.87 trillion.

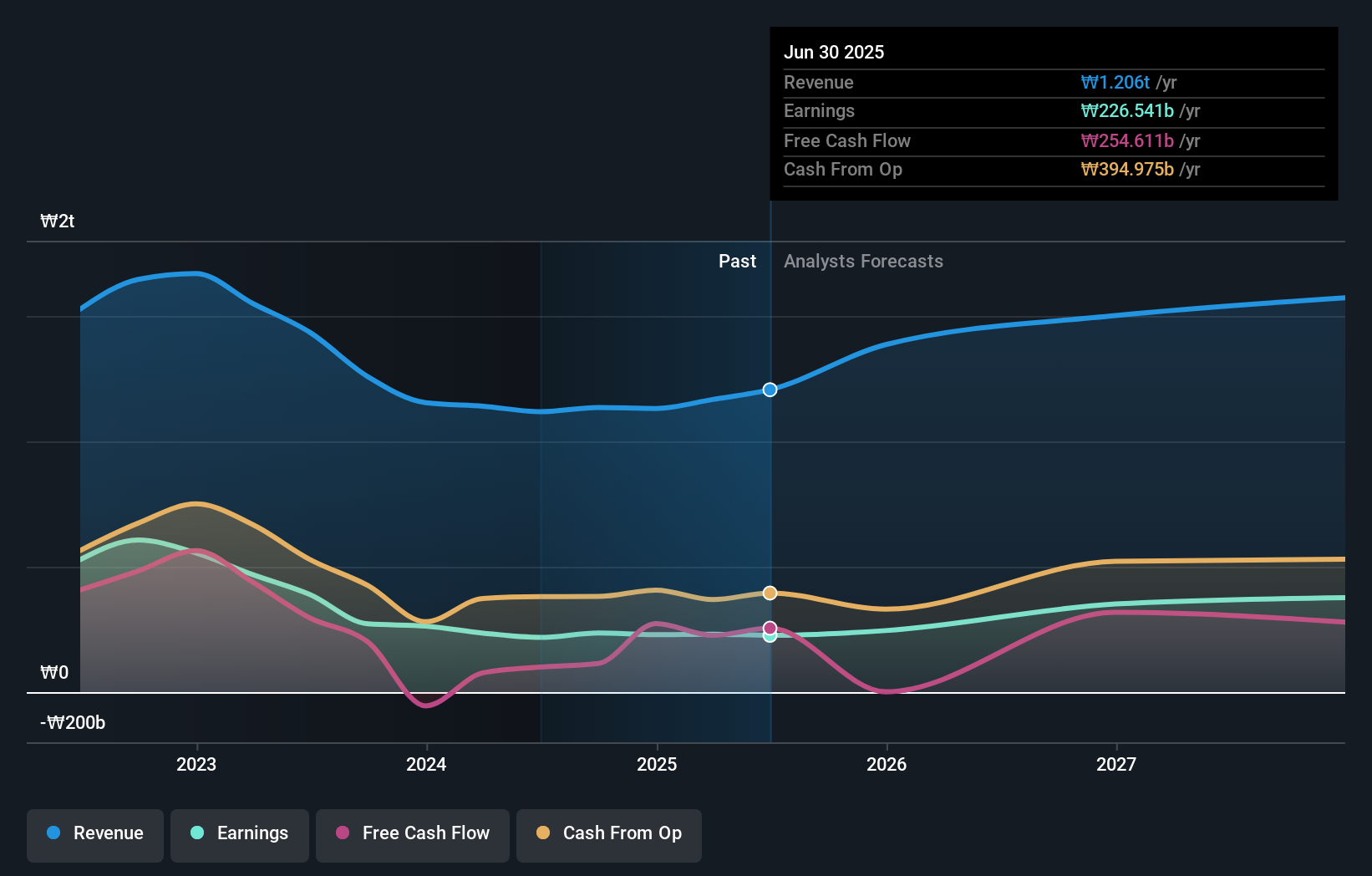

Operations: The primary revenue stream for DB HiTek comes from its semiconductor segment, generating approximately ₩1.21 trillion.

DB HiTek, a player in the semiconductor space, is trading 26.5% below its estimated fair value, presenting an intriguing opportunity. The company has improved its debt situation significantly over five years, with the debt-to-equity ratio dropping from 21.6% to 5.4%. Despite not outpacing industry growth of 13.7%, it has achieved a steady earnings increase of 2.8% annually over five years and forecasts an annual growth rate of 8%. Recent buybacks saw the company repurchase over one million shares for KRW 44,996 million this year alone, indicating confidence in its future prospects and financial health.

- Unlock comprehensive insights into our analysis of DB HiTek stock in this health report.

Understand DB HiTek's track record by examining our Past report.

Jiangxi Huangshanghuang Group Food (SZSE:002695)

Simply Wall St Value Rating: ★★★★★★

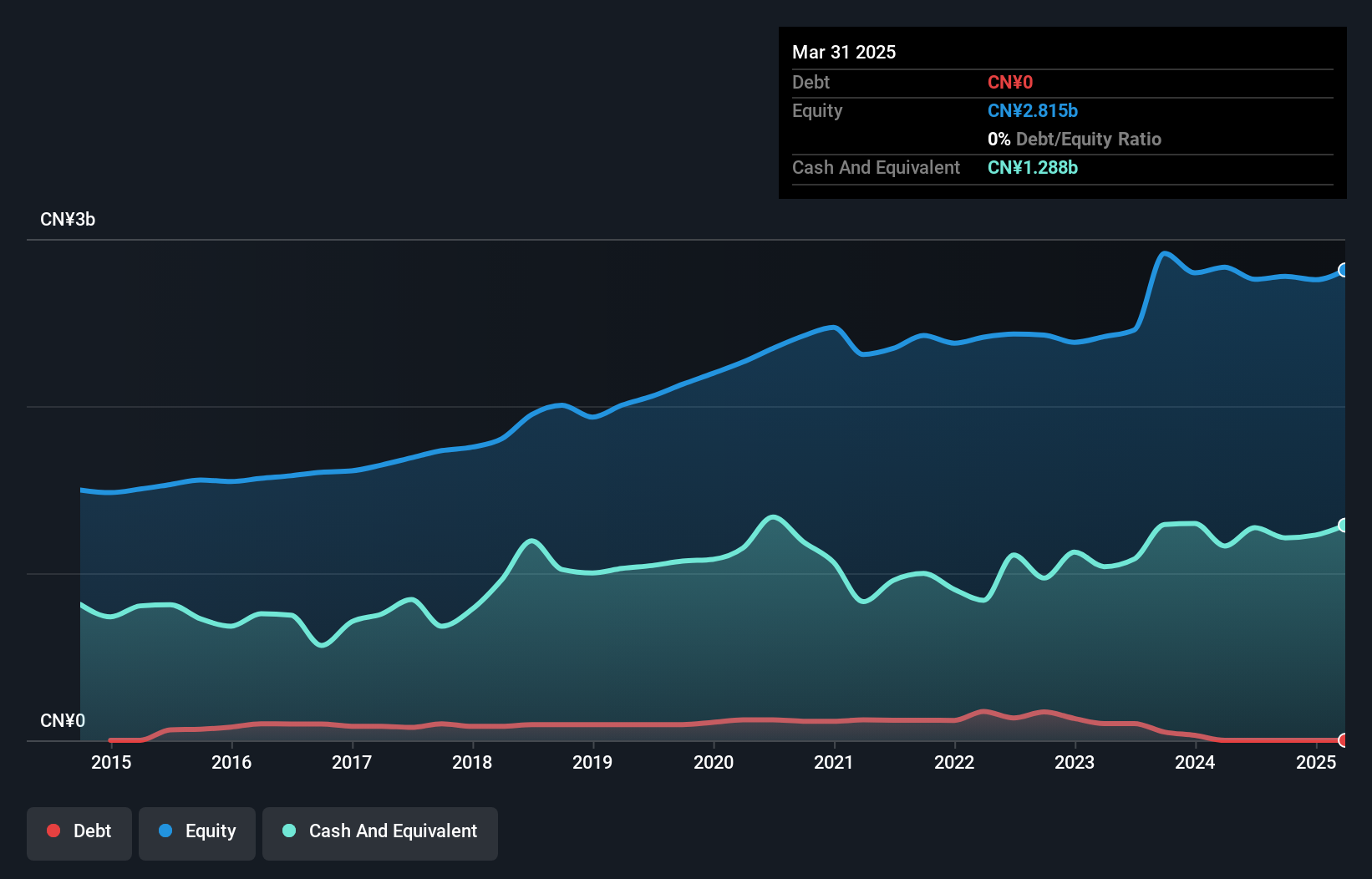

Overview: Jiangxi Huangshanghuang Group Food Co., Ltd. is engaged in the development, production, and sale of braised meat products in China and has a market capitalization of CN¥7.52 billion.

Operations: The company's revenue is primarily derived from the sale of braised meat products. It has a market capitalization of CN¥7.52 billion.

Jiangxi Huangshanghuang Group Food, a smaller player in the food industry, has shown robust financial health with no debt and a notable earnings growth of 16.5% over the past year, surpassing the industry's 0.1%. The company reported net income of CN¥76.92 million for H1 2025, up from CN¥60.62 million last year, driven by improved profitability despite revenue dipping to CN¥984.14 million from CN¥1.06 billion previously. A one-off gain of CN¥12.5 million influenced recent results positively, and with projected annual earnings growth at 21.89%, it presents an intriguing prospect for future expansion in its sector.

Nanjing Railway New TechnologyLtd (SZSE:301016)

Simply Wall St Value Rating: ★★★★★★

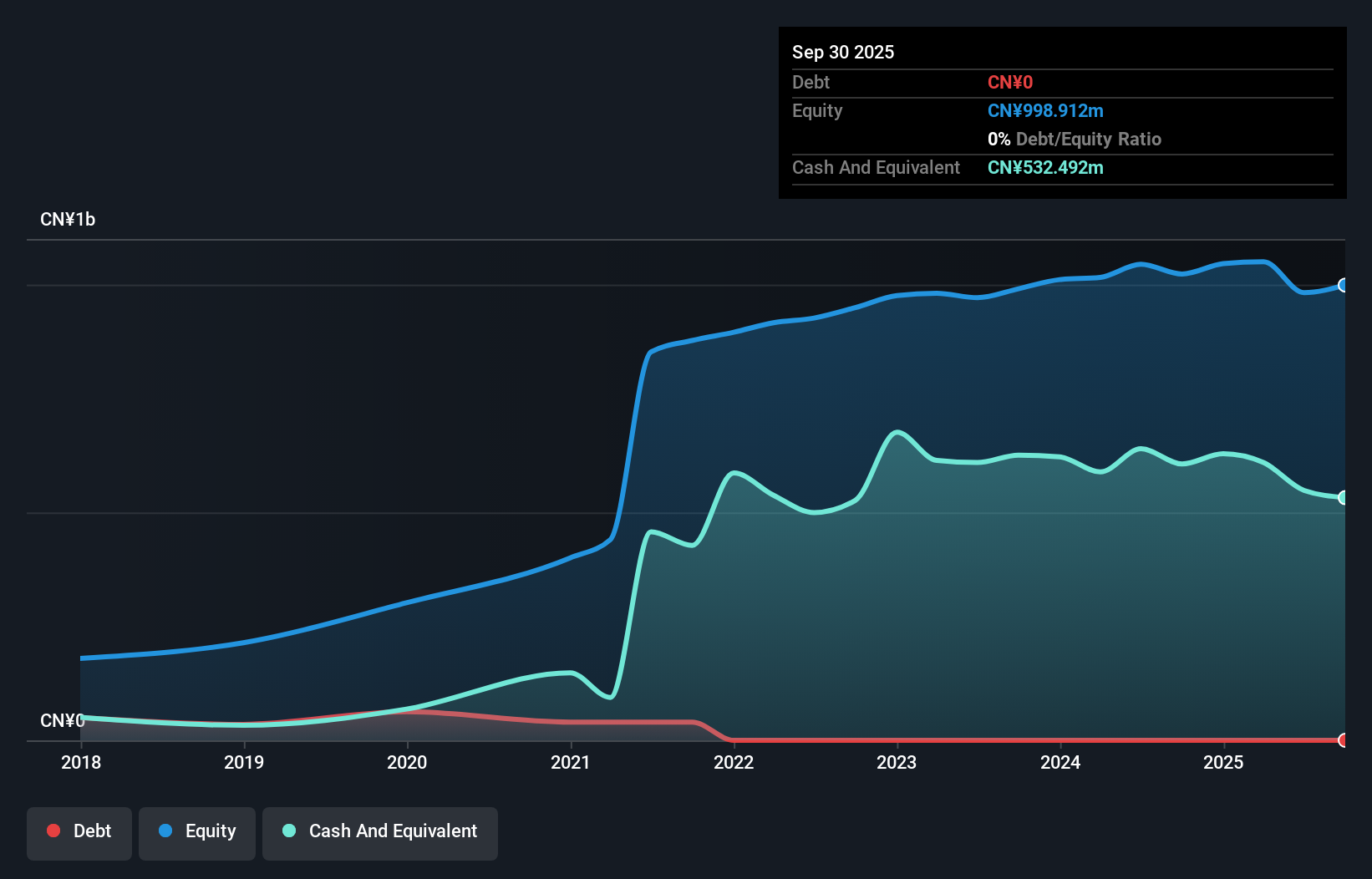

Overview: Nanjing Railway New Technology Co., Ltd. focuses on the research, development, and manufacturing of rail vehicle body and bogie parts for both domestic and international markets, with a market cap of CN¥4.64 billion.

Operations: Nanjing Railway New Technology generates revenue primarily from the sale of railroad equipment, amounting to CN¥381.23 million. The company's financial performance is characterized by a focus on manufacturing components for rail vehicles, contributing significantly to its revenue stream.

Nanjing Railway New Technology, a compact player in its field, showcases intriguing financials with no debt and positive free cash flow. Over the past year, earnings growth of 6.6% outpaced the machinery industry’s 4%, though earnings have seen an annual decrease of 18.7% over five years. Recent half-year results reveal sales at CNY 155.19 million and net income at CNY 29.17 million, indicating steady performance compared to last year’s figures despite flat basic earnings per share at CNY 0.13. The company is also revisiting its articles of association, potentially signaling strategic shifts ahead.

Seize The Opportunity

- Investigate our full lineup of 2948 Global Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000990

DB HiTek

DB HiTek Co.,Ltd. engages in semiconductor foundry business in South Korea.

Flawless balance sheet and fair value.

Market Insights

Community Narratives