- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

SK hynix Inc. (KRX:000660) Held Back By Insufficient Growth Even After Shares Climb 55%

Despite an already strong run, SK hynix Inc. (KRX:000660) shares have been powering on, with a gain of 55% in the last thirty days. The last month tops off a massive increase of 207% in the last year.

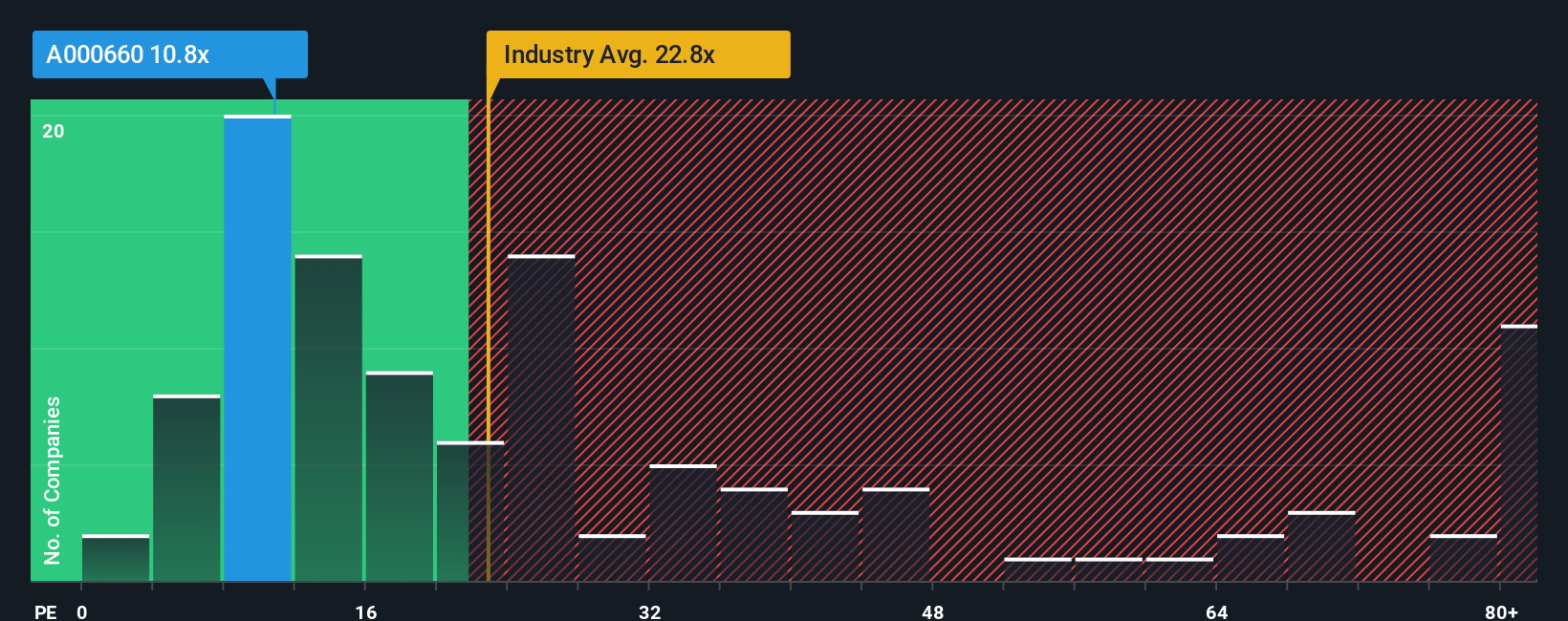

Although its price has surged higher, SK hynix may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.8x, since almost half of all companies in Korea have P/E ratios greater than 15x and even P/E's higher than 35x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

SK hynix certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for SK hynix

Is There Any Growth For SK hynix?

In order to justify its P/E ratio, SK hynix would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 242% last year. The strong recent performance means it was also able to grow EPS by 283% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 8.7% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 20% each year, which paints a poor picture.

In light of this, it's understandable that SK hynix's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From SK hynix's P/E?

Despite SK hynix's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of SK hynix's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - SK hynix has 1 warning sign we think you should be aware of.

If you're unsure about the strength of SK hynix's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000660

SK hynix

Manufactures, distributes, and sells semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives