- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A452160

JNB Co., Ltd.'s (KOSDAQ:452160) Popularity With Investors Under Threat As Stock Sinks 28%

To the annoyance of some shareholders, JNB Co., Ltd. (KOSDAQ:452160) shares are down a considerable 28% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

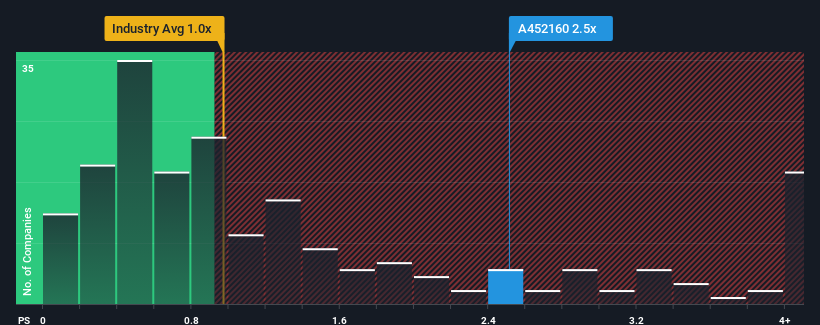

Even after such a large drop in price, when almost half of the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1x, you may still consider JNB as a stock probably not worth researching with its 2.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for JNB

What Does JNB's Recent Performance Look Like?

As an illustration, revenue has deteriorated at JNB over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on JNB will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

JNB's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 6.7% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 47% shows it's noticeably less attractive.

With this information, we find it concerning that JNB is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

There's still some elevation in JNB's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of JNB revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

You should always think about risks. Case in point, we've spotted 4 warning signs for JNB you should be aware of, and 2 of them are a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A452160

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives