- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A348210

The Price Is Right For NEXTIN, Inc. (KOSDAQ:348210) Even After Diving 25%

NEXTIN, Inc. (KOSDAQ:348210) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

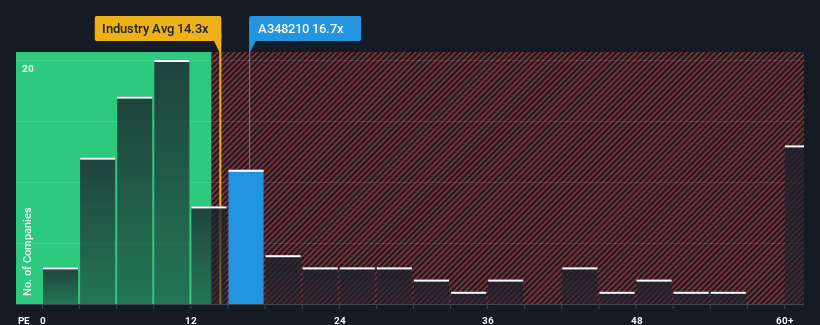

In spite of the heavy fall in price, NEXTIN's price-to-earnings (or "P/E") ratio of 16.7x might still make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for NEXTIN as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for NEXTIN

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like NEXTIN's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 4.6%. The latest three year period has also seen an excellent 42% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 41% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 33%, which is noticeably less attractive.

With this information, we can see why NEXTIN is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

A significant share price dive has done very little to deflate NEXTIN's very lofty P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of NEXTIN's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for NEXTIN that you should be aware of.

Of course, you might also be able to find a better stock than NEXTIN. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NEXTIN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A348210

NEXTIN

Manufactures defect inspection and metrology systems for semiconductor and display industries in South Korea.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026