- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A348210

KRX Value Stock Picks Including Oscotec And Two Others For Estimated Undervaluation

Reviewed by Simply Wall St

The South Korean stock market has experienced a downturn, with the KOSPI index dropping over recent sessions amid global economic uncertainties and geopolitical tensions affecting investor sentiment. In this challenging environment, identifying undervalued stocks can offer potential opportunities for investors seeking value; Oscotec and two other companies stand out as intriguing prospects in this regard.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Samwha ElectricLtd (KOSE:A009470) | ₩48000.00 | ₩93613.50 | 48.7% |

| T'Way Air (KOSE:A091810) | ₩3030.00 | ₩5618.78 | 46.1% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7570.00 | ₩14930.31 | 49.3% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩82200.00 | ₩153007.74 | 46.3% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Oscotec (KOSDAQ:A039200) | ₩38050.00 | ₩65156.22 | 41.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩54200.00 | ₩91229.31 | 40.6% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1648.00 | ₩2976.60 | 44.6% |

| Global Tax Free (KOSDAQ:A204620) | ₩3650.00 | ₩6410.75 | 43.1% |

| Hotel ShillaLtd (KOSE:A008770) | ₩46150.00 | ₩81760.75 | 43.6% |

Let's uncover some gems from our specialized screener.

Oscotec (KOSDAQ:A039200)

Overview: Oscotec Inc. is a biotechnology company involved in drug development, functional materials, and dental bone graft materials, with a market cap of approximately ₩1.46 trillion.

Operations: The company's revenue segments include the Food Business Division with ₩1.69 billion, the Medical Business Sector at ₩1.63 billion, the New Drug Business Division generating ₩990.90 million, and the Functional Materials Division contributing ₩310.71 million.

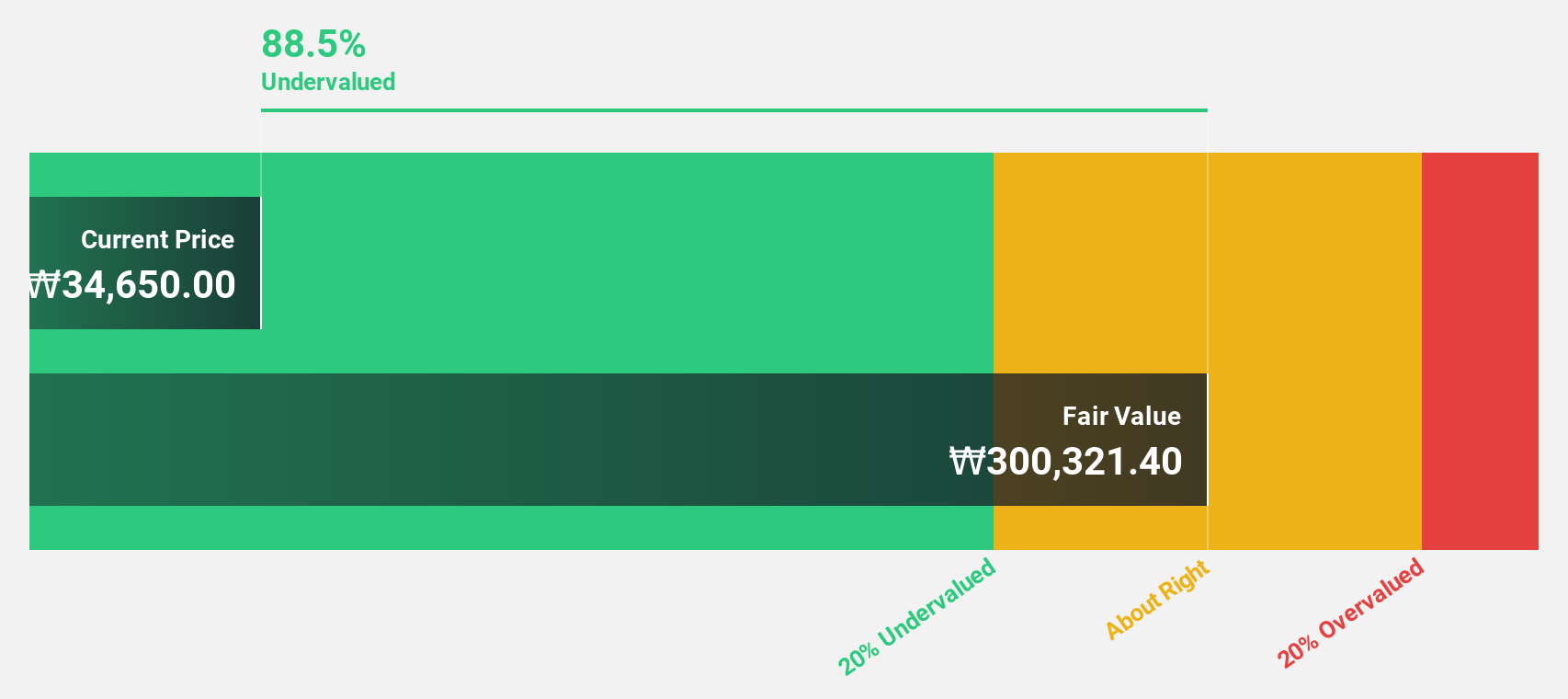

Estimated Discount To Fair Value: 41.6%

Oscotec, trading at ₩38,050, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of ₩65,156.22. Despite its current lack of meaningful revenue (₩5B), the company's revenue is projected to grow rapidly at 68.9% annually—outpacing the South Korean market's growth rate. Although its share price has been highly volatile recently, Oscotec's earnings are expected to grow by 122% annually and achieve profitability within three years.

- According our earnings growth report, there's an indication that Oscotec might be ready to expand.

- Unlock comprehensive insights into our analysis of Oscotec stock in this financial health report.

NEXTIN (KOSDAQ:A348210)

Overview: NEXTIN, Inc. is a South Korean company that produces defect inspection and metrology systems for the semiconductor and display industries, with a market cap of ₩547.26 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, amounting to ₩81.68 billion.

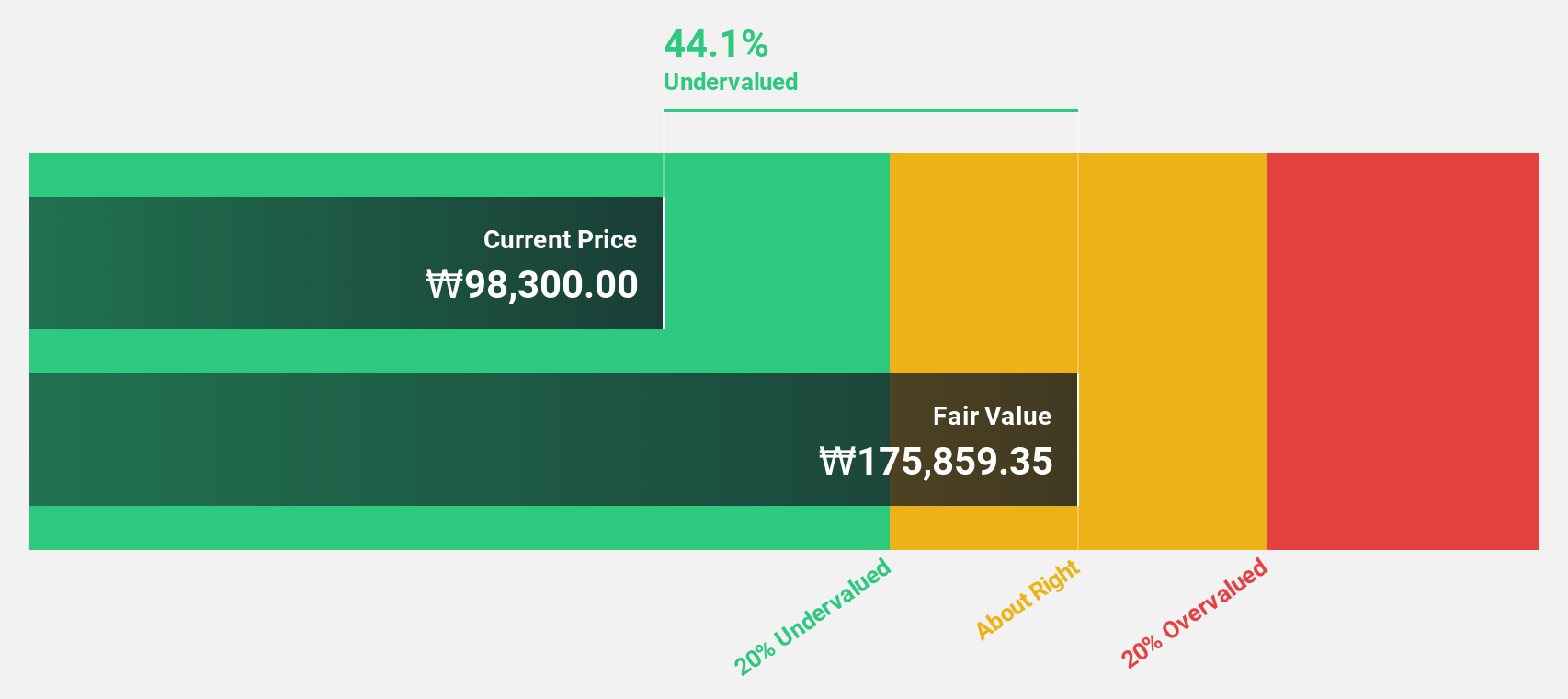

Estimated Discount To Fair Value: 18.4%

NEXTIN, Inc., trading at ₩52,900, appears undervalued with a fair value estimate of ₩64,811.91. Despite recent earnings declines and shareholder dilution, the company is implementing a share buyback program to stabilize stock prices. Forecasts indicate robust revenue growth of 30.1% annually—outpacing the broader South Korean market—and significant annual profit growth of 34.9%. With total debt at KRW 15.95 billion against substantial equity and assets, NEXTIN's financial health remains strong amidst market challenges.

- The growth report we've compiled suggests that NEXTIN's future prospects could be on the up.

- Click here to discover the nuances of NEXTIN with our detailed financial health report.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research and development of drugs for central nervous system disorders, with a market cap of ₩8.48 trillion.

Operations: The company's revenue primarily comes from its new drug development segment, which generated ₩465.06 million.

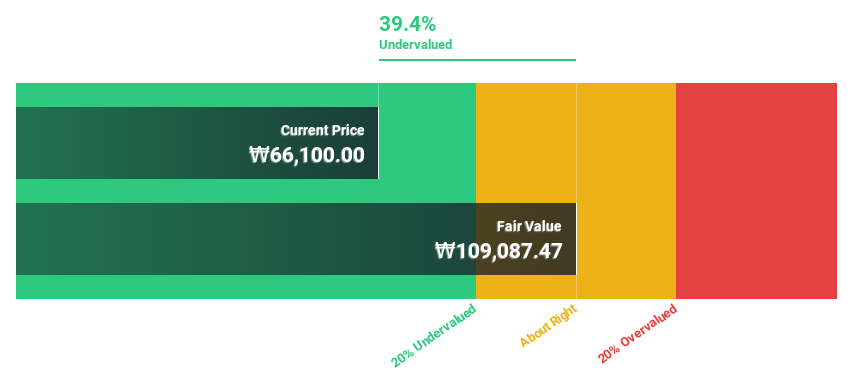

Estimated Discount To Fair Value: 39.8%

SK Biopharmaceuticals, trading at ₩108,300, is significantly undervalued with a fair value estimate of ₩179,969.09. The company's earnings are expected to grow substantially at 70.6% annually over the next three years—outpacing the South Korean market's growth rate of 29.9%. Revenue is also projected to increase by 22.4% per year, surpassing market expectations. Despite recent profitability challenges, these forecasts suggest strong future cash flow potential and robust financial performance.

- Insights from our recent growth report point to a promising forecast for SK Biopharmaceuticals' business outlook.

- Delve into the full analysis health report here for a deeper understanding of SK Biopharmaceuticals.

Summing It All Up

- Click through to start exploring the rest of the 30 Undervalued KRX Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEXTIN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A348210

NEXTIN

Manufactures defect inspection and metrology systems for semiconductor and display industries in South Korea.

Exceptional growth potential with flawless balance sheet.