- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A330860

Nepes Ark Corporation's (KOSDAQ:330860) Popularity With Investors Under Threat As Stock Sinks 26%

The Nepes Ark Corporation (KOSDAQ:330860) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 18% in the last year.

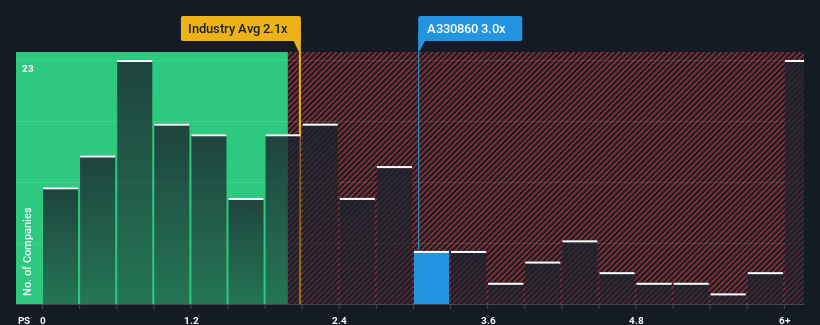

Even after such a large drop in price, you could still be forgiven for thinking Nepes Ark is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 2.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Nepes Ark

What Does Nepes Ark's Recent Performance Look Like?

Nepes Ark has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. Perhaps the market is expecting the company to continue to outperform the industry, which has propped up the P/S. While you'd prefer that its revenue trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Nepes Ark's future stacks up against the industry? In that case, our free report is a great place to start.How Is Nepes Ark's Revenue Growth Trending?

In order to justify its P/S ratio, Nepes Ark would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. Even so, admirably revenue has lifted 86% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 80%, which is noticeably more attractive.

With this information, we find it concerning that Nepes Ark is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Nepes Ark's P/S

There's still some elevation in Nepes Ark's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Nepes Ark, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for Nepes Ark (1 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Nepes Ark, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nepes Ark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A330860

Nepes Ark

Engages in the semiconductor manufacturing-related testing and engineering service, semiconductor test production, and semiconductor product wholesale and retail businesses in South Korea.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026