- South Korea

- /

- Packaging

- /

- KOSE:A014820

Undiscovered Gems in South Korea for October 2024

Reviewed by Simply Wall St

Over the last seven days, the South Korean market has remained flat, but it is up 3.8% over the past year with earnings anticipated to grow by 30% annually in the coming years. In this context of steady growth and promising future earnings, identifying stocks that are undervalued or overlooked can offer unique opportunities for investors seeking to capitalize on emerging potential within this dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. is a company that specializes in the development, manufacturing, and sale of PCB automation equipment both in South Korea and internationally, with a market capitalization of approximately ₩999.26 billion.

Operations: Taesung generates revenue primarily from the manufacturing and sale of PCB automation equipment, amounting to approximately ₩45.68 billion.

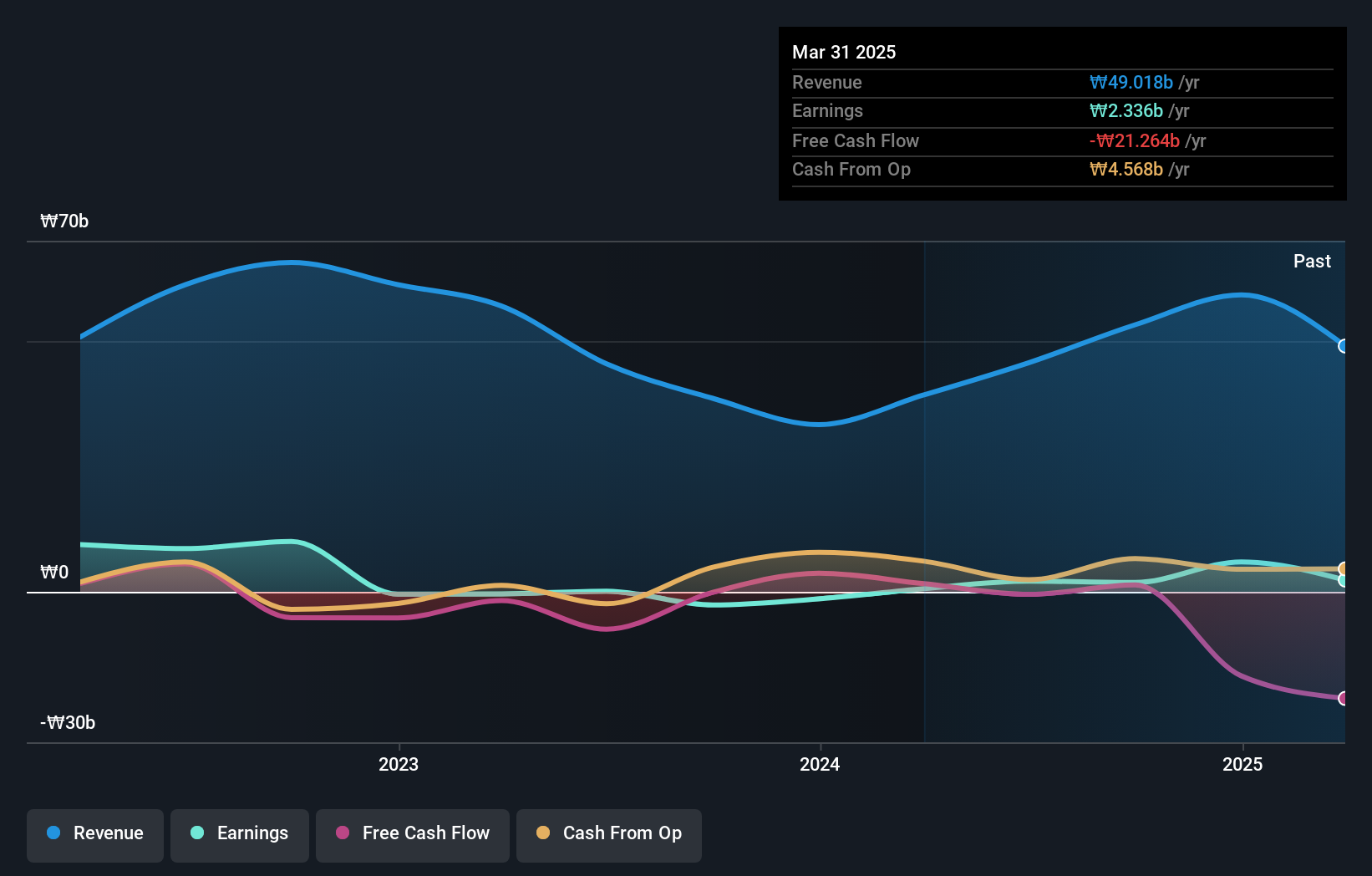

Taesung Ltd., a dynamic player in the semiconductor sector, posted an impressive earnings surge of 1482% over the past year, outpacing industry growth. Despite recent shareholder dilution and volatile share prices, its debt management remains robust with a net debt to equity ratio of 4.2%, indicating satisfactory leverage. The company's inclusion in the S&P Global BMI Index highlights its growing recognition on the global stage, although free cash flow challenges persist.

- Click here to discover the nuances of TaesungLtd with our detailed analytical health report.

Examine TaesungLtd's past performance report to understand how it has performed in the past.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company specializing in the manufacturing and sale of machinery and heat combustion equipment, with a market cap of ₩1.15 trillion.

Operations: Kyung Dong Navien generates revenue primarily from its air conditioning manufacturing and sale segment, which accounts for approximately ₩1.29 billion. The company's financial performance is influenced by its cost structure and market dynamics within this segment.

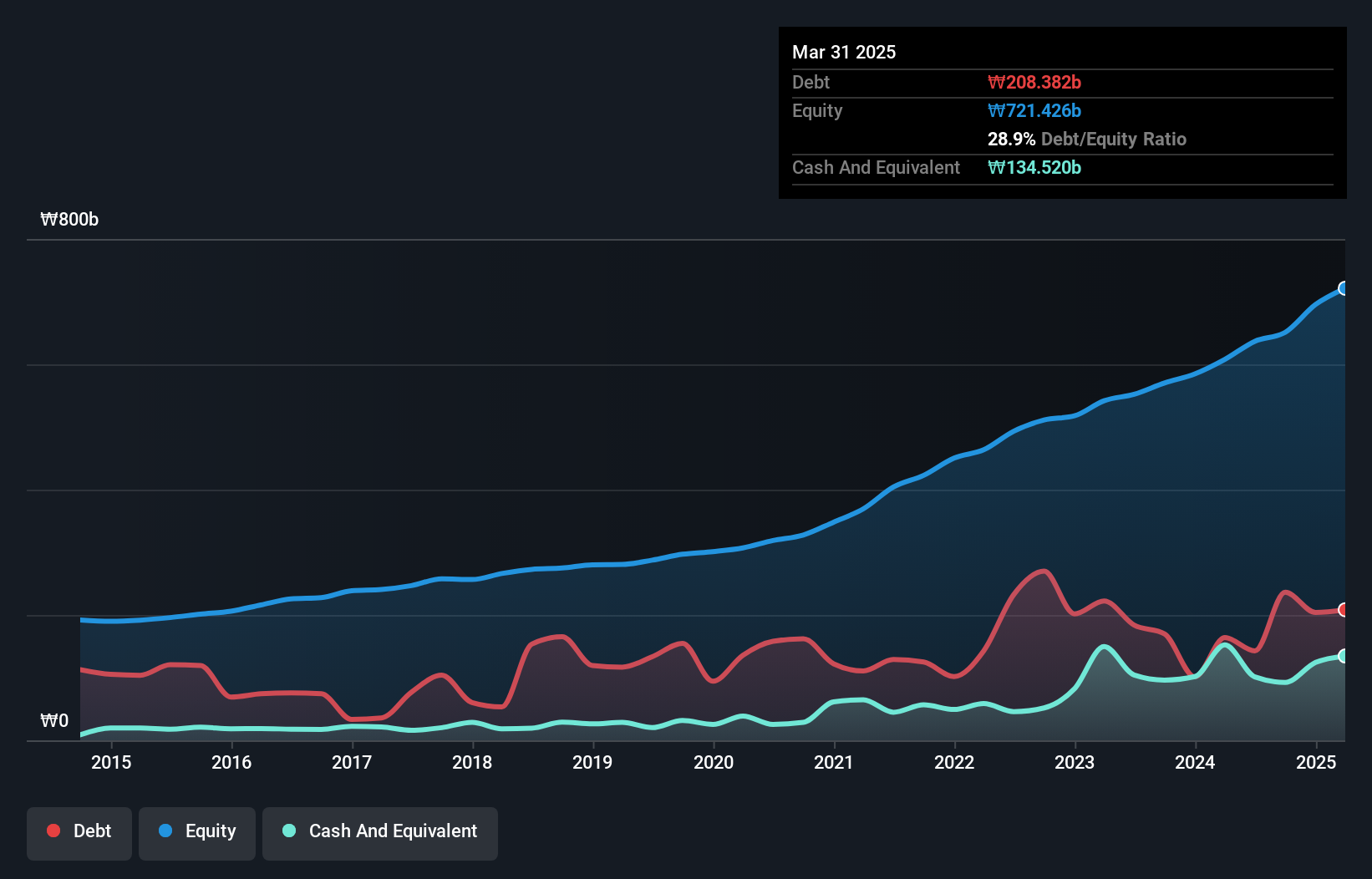

Kyung Dong Navien, a notable player in the heating industry, has shown impressive financial health with earnings growth of 85.5% over the past year, significantly outpacing the building industry's 28.5%. The company's net debt to equity ratio stands at a satisfactory 6.5%, reflecting prudent financial management as it reduced from 46.4% five years ago to 22.4%. With EBIT covering interest payments by 27 times, Kyung Dong Navien demonstrates robust operational efficiency and stability within its sector.

- Click here and access our complete health analysis report to understand the dynamics of Kyung Dong Navien.

Assess Kyung Dong Navien's past performance with our detailed historical performance reports.

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★☆☆

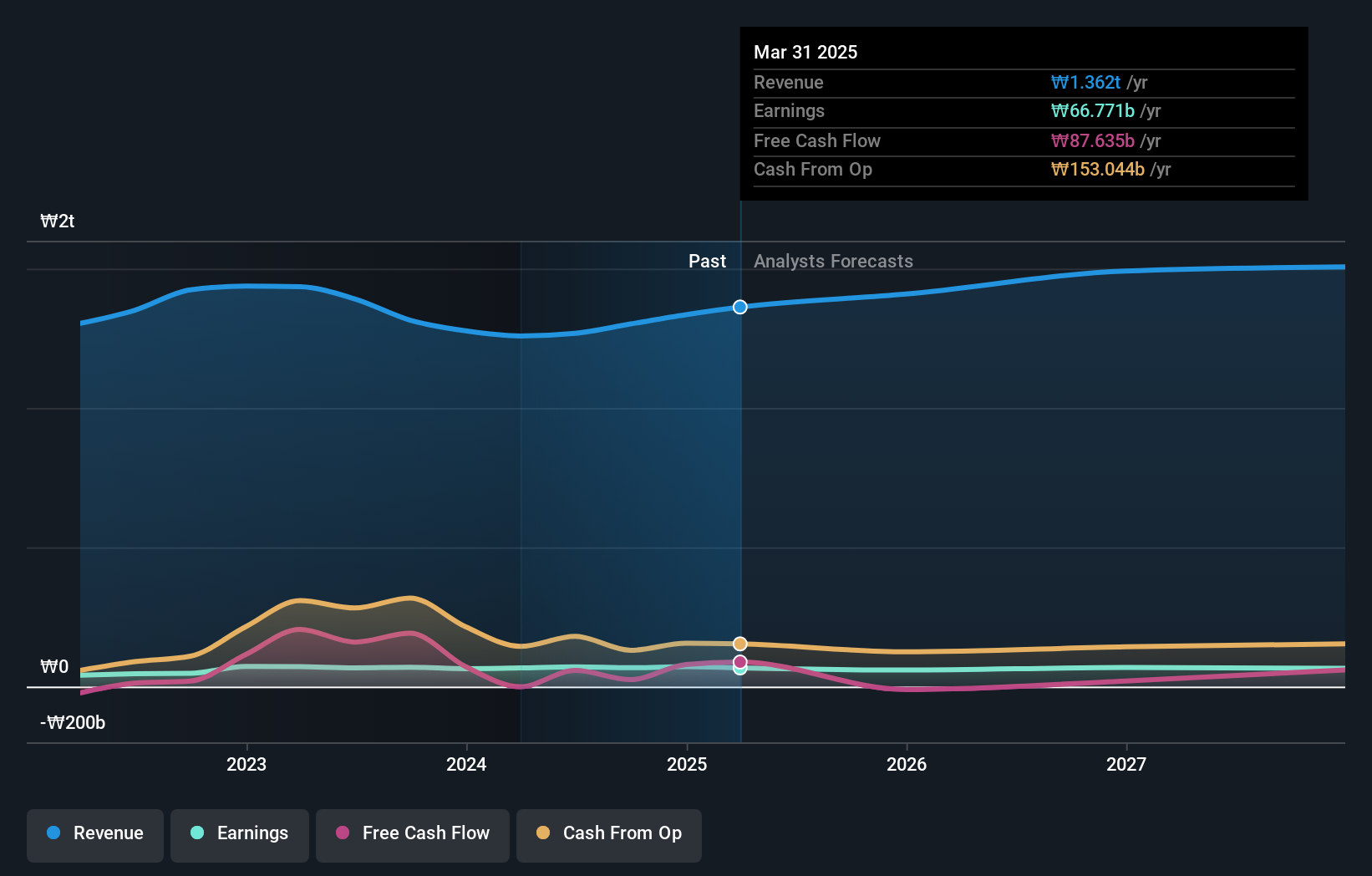

Overview: Dongwon Systems Corporation is a packaging company that manufactures and markets packaging materials in South Korea, with a market cap of ₩1.50 trillion.

Operations: The company's primary revenue stream is its Packing Business, generating approximately ₩1.27 trillion.

Dongwon Systems has shown promising growth, with recent earnings outpacing the packaging industry at 4.8%. The company reported a net income of KRW 22.26 million in Q2 2024, up from KRW 17.89 million the previous year, reflecting solid performance despite high debt levels with a net debt to equity ratio of 48.4%. Its EBIT covers interest payments well at 5.2x, indicating robust financial health and potential for continued growth in earnings forecasted at nearly 6% annually.

- Navigate through the intricacies of Dongwon Systems with our comprehensive health report here.

Understand Dongwon Systems' track record by examining our Past report.

Seize The Opportunity

- Unlock our comprehensive list of 185 KRX Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A014820

Dongwon Systems

A packaging company, manufactures and markets packaging materials in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives