- South Korea

- /

- Semiconductors

- /

- KOSE:A281820

Undiscovered Gems in South Korea for October 2024

Reviewed by Simply Wall St

The South Korean stock market has experienced a downturn, with the KOSPI index stumbling almost 3 percent over two sessions and closing at 2,593.27 amid rising geopolitical tensions in the Middle East. As investors navigate this volatile landscape, identifying robust small-cap stocks with strong fundamentals and growth potential becomes crucial for building resilient portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Young Poong Precision (KOSDAQ:A036560)

Simply Wall St Value Rating: ★★★★★★

Overview: Young Poong Precision Corporation develops, manufactures, and sells chemical process pumps in South Korea and internationally, with a market cap of ₩398.48 billion.

Operations: Young Poong Precision generates revenue primarily from the sale of chemical process pumps. The company's cost structure and profit margins are influenced by material costs, labor expenses, and manufacturing overheads.

Young Poong Precision, trading at 76% below its estimated fair value, has seen earnings grow by 10.1% over the past year, outpacing the Machinery industry’s 5.4%. Despite a highly volatile share price in recent months, the company remains debt-free and boasts high-quality earnings. Recently, Korea Corporate Investment Holdings Co., Ltd. offered approximately ₩170 billion (US$127 million) to acquire a 43.43% stake in Young Poong Precision with completion expected on October 4, 2024.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. develops, manufactures, and sells PCB automation equipment in South Korea and internationally, with a market cap of ₩699.74 billion.

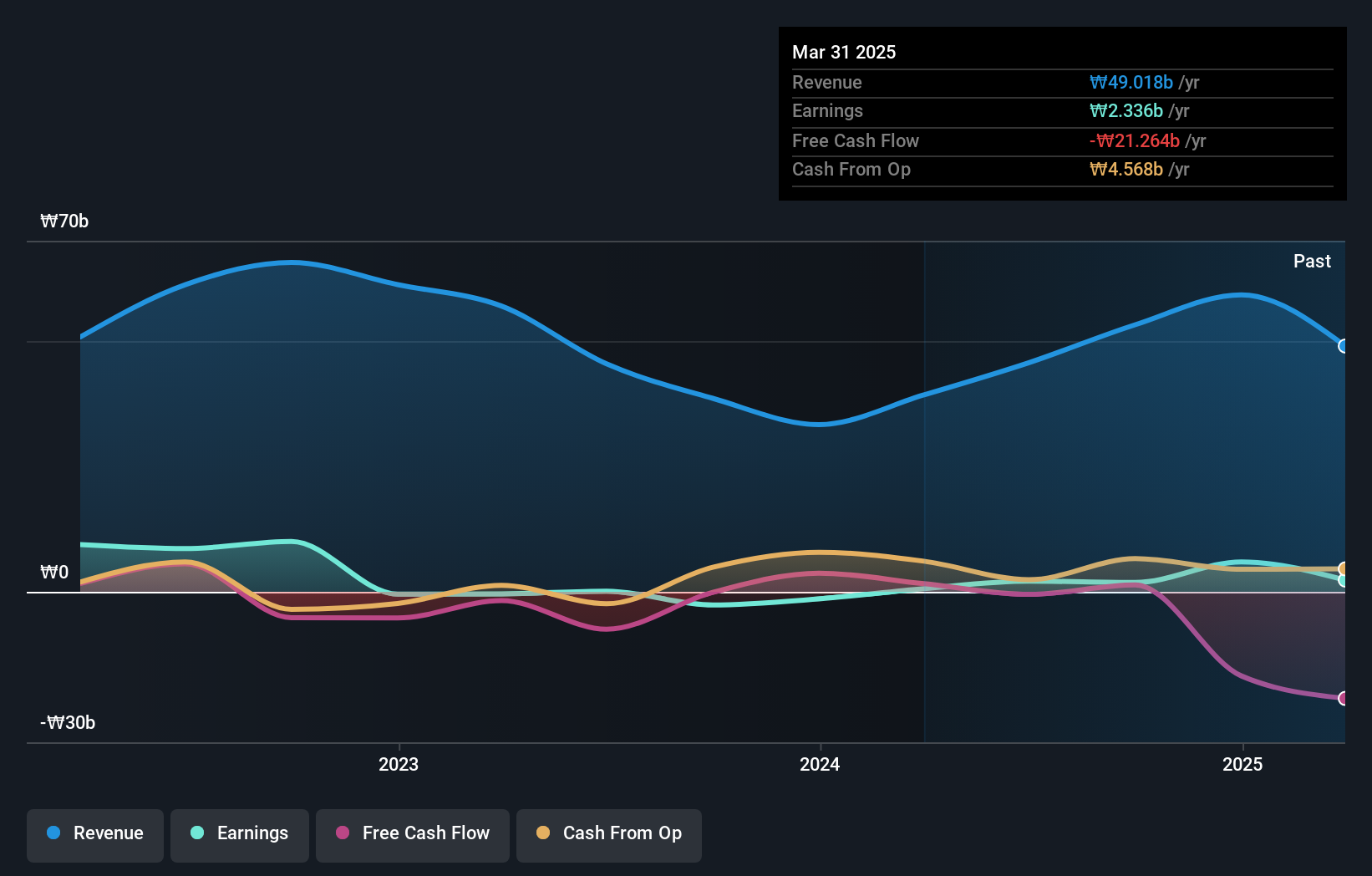

Operations: Taesung Ltd. generates revenue primarily from manufacturing and selling PCB automation equipment, amounting to ₩45.68 billion. The company's cost structure and profitability metrics are not detailed in the provided data.

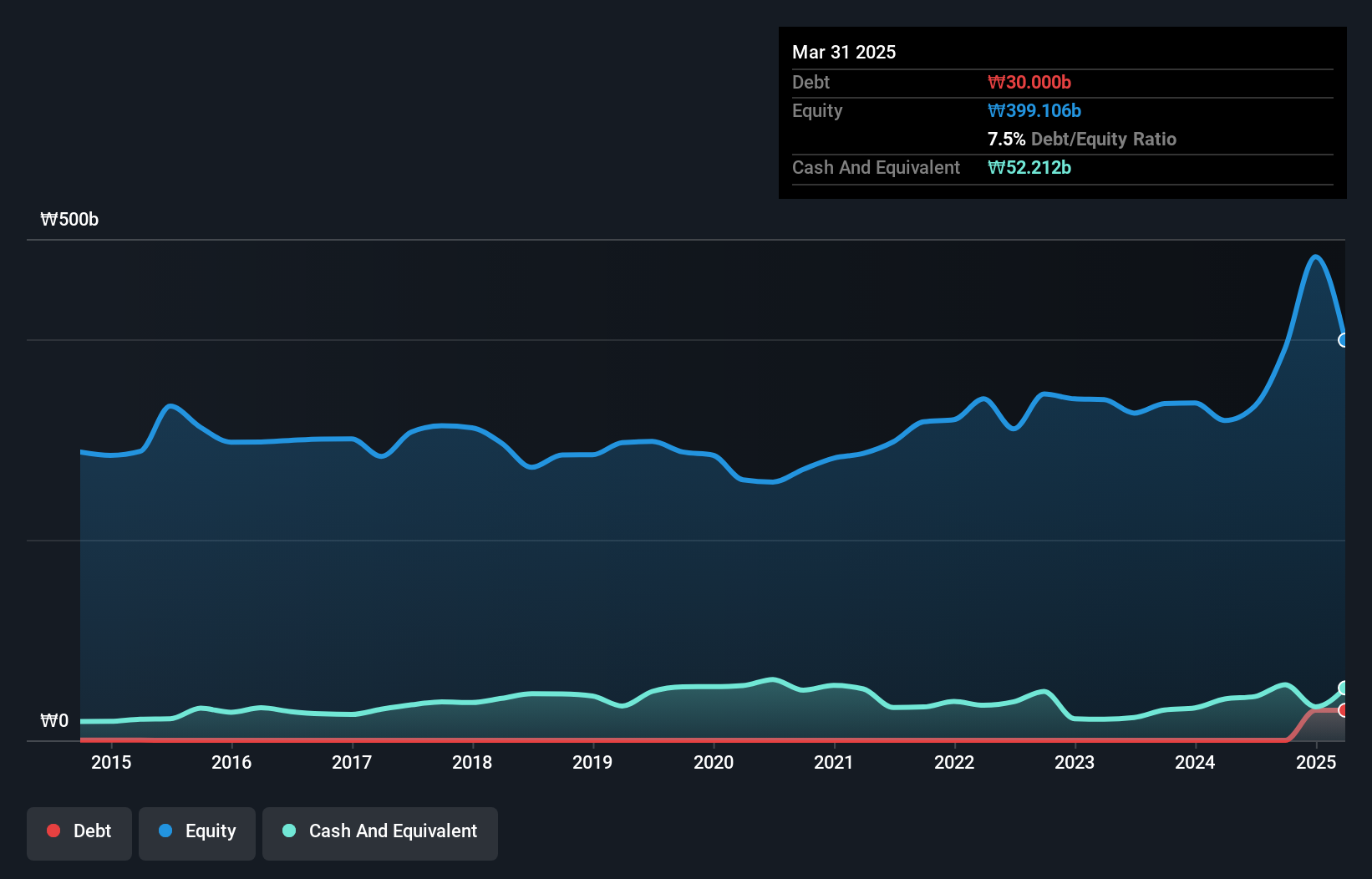

Taesung Ltd. has shown remarkable earnings growth of 1482.3% over the past year, significantly outperforming the Semiconductor industry's -10%. The company's debt management is commendable with a net debt to equity ratio of 4.2%, which is considered satisfactory. Additionally, Taesung's interest payments are well covered by EBIT at 17.5x coverage, reflecting strong financial health. Despite this, shareholders experienced dilution in the past year and the stock price has been highly volatile over the last three months.

- Dive into the specifics of TaesungLtd here with our thorough health report.

Examine TaesungLtd's past performance report to understand how it has performed in the past.

KCTech (KOSE:A281820)

Simply Wall St Value Rating: ★★★★★★

Overview: KCTech Co., Ltd. manufactures and distributes semiconductor systems, display systems, and electronic materials in South Korea, with a market cap of ₩743.71 billion.

Operations: KCTech generates revenue through the sale of semiconductor systems, display systems, and electronic materials.

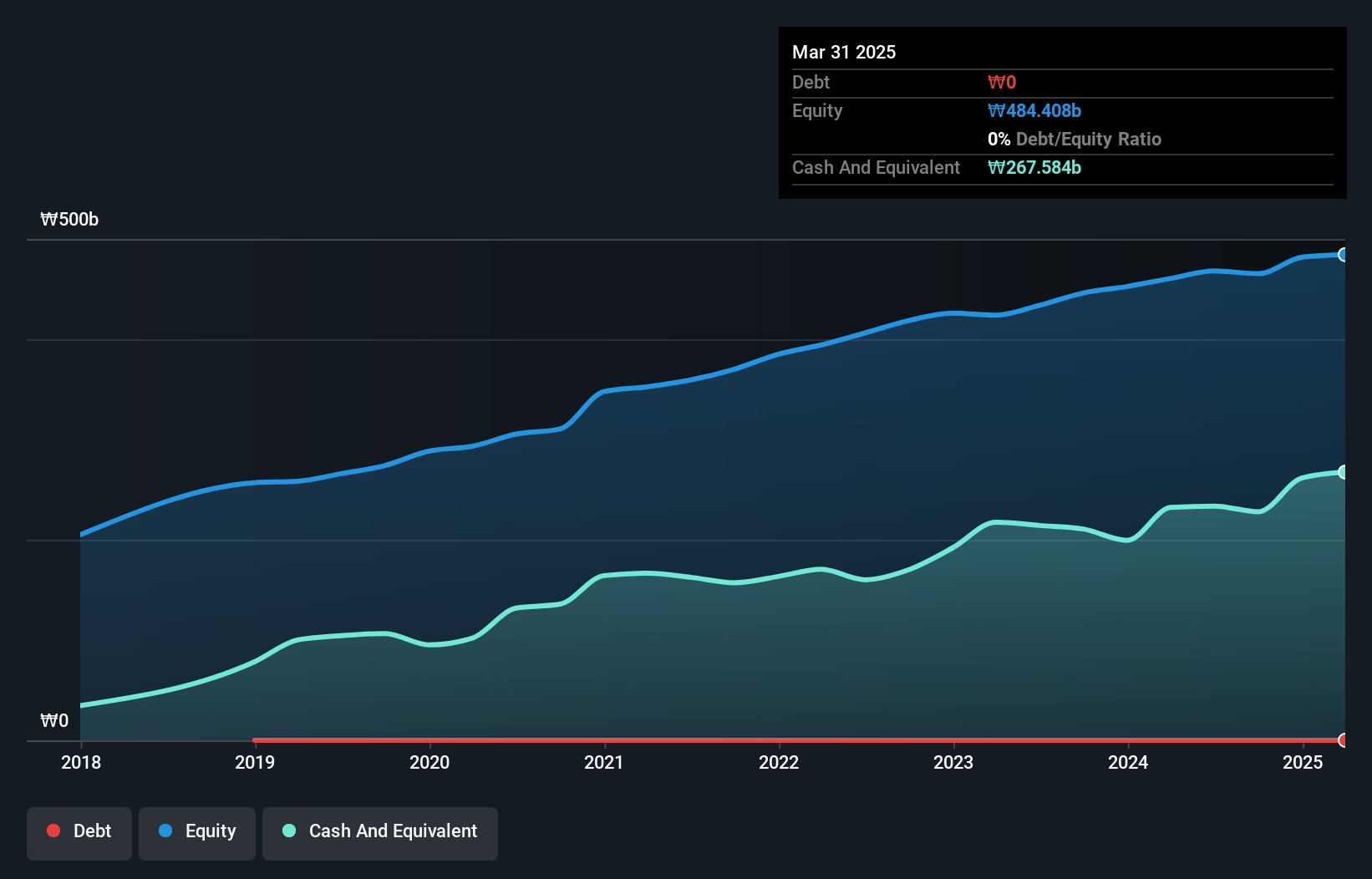

KCTech, a small yet promising player in South Korea's semiconductor industry, is set to grow earnings by 24.6% annually despite a recent -1.5% earnings dip. The company has no debt and boasts high-quality past earnings, making it financially robust. Recent buyback programs worth up to KRW 10 billion aim to enhance shareholder value and stabilize stock prices. With positive free cash flow and no interest payment concerns, KCTech seems well-positioned for future growth.

- Click here to discover the nuances of KCTech with our detailed analytical health report.

Assess KCTech's past performance with our detailed historical performance reports.

Next Steps

- Unlock more gems! Our KRX Undiscovered Gems With Strong Fundamentals screener has unearthed 185 more companies for you to explore.Click here to unveil our expertly curated list of 188 KRX Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KCTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A281820

KCTech

Engages in the manufacture and distribution of semiconductor systems, display systems, and electronic materials in South Korea.

Flawless balance sheet and fair value.