- China

- /

- Semiconductors

- /

- SZSE:300236

3 Undiscovered Gems In Global Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amidst the backdrop of favorable trade deals propelling global stock markets to record highs, small-cap stocks have also seen gains, with indices like the S&P MidCap 400 and Russell 2000 climbing steadily. As economic indicators reveal a robust services sector but a struggling manufacturing landscape, investors may find opportunities in lesser-known stocks that can offer diversification and potential growth. In this environment, identifying stocks with strong fundamentals and resilience to market fluctuations becomes crucial for enhancing portfolio performance.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.23% | ★★★★★★ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

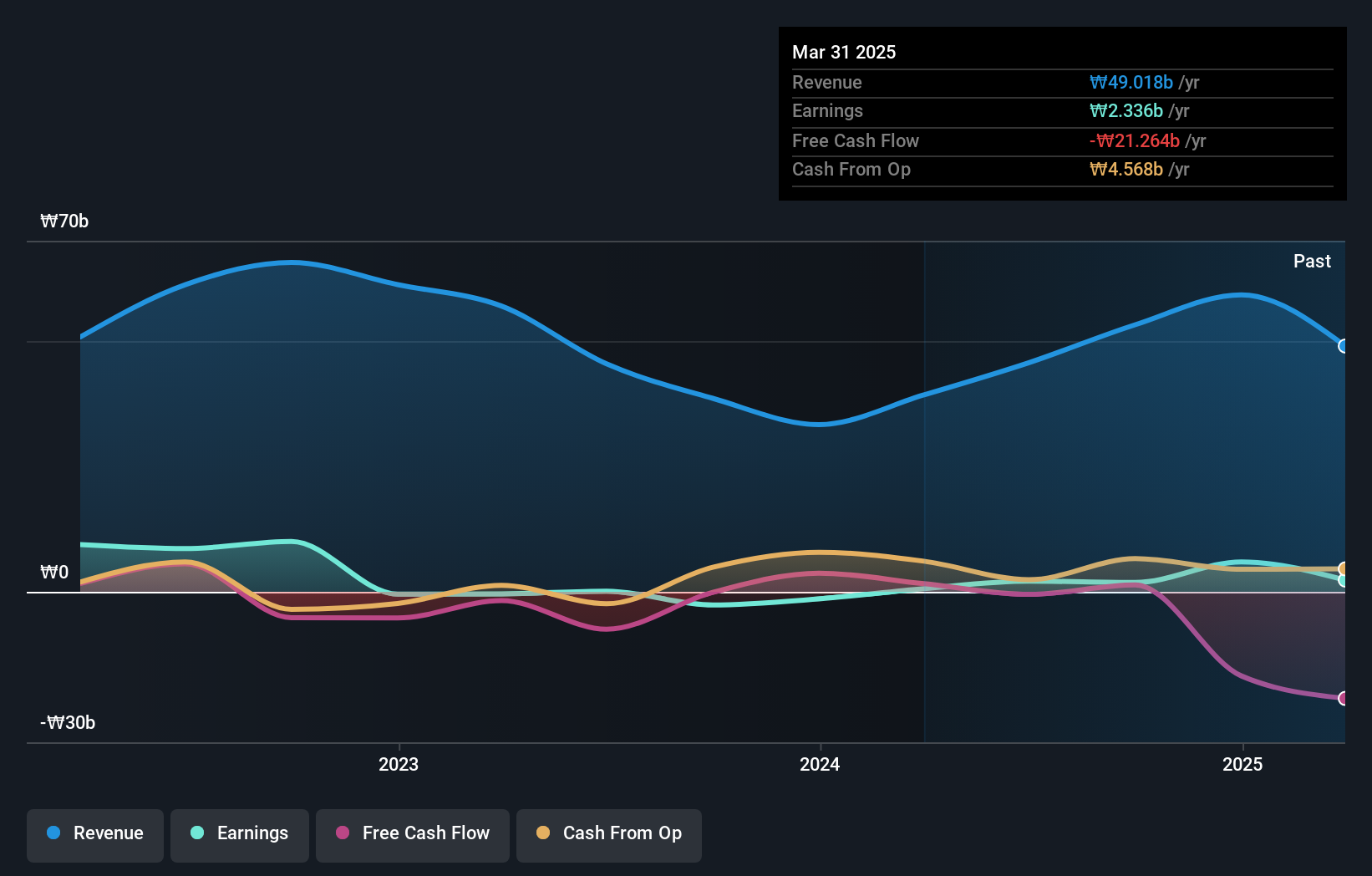

Overview: Taesung Co., Ltd. specializes in the development, manufacturing, and sale of PCB automation equipment both domestically and internationally, with a market capitalization of approximately ₩969.92 billion.

Operations: Taesung generates revenue primarily from manufacturing and selling PCB automation equipment, amounting to approximately ₩49.02 billion.

Taesung Ltd. has shown impressive earnings growth of 265.7% over the past year, significantly outpacing the Semiconductor industry's 28.6%. Despite this, their earnings have seen a 54.3% per year drop over the last five years, suggesting volatility in performance. The company is profitable and covers its interest payments comfortably, indicating solid financial health despite high non-cash earnings levels which could skew perceived profitability. Recent shareholder dilution may concern some investors; however, Taesung's robust cash position compared to total debt suggests resilience against financial pressures and potential for future stability in an unpredictable market landscape.

- Delve into the full analysis health report here for a deeper understanding of TaesungLtd.

Gain insights into TaesungLtd's past trends and performance with our Past report.

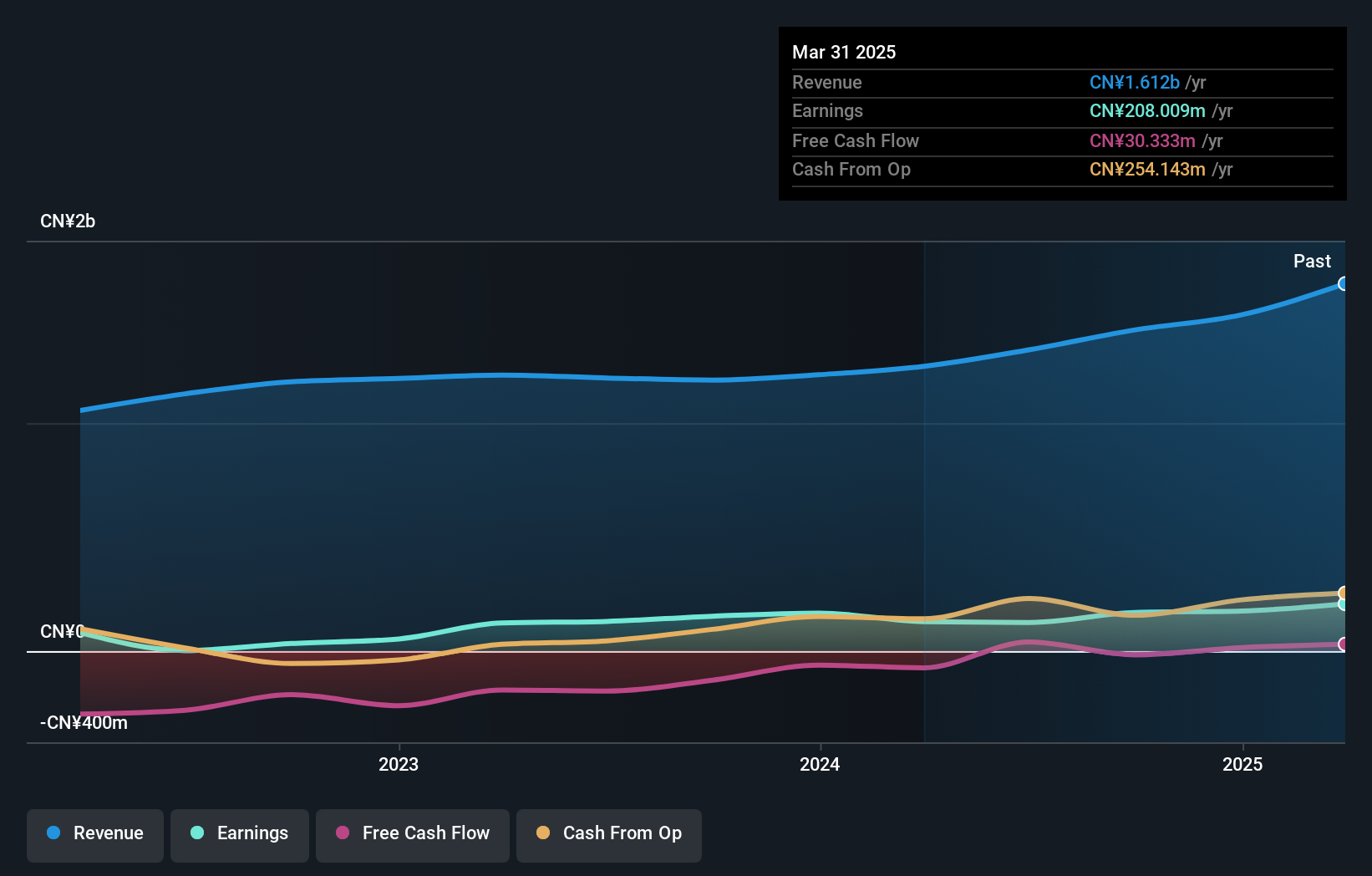

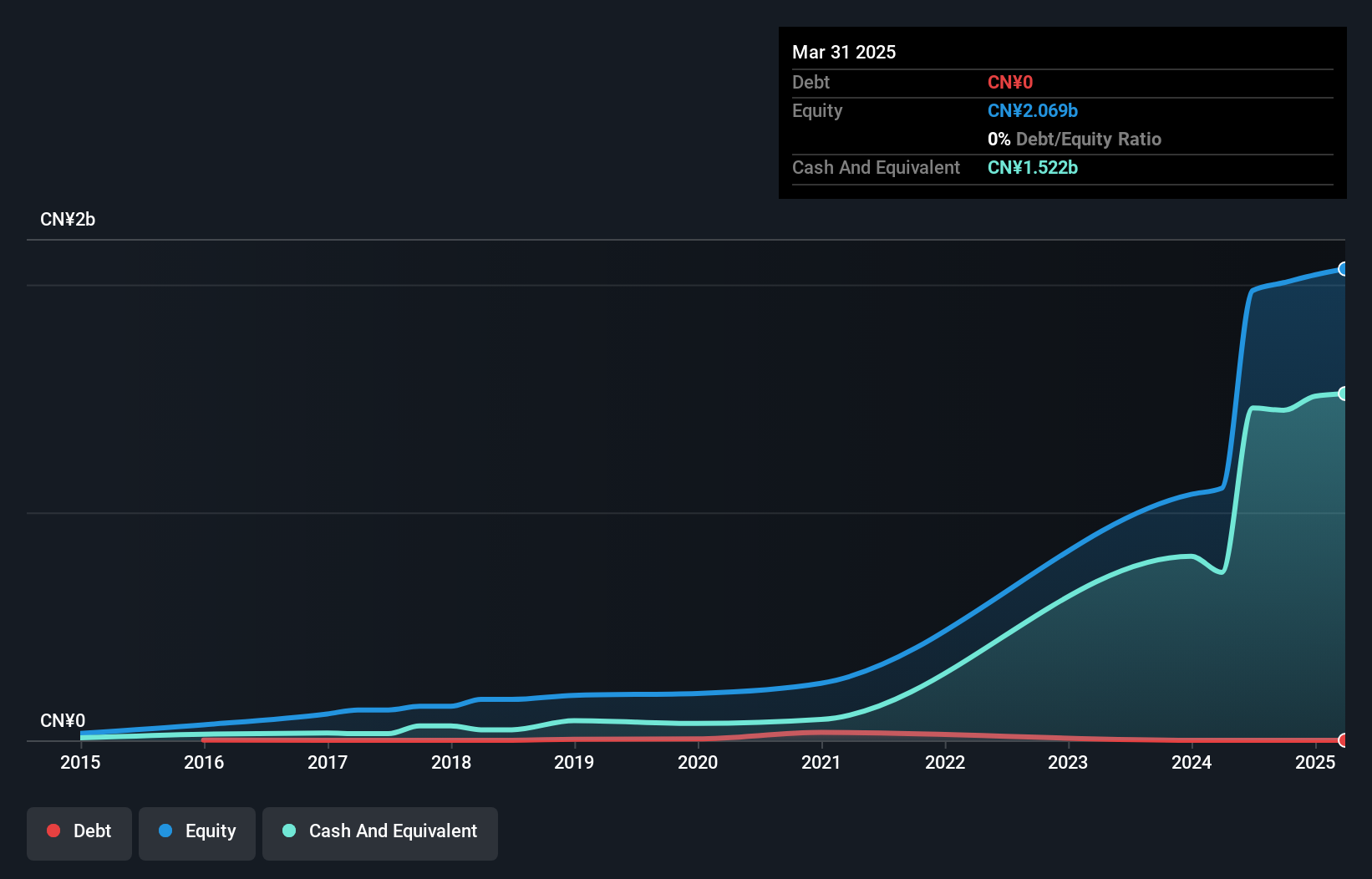

Shanghai Sinyang Semiconductor Materials (SZSE:300236)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Sinyang Semiconductor Materials Co., Ltd. is engaged in the production and sale of semiconductor materials, with a market cap of CN¥13.13 billion.

Operations: Shanghai Sinyang Semiconductor Materials generates revenue primarily through the production and sale of semiconductor materials. The company operates with a market capitalization of CN¥13.13 billion, reflecting its position in the industry.

Shanghai Sinyang Semiconductor Materials, a smaller player in the semiconductor industry, is showing promising signs of growth. With earnings surging by 61% over the past year, it outpaced the industry's average growth of 8%. The company's price-to-earnings ratio stands at 64x, which is below the industry average of 69.9x, suggesting potential value. Despite a one-off gain of CN¥44M affecting recent results, its financial health appears robust with more cash than total debt. The recent dividend increase to CNY2.60 per share reflects confidence in its ongoing performance and future prospects within this competitive sector.

Aidite (Qinhuangdao) Technology (SZSE:301580)

Simply Wall St Value Rating: ★★★★★★

Overview: Aidite (Qinhuangdao) Technology Co., Ltd. specializes in the production and sale of dental materials and equipment, with a market cap of approximately CN¥5.20 billion.

Operations: Aidite generates revenue primarily from the medical equipment industry, amounting to CN¥919.60 million.

Aidite Technology, a nimble player in the medical equipment sector, shows promising growth potential. The company's earnings grew by 3.1% last year, outpacing the industry's -2.2% dip, and it remains debt-free compared to five years ago when its debt-to-equity ratio was 6.1%. With a price-to-earnings ratio of 38.3x below the CN market average of 42.5x, Aidite seems attractively valued for investors seeking opportunities in smaller companies. Recent amendments to its articles of association and a CNY 0.65 per share dividend highlight proactive management strategies and shareholder value focus amidst forecasted earnings growth of over 23% annually.

- Take a closer look at Aidite (Qinhuangdao) Technology's potential here in our health report.

Learn about Aidite (Qinhuangdao) Technology's historical performance.

Next Steps

- Access the full spectrum of 3161 Global Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300236

Shanghai Sinyang Semiconductor Materials

Shanghai Sinyang Semiconductor Materials Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives