- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A265520

We Think Advanced Process Systems' (KOSDAQ:265520) Statutory Profit Might Understate Its Earnings Potential

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Advanced Process Systems (KOSDAQ:265520).

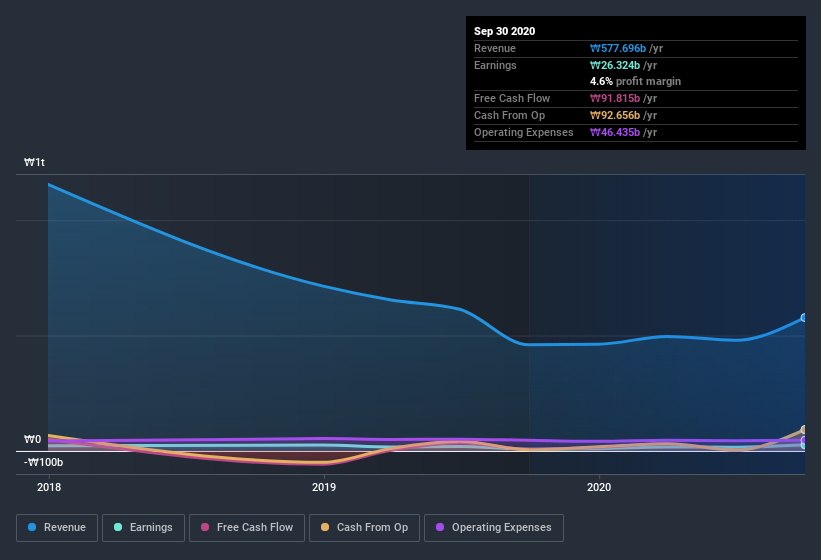

It's good to see that over the last twelve months Advanced Process Systems made a profit of ₩26.3b on revenue of ₩577.7b.

See our latest analysis for Advanced Process Systems

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. Therefore, we think it's worth taking a closer look at Advanced Process Systems' cashflow, as well as examining the impact that unusual items have had on its reported profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

A Closer Look At Advanced Process Systems' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to September 2020, Advanced Process Systems recorded an accrual ratio of -0.28. Therefore, its statutory earnings were very significantly less than its free cashflow. To wit, it produced free cash flow of ₩92b during the period, dwarfing its reported profit of ₩26.3b. Advanced Process Systems' free cash flow improved over the last year, which is generally good to see. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

The Impact Of Unusual Items On Profit

Advanced Process Systems' profit was reduced by unusual items worth ₩7.4b in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. In a scenario where those unusual items included non-cash charges, we'd expect to see a strong accrual ratio, which is exactly what has happened in this case. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Advanced Process Systems to produce a higher profit next year, all else being equal.

Our Take On Advanced Process Systems' Profit Performance

Considering both Advanced Process Systems' accrual ratio and its unusual items, we think its statutory earnings are unlikely to exaggerate the company's underlying earnings power. After considering all this, we reckon Advanced Process Systems' statutory profit probably understates its earnings potential! Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. In terms of investment risks, we've identified 1 warning sign with Advanced Process Systems, and understanding this should be part of your investment process.

Our examination of Advanced Process Systems has focussed on certain factors that can make its earnings look better than they are. And it has passed with flying colours. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Advanced Process Systems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A265520

Advanced Process Systems

Develops and sells semiconductors and display manufacturing equipment primarily in South Korea, China, and Vietnam.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion