- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A232140

Capital Allocation Trends At YIK (KOSDAQ:232140) Aren't Ideal

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after briefly looking over the numbers, we don't think YIK (KOSDAQ:232140) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on YIK is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.06 = ₩13b ÷ (₩306b - ₩88b) (Based on the trailing twelve months to September 2020).

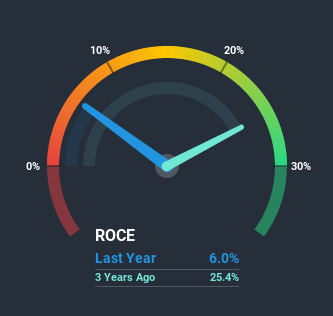

Therefore, YIK has an ROCE of 6.0%. Ultimately, that's a low return and it under-performs the Semiconductor industry average of 8.7%.

View our latest analysis for YIK

Historical performance is a great place to start when researching a stock so above you can see the gauge for YIK's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of YIK, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

The trend of ROCE doesn't look fantastic because it's fallen from 25% three years ago, while the business's capital employed increased by 158%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. YIK probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

The Bottom Line

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for YIK. Furthermore the stock has climbed 26% over the last three years, it would appear that investors are upbeat about the future. So should these growth trends continue, we'd be optimistic on the stock going forward.

If you'd like to know more about YIK, we've spotted 2 warning signs, and 1 of them can't be ignored.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade YIK, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A232140

YC

Engages in the development, manufacture, and sale of inspection equipment for semiconductor memories in South Korea and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026